Should have believe in my own lucky streak. Recently, my handpicked stocks always gap up after earnings.

Should have believe in my own lucky streak. Recently, my handpicked stocks always gap up after earnings.

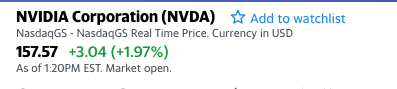

Still has a ton of room above. Far below its 200 day.

• Nvidia (NASDAQ:NVDA) shares climb 8.6% after Q4 results beat on EPS but missed on revenue though the figure was in-line with the $2.2B midpoint of the guidance cut. Downside Q1 guidance has revenue within 2% of $2.2B or about $2.156B to $2.244B (consensus: $2.34B) with a 59% gross margin and $755M in operating expenses.

• FY20 guidance expects revenue flat to slightly down on the year compared to the analyst estimate of a 5% drop.

• Revenue breakdown: GPU, $1.98B (-20% Y/Y; 29% Q/Q); Gaming, $954M (-45% Y/Y; Q3: $1.76B); Professional Visualization, $293M (+15% Y/Y; Q3: 305M); Datacenter, $679M (+12%; Q3: $792M); Auto, $163M (Q3: $172M); OEM & IP, $116M (Q3: $148M).

Prescient! but no prize.

No debate that semi stocks had bottomed but is it ready for new ATH?

Cloud companies run on datacenter which require semis such as MU and NVDA. Almost all cloud stocks are hitting ATHs after ATHs yet semi stocks are lingering… so are cloud overvalued or semis are few months behind?

MU hit counter-trend target and retreated.

NVDA not near counter-trend target at all. May be a double bottom is forming.

• Facebook (NASDAQ:FB) wants to develop its own artificial intelligence chips that go beyond what’s currently on the market, according to an interview with Yann LeCun, Facebook’s chief AI scientist.

• While the company is already developing its own custom ASIC (application-specific integrated circuit) chip, the idea is to provide faster computing that Facebook needs in order to achieve new AI breakthroughs including digital assistants imbued with enough “common sense.”

Short NVDA? According to you, NVDA advantage left is training, big companies (Apple, Google, FB, BIDU, BABA, AMZN) have/are developing their own AI inference chips for their data centers. Is good for MU since once their chips are ready, would need to upgrade data centers and build more capable data centers. Buy, buy, buy MU.

There are some new algorithms on the horizon that don’t need to train on massive data. Babies learn how to talk from just a small training set. Machines should be able to do the same. But they are still in university research and not yet in production, if I understand correctly. That’s the real threat to Nvidia.

Ain’t Apple AI chips like that?

Most of the big companies using their own AI chips to protect intellectual property theft. If they use NVDA or other generic chips, it becomes then software creation over the CHIP and the software can be easily stolen by other big companies. If they create their own chips, the software becomes proprietary and protect their intellectual property for a longer time.

Should we buy rentals in Austin, Santa Clara city and San Diego? Semi businesses are mostly in those three places.

3 Big Reasons to Stay Away From Nvidia

In a nutshell, NVDA is overvalued at current price. Still holding 12 shares and 3 short puts ($130), wondering whether to close the short puts.

Nvidia Could Be Ready for a Rebound

TA says could be an inverse H&S forming, last week I said is could be double bottom, whether inverse H&S or Double bottom, they look similar  and is a bullish reversal chart pattern. Nevertheless I don’t feel is that great since the target of the chart pattern is not that high. Good for a short-term to medium term trade, shouldn’t take a position trade.

and is a bullish reversal chart pattern. Nevertheless I don’t feel is that great since the target of the chart pattern is not that high. Good for a short-term to medium term trade, shouldn’t take a position trade.

Follow citi into TSMC ![]() 500 shares

500 shares ![]()

@Jil,

Market rotates between semi and cloud. Cloud down today, semi shot up.

Mr Market is saying farewell to FAANG and prefer semi and cloud.

Your previous employers?

My favorites are LRCX and AVGO only here.

Semis are clearly the way to go for the next few years for good return,

@Jil prefers LRCX and AVGO.

@manch owns XLNX, AMD, MU.

I have NVDA (short puts), MU (calls) and TSM (shares).

Any1 own semis? What are they?

I got shaken out of NVDA. Will go back in next month.

TA indicates might go down to $140s. I have sold my shares and calls, and plan to recapture them at lower prices ![]() Owned 3 short puts for that. If go low enough, would long calls

Owned 3 short puts for that. If go low enough, would long calls ![]()

The Cold War in Tech Is Real and Investors Can’t Ignore It

THE HARDEST HIT: CHIP STOCKS

THE MOST TO LOSE: MICRON TECHNOLOGY

THE NEUTRAL PARTY: TAIWAN SEMICONDUCTOR MANUFACTURING

Taiwan Semi is a top holding for many global fund managers. The company’s strong balance sheet and 2.7% dividend yield offer investor protection,

To err on the safe side,

MU: closed all short-term calls and sold shares. Long 20 calls (L20 $35).

NVDA: closed all short-term calls and sold shares. Short 3 puts (L20 $130).

TSM: 500 shares.

AMD and XLNX: no position.

Using management guidance and Street’s estimates, Micron shares may appear to be traded at a $10 premium or overvalued about 30%, at least for the time being. That being said, for a “near” commodity stock like Micron, it is not unusual that the stock reacts more to macro and industry events than to company specifics.

Micron’s Valuation Is Everything

Against FY18-19 average EPS of $9.02, this has a fair value estimate at $193.93. For every year that Micron successfully invests greater than 14% of their earnings at a higher average ROI than 43%, they will outperform my expectations.

Micron: 3D XPoint Is A Game Changer

Micron’s intrinsic valuation based on cash flows implies the share price should be trading in the $70-$80 range well above the current price of $42, which is also supported by their favourably low P/E ratio of 3.46x (vs semiconductor industry average of 18.17x).

@Jil, they use FA, one said overvalued by 30%, one said is undervalued significantly. FA is scientific BS.

Goldman has been bad mouthing Micron for the last few months and so far market has been ignoring it. Let’s see how market reacts next week. It feels to me most of the bad news has already been priced in and that’s why stock is so darn cheap with PE only at 3.5. However it seems DRAM pricing will bottom out middle of the year and then go back up in back half.

My Final AMD Article - I Was Wrong

When it came to AMD (AMD) I was vaguely right on the facts. It did end 2018 with mediocre growth and it did offer terrible guidance. It never did become free cash flow generative. The facts played out. But the market ignored these facts. Consequently, while I was right, my timing was wrong. Which essentially means I was wrong. No matter how loudly I argued that AMD was overvalued, the stock continued to show my thinking was wrong. Therefore, this will be my final article on AMD on Seeking Alpha.

AMD will close the gap with Nvidia introducing its GPU code named Navi.

When we look to the future, we see an AMD where the release of ROME for servers is not that far out, along with Ryzen 2. GPU efforts have achieved some minor success with the release of the 590 and Radeon VII series, but the real come back might be Navi.

The stock traded in the teens for several months so now isn’t the time to chase AMD at $24. Use further market weakness from a failed China trade deal or a Fed rate hike as the next opportunity to own the stock.