I haven’t looked into SHOP so I’m not sure. But if I were SHOP I’d do rev share on companies that are low on volume but big on dollar amounts. The per transaction model only works on high volume low dollar businesses.

The basic Shopify plan is a flat fee $29 a month plan. It doesn’t matter you are selling a $100K car or a $1 cheap toy, the processing is the same. So we are looking at the unit volume, not dollar volume, that should be tied to any Shopify contract.

Everybody either has a e-commerce solution, building one or buying. Adobe bought Magento last year. Square bought Weebly. Salesforce has something but maybe they need to buy some to beef it up. You need to tie the commerce part to the marketing, and if you have offline sales that need to be tied into too.

You realize FBA sellers on Amazon use Shopify. FBA is growing faster than Amazon’s own retail business.

No, you don’t need Shopify to use FBA. The only scenario is if the seller has more than one channel, like selling thru their own websites.

How many FBA sellers do meaningful business on channels other than Amazon? Being bullish on Shopify means being bearish on Amazon.

Nope. Didn’t buy any.

Did not know you can buy bitcoin with the Cash app.

OMG… it’s time to load up on bitcoin!!!

@caiguycaiguy, worthwhile investing big in SQ? Got better candidates?

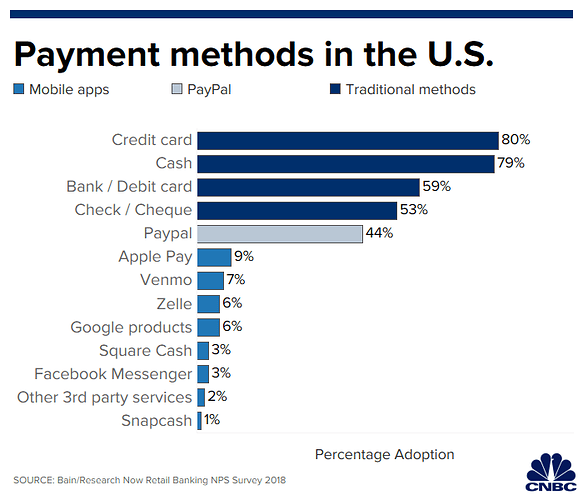

Cards are widely accepted, and in some cases it’s easier to swipe a credit card than to take out your digital device, hold it up to your face to unlock it, then double tap the button and hold it up to a monitor. Arieh Levi, senior analyst at CB Insights, also said the popularity of cards is a key reason mobile isn’t taking off.

Apple Watch ![]() to the rescue.

to the rescue.

Apple Pay means Apple Cash? I pay using credit cards via Apple Pay all the time. I have yet to use Apple Cash.

Apple’s new credit card with Goldman Sachs was designed with that in mind. It offers 2% in cash back on Apple Pay transactions, 3% for purchases made directly through Apple, and 1% on purchases with a physical card. The rewards are paid out on a daily basis.

Apple Physical Card is of not much use. Kept in the original folder for souvenir.

My current payment method is:

Use Apple Card via Apple Pay except:

a. At Costco and restaurants/travel: Costco card

b. If no Apple pay, use Citi double cash.

Don’t use debit cards. Occasionally use cheque and cash.

I’m more inclined to say Visa and Mastercard might be better way to play the payments space. All these digital payment companies use the the credit card companies infrastructure.

"Visa is powering most of the big P2P systems in the United States: Zelle, Square Cash, Venmo, Apple’s

new P2P capability with Apple Cash are all powered by our rail. So when you move money to me or any one of

those systems, those – that money is moving on Visa’s rails and we’re being paid for it. "

SQ is not in your portfolio. Vaguely recall your reason for not buying is because your computation indicates that credit cards have better profitability and win regardless who in FinTech win. Did I recall correctly?

But that doesn’t mean the share price gain by FinTech would be less than those of credit card biz, right?

Since that article, is trading at $62 vs date of article $72.