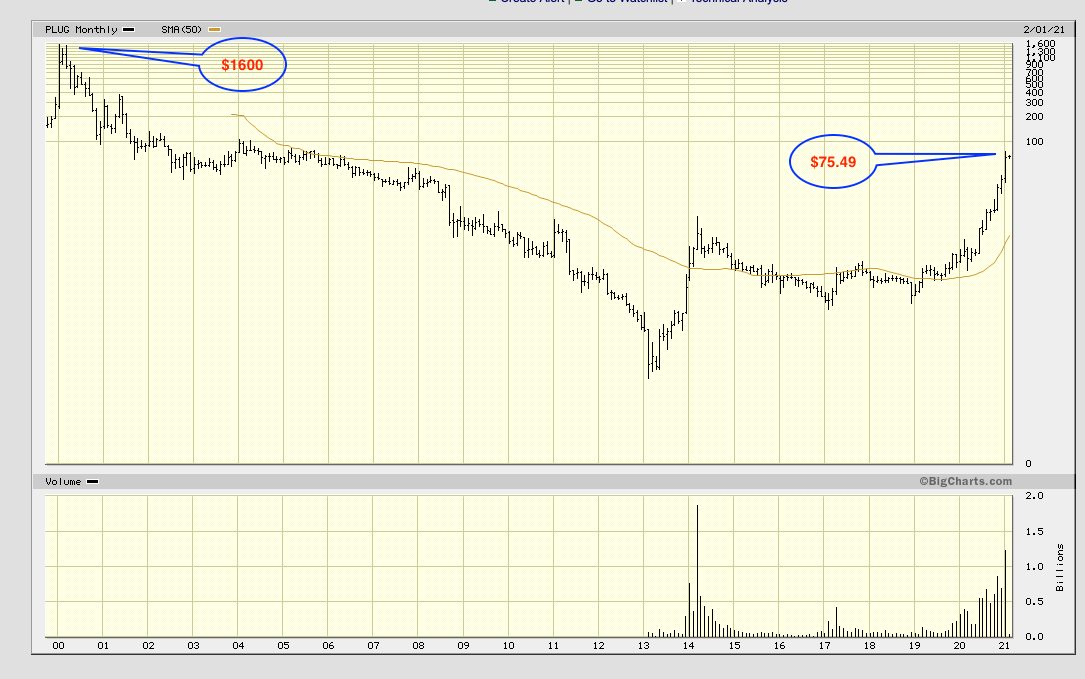

Zoom out a bit and you can see PLUG has been dead since dot-com. But it has come back alive now!

A new set of young investors, they roam the streets of SF. Those older ones can’t afford the high cost of living in SF and are squatting in Austin.

Look at the chart below, you should liquidate all your stocks and jump in! You will catch up with @wuqijun and @Zeapelido in a breeze. 1600/76 = 21x ![]() potential

potential

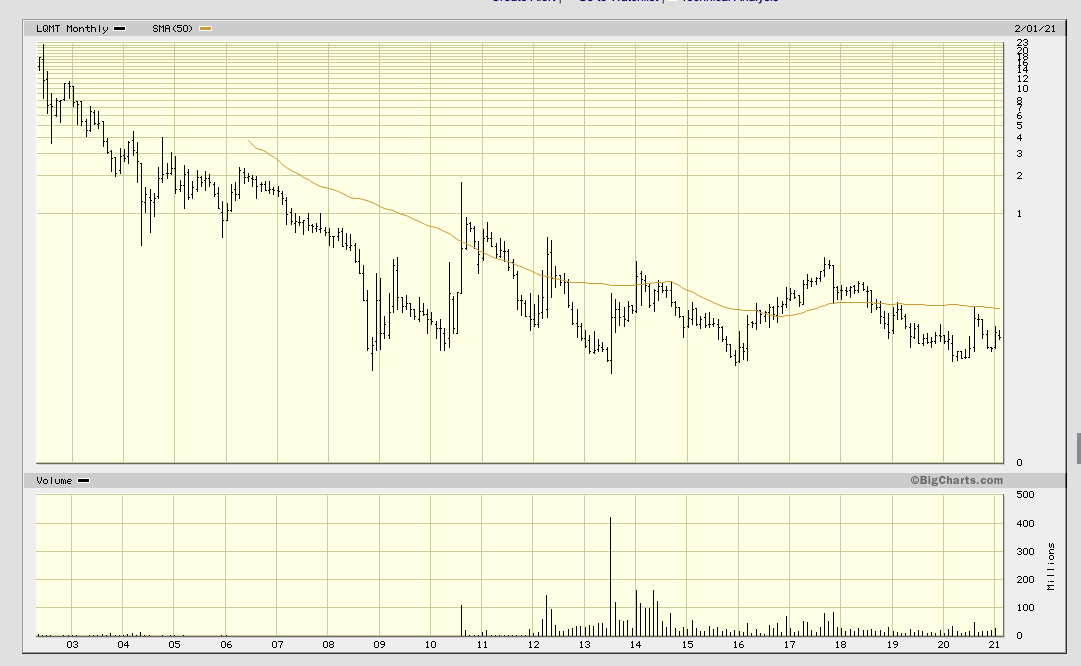

If you want 200x follow me into LQMT,

I’ve been doing this for nearly 30 years now, and I’ve learned that more knowledge is not more power when it comes to trading. It’s all about probabilities and risk control.

![]() Practice makes perfect. Yes, everything in life is about probabilities. Outcome is unpredictable.

Practice makes perfect. Yes, everything in life is about probabilities. Outcome is unpredictable.

@Jil takes note. More knowledge is not more power wrt trading. Don’t spend too much time researching.

A large part of successful trading is learning when to do nothing.

![]() Being a chess player (school and inter-school champion

Being a chess player (school and inter-school champion ![]() ), I understood doing nothing at the right moment is very powerful.

), I understood doing nothing at the right moment is very powerful.

He uses the best option trading platform ToS and Tastywork (same founders as ToS, sold ToS to AmeriTrade and started Tastywork). I have a ToS account.

Lastly, I’ve found that the biggest gift I can give myself is to go to a 100% cash position from time to time, especially over long weekends. As a trader, that is when your mind is truly free. It’s like getting a spa treatment.

@Jil

You have learned this. Is about time I learn too.

I definitely differ some.

Regarding researching, I do that only for buy and hold stocks, not for trading stocks.

More knowledge is important for trading, that is the key for success. I was zero in stock market when I started aggressively five years before. Money does not come easy, it is our work+time+knowledge translated into returns.

I’ve found that the biggest gift I can give myself is to go to a 100% cash position from time to time => Correct

Being a chess player (school and inter-school champion ![]() ) => Me too, what a coincidence !

) => Me too, what a coincidence !

Finished the long article. Trading is an extremely difficult way to make money. You take your mind off it for an hour and you could be completely ruined.

@hanera will you be trading like that guy now?

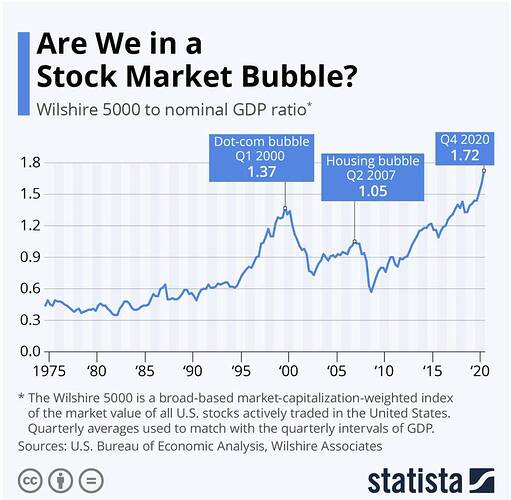

Biggest difference is that the biggest companies today are insanely profitable. Not so back in the dot-com days.

For me, the biggest bubble in the world today is the Chinese real estate market. Saw a Chinese article last month boasting that Shenzhen’s current real estate valuation can buy half of the entire US. Reminds me of how Tokyo’s RE was worth more than the entire US back in the late 80s. Did not end well.

WSJ story of a Reddit day trader, a grad student at MIT:

Archive link if you bump into paywall: https://archive.is/GtsT4

Anubhav Guha started day trading a few thousand dollars in March but managed to lose half of his money despite the stock market’s epic rally last year. He made that up and far, far more betting on GameStop Corp.

Mr. Guha turned $500 into $203,411 in less than three weeks with an options trade on the mall retailer.

The rally and now collapse of GameStop was a dramatic clash of small-time traders against hedge funds, but for Mr. Guha it was more of a lottery ticket, though it had more ups and downs than a typical Powerball drawing.

The 24-year-old is a graduate student in mechanical engineering at the Massachusetts Institute of Technology. He pinches pennies by eating the same simple meal for lunch and dinner seven days a week to help get by on his $36,000-a-year income.

So? Do you mean the biggest companies during the Dotcom era is not insanely profitable?

The way bubble works is the future ones would be bigger than the past bubbles. So the right question is:

Is current bubble big enough?

Looking at your chart, it screams not that big. Wake me up when it hits 2.33 ![]()

An interests rate of 0% now is very different from the 5% back in dot-com days.

You can dig up the historical PE charts I post a while back. The biggest companies back then: Cisco, Intel, Oracle etc all had insanely high PE. Compare with today’s biggest like Apple and Microsoft.

I was just checking the 12-month stock charts of the biggest S&P500 companies by market cap. Most of them did nothing since last summer. For 6 months they have gone sideway. That doesn’t look like a blow off top to me. Microsoft had a mini ramp up. Obviously Tesla went up a lot, which seems to be clouding everybody’s judgement. Paypal also did well. Other than these 3 the top 20 stocks by market cap did nothing for the last 6 months.

The action right now is in the small cap Russell 2k.

Your article is shit because nobody say big tech is excessively overvalued. Author essentially put words in those who say market is in a bubble and then counter it. F… the article and the author. Go and ask those who say is a bubble what do they mean FIRST. Don’t look at me, I didn’t say is in a bubble. And I don’t know what those guys mean too.

Don’t be coy. I know you are jealous at Wu and have been secretly cheering for TSLA to go down…

![]()

Projecting your feeling onto me?

You don’t have to be jealous. RHers are into your NVDA. Also AAPL.

https://www.investors.com/research/best-robinhood-stocks-to-buy-now/?src=A00220

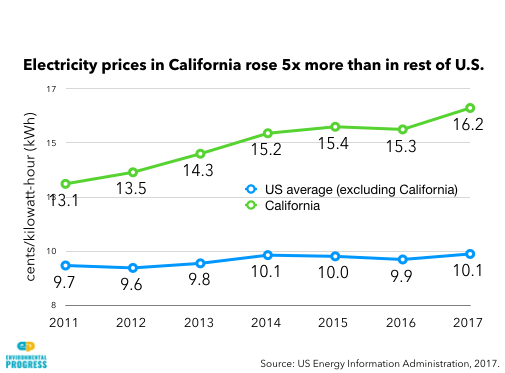

The GDP in year 2000 was composed of different elements.

my garbage and recycling bill was one sixth in year 2001 compared to now.

I am sure you can extrapolate health care cost.

these are just avg. PGE will be 10X in past 20 years.

Robinhood is POS, allowing teens to trade options is unconscionable. We need to rein these a-holes in before they destroy our financial system.

Watch this teenage boy getting mad over Fidelity’s option application form: