A Ten-Fold Sales Rise Is One Way to Justify Tesla at $1,000

https://www.bloomberg.com/news/articles/2020-02-10/a-ten-fold-sales-rise-is-one-way-to-justify-tesla-at-1-000

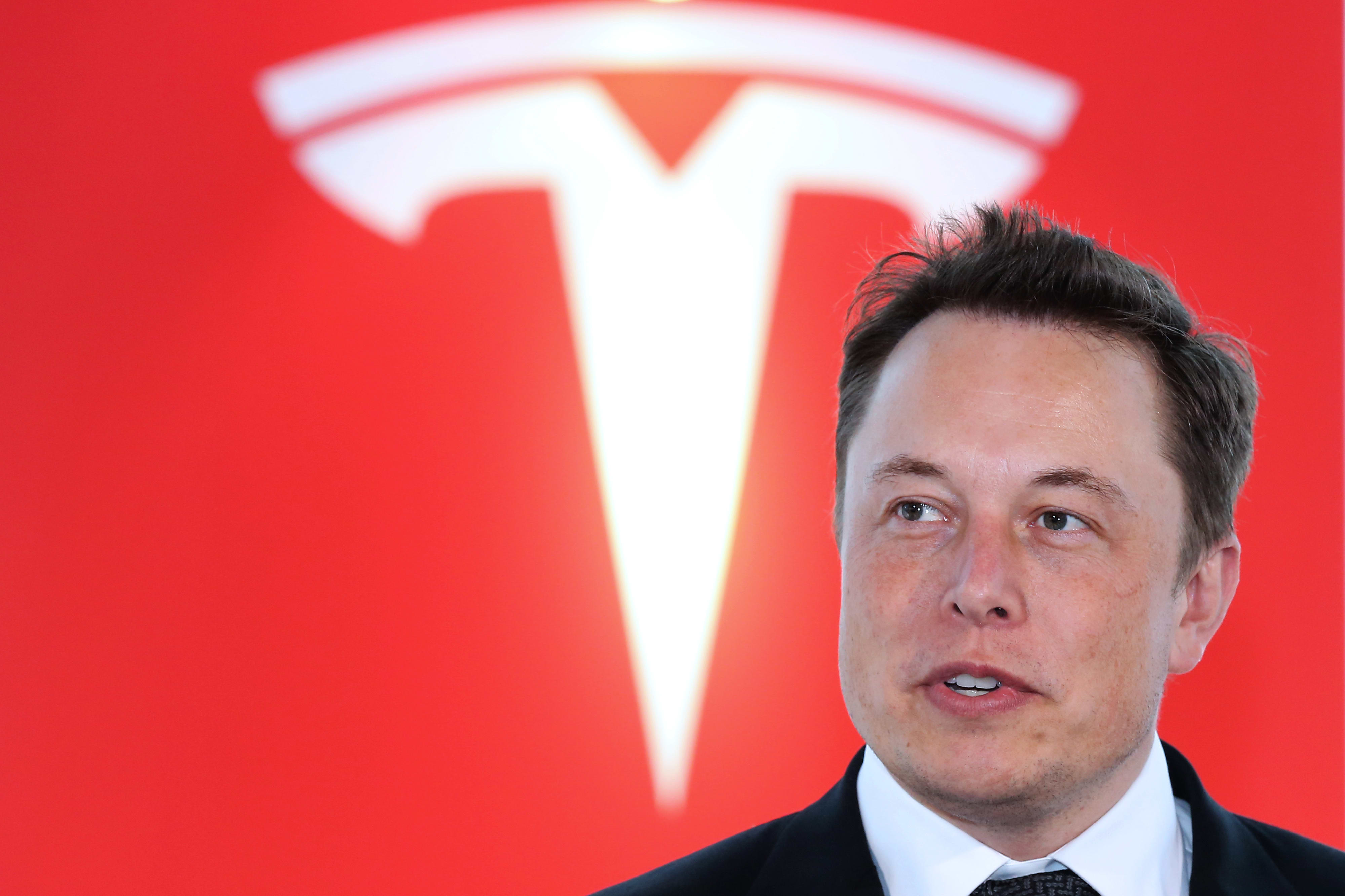

When Tesla Inc. shares briefly approached $1,000 in the midst of a manic surge last week, a host of experts and market watchers started scrambling to figure out what it would take for Elon Musk’s electric-vehicle maker to justify such a massive valuation.

After a big pullback last Wednesday, Tesla shares were up again on Monday, gaining as much as 9.6% to $819.99, on news that the company’s Shanghai plant has resumed production after delays caused by the coronavirus outbreak, and after a Forbes report explored the possibility of Google buying Tesla for as much as $1,500 a share. Tesla is up 88% so far in 2020.

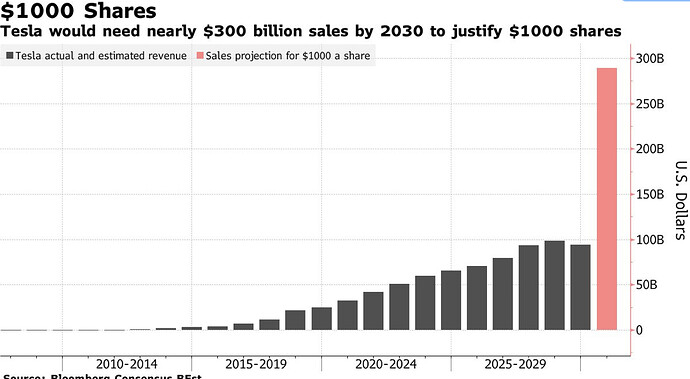

Using a valuation model created by Aswath Damodaran, a professor at New York University’s Stern School of Business, there’s a way to reach $1,000 per share – though it would require sales at the electric car-maker to jump 10-fold from 2019’s full year figures.

Revenue would need to exceed $289 billion by 2030 from $24.48 billion last year, using a model that assumes growth persists for years at a 40% rate before slowing to 1.75% in 2026. Operating margin would also need to rise from 1.6% to 12% with a fixed tax rate at 25%. Current expectations on the Street estimate a far slower pace of sales expansion.

A sales explosion of that magnitude brings to mind Tesla Chief Executive Officer Elon Musk’s promise in 2017 that Model 3 production would ramp up in similar fashion. But while Tesla has shown the ability to mass produce the sedans, it can also be argued that the pace has been far from what Musk predicted.

There are other challenges as well. “The problem using a fixed growth rate off to the horizon is it assumes a company operates in a vacuum,” Roth Capital Partners analyst Craig Irwin said. Tesla eventually will face intense competition, which has been tepid so far, the analyst said, adding that the most important question is whether other carmakers catch up to Tesla within two years or ten.

“I think other carmakers will be aggressive in working to catch up,” Irwin said.