Ha ha ha, remember TSLA was IPO during Obama period, tax incentives for climate change, alternate energy…etc

RUN went up 7% (Pre Market), TSLA has SolarCity inside, still largest in USA

Ha ha ha, remember TSLA was IPO during Obama period, tax incentives for climate change, alternate energy…etc

RUN went up 7% (Pre Market), TSLA has SolarCity inside, still largest in USA

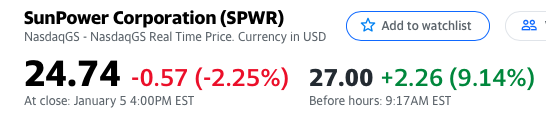

Less than my SPWR.

When Space X becomes IPO, he will maintain No 1 position longer time.

Justine Musk would be a hot chick as she owned 10% of SpaceX.

Just sold 45% of my TSLA stock (what was in my IRAs). My exposure was already getting way to high and right now feels a bit bubbly. Long term upside from these levels is decent, but no 10x

Read chapter 2 of “Margin of Safety”, Wallstreet work against investors.

They (News/Media) are fooling retail investors, TSLA is bound for correction now. @Zeapelido has done excellent work selling it today.

My algorithm flashed a red signal on TSLA. Just took a token TSLA short today just close. If Monday TSLA is up, I will be buying $600 Jan 29th put to validate my algorithm and sell it within next week (Gain or loss) ! Last time when it splashed red signal, it dropped nicely from $498 to $330.

This is my real life testing my algorithm. Let me see my luck.

BTW: Never depend on this statement, this is my live testing, it can go right or wrong 100%.

@hanera, can you do EWT and see how much it can go down? Expecting low = $880 * 0.618 = $543, safe bet I set $600 put Monday (if it is going up).

I think I might start selling conservative covered calls and buy some puts. But I haven’t done it before so I have to start carefully and conservatively.

Tesla is only worth what it’s cult members believe. It will have a reckoning sooner or later. Things feel a lot like the 2000 dot bomb

Look like TSLA would hit $1T before FB. Recall you claim that market cap of FB would eclipse AAPL? I am still waiting.

Same chart applies.

@hanera, if TSLA drops to EWT low, will you buy ? I plan to take some as it will recover faster than S&P or QQQ !

We still have time. What’s your hurry?

No. No money. Kind of distraction.

Is not how fib ratio is applied. Is supposed to apply to the length of the impulse and not the absolute dollar. For example, if the completion is not wave III.5.v and instead is wave III.5.i, then the normal retracement for wave III.5.ii (to retrace wave i) is 0.618* length of wave i i.e. to price = peak of wave i less retracement value = $884.49 - 0.618*(884.49-396.03) = $582.6.

Retracement of wave ii is from 23.6% to 99.9%, most common 50% to 61.8%.

Excellent, noted the points.

Here are my past pattern match where it dropped and then recovered.

BTW: Viewers, this is live testing, do not make any action based on such updates as it can go wrong easily.

This guy will live to regret. He will learn it the hard way. Lucky he is still young and time is on his side.

regret after cashing out 10M?

There is more to life than accumulation of a pile of money. A guy in his twenties can go out and do anything and well he should before becoming tied down.