Price cut in South Korea.

Massive price cuts in US coming. US buyers of Tesla were fleeced and fooled so far. But This is what sheep’s deserve.

Margins will plummet now. Volumes are already plummeting. And inventory rising. This is what happens to US manufacturing business competing with China.

RIP TSLA. $25 by 2023 end. Welcome back to earth.

I had a Prius but dumped it. No good for rural driving. Low clearance and soft suspension which isn’t adjustable. Good thing the dealer didn’t look underneath it when I traded it in - I must have bottomed it half a dozen times, often on paved roads with a sudden change of grade. It also sucked if roads were icy. But that was a 2009 model; maybe Toyota fixed those problems.

I am willing to look at the new ones. I got rid of my 2013 because it’s not a great snow car. But it used get preferred parking at some ski resorts and held my skis inside. A good spring ski car. I really don’t need another winter car. Even then I rarely had a day I couldn’t use it. Plus I had a 4Runner at the same time. I sold it after the huge 16/17 winter in December 17. We haven’t had that much snow since. It really was only useless for 2 months. It handled the bad pot holes in Tahoe. I even drove it in Mexico. 50 mpg. 700 mile range. Just slow and boring. I have owned ego cars like Porsche Jag Corvette mustang… just don’t care much about the cool factor anymore. Old age makes comfort, economy and reliability more important than what other people think of your car. I did learn that Tahoe people hate Teslas and Prius… mainly because they get stuck more than SUVs

15% isn’t anemic. 15% constant as BEV sales grow is actual right in line with their target market share.

My Honda is 18 years old. Still runs strong and gives me zero problems. I suspect I may die before it does.

Japanese engineers make great cars.

15% share in a growing market is not bad. Tesla today is already a very successful car company. It’s just that the world domination target (eg worth more than Apple + Aramco) many of its most bullish fans have doesn’t line up with reality.

Even if Tesla market cap got cut in half it’s still one of the highest valued auto manufacturers. It’s still a huge success even its stocks is worth $50.

With my Tesla Model 3 since I bought it I got the following additional capabilities via software updates(listing only the ones at the top of my mind):

- 15 miles higher range

- Faster 0-60mph speed.

- 2 additional side camera views when reversing

- side camera view when signaling to change lanes.

- New maps and new UIs.

- V3/250KW charging

- untold feature updates/too many to list…

…

…

With BMW this is what one gets.

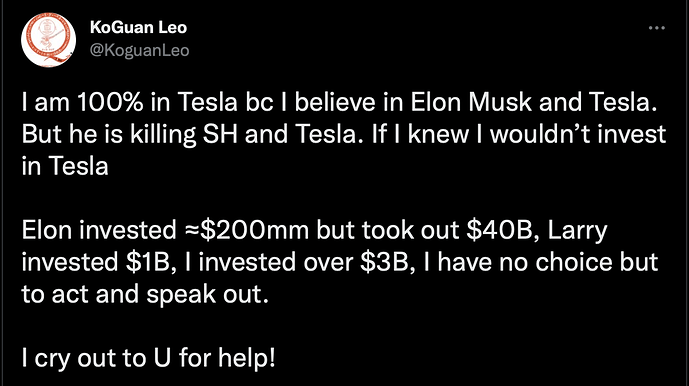

Leo KoGuan is having serious regrets about his investment decisions but rather than blaming himself (which he should) he blames Elon instead. Unbelievable.

Neither EM nor early investors like me will be happy with or consider a $50 exit a “success”. You can count on that.

Most bulls think that market share ends up around what Toyota’s is. The leader, but not some absurd proportion. That is not what people financially model for.

In most bullish analyses, Tesla’s market share will have to decrease over 5-10 years. They will not sustain 20-22% of the world BEV market (which is what they have maintained the last 4-5 years).

The thing that makes bulls crazy is when they think robotaxis are going to happen. That’s what gives the outlandish valuations like value more than Apple + Aramco.

At this stock price, literally none of that is valued in. After Q4 earnings, Tesla will basically be valued at 25 PE, so assumptions of slow growth like Nasdaq 100 collective.

FSD is a far reach, but Energy will not be considered but will soon begin contributing signficantly to the bottom line. This buoy to earnings growth will being happening at some point this year (though could be near the end) and will be hard to keep share price this low (let alone below $100) unless margins fall so much to make automotive earnings negative. The price cuts so far I believe are not enough to do that.

You are missing the point that from this point on their margins will only shrink as they are forced to cut prices and as EVs get commoditized.

Margins would have to shrink dramatically for earnings growth to stop while volumes are going up 50% YoY

If Tesla can grow their production/delivery over 50% per year, nobody is going to care about margins/profits.

Growing at 50% a year is unsustainable. It makes predictions of Tesla becoming a $5trillion valuation absurd just in theory of big numbers merits. It was obvious at a $1.25 trillion valuation when I recommended taking money off of the table. Unsurprisingly prices for Teslas are dropping. You can get a used 2020 $160k X now for $100k… new car prices are falling and inventory is rising throughout the industry. How many cars do we really need? Plus they last over 12 years now and increasing. And if FSD actually works the numbers of cars needed will drastically drop 90%… Musk will literally build himself out of a job.

Hilarious. If Tesla can’t grow at 50% now at far lower volumes and no competition what makes you think they will grow at 50% in the future. Zero chance.

BYD is killing Tesla in China and now gearing to export to Europe. As I said earlier Tesla is no longer a prestigious item to own, for sure in Bay Area. Tesla’s high growth days are over. I doubt Tesla can even grow their volumes by 20% next 2-3 years. Then even lower. Couple that with plummeting margins which is already happening for a fact and you have your next $5T company.

Tesla has been growing 50% on average for many years.

You do realize the the only reason they don’t grow production 50% this year was because of the multi month Shanghai shutdown due to Covid, right?

I find evidence that extremely weak that they will slow down revenue growth when considering the energy sector, so yes I find the investment solid at these price levels.