Long CA!

Market cap to $5T is highly possible. I have large exposure to TSLA through S&P and Austin properties.

HQ TSLA is in Austin ![]()

.

Beverly Hills is good only if you want/ can/ able to flirt with super models and celebrities.

This guy is not uber, $5T by 2030, sound reasonable. He backs his forecast using numbers and examples. Not just blah, blah, blah… with no basis and vague dreamy statements.

Modeling out 7 years is just a handwaving guess. I have no idea about TSLA stock price. It’s mostly human emotions in the short term.

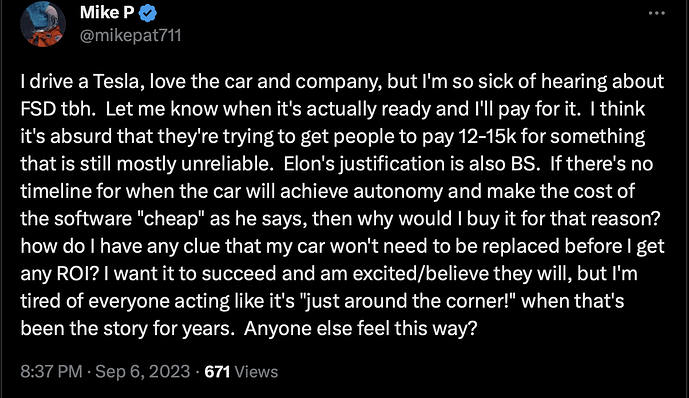

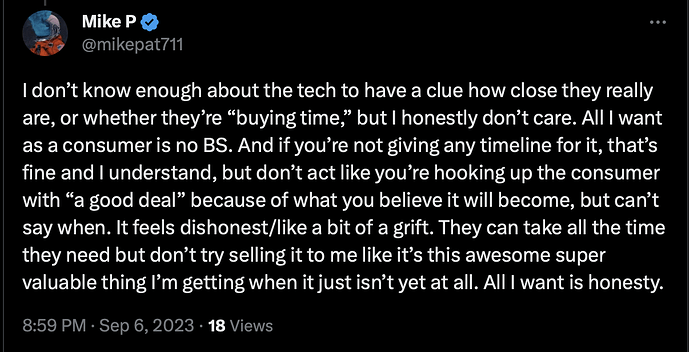

I only know Tesla is facing some significant problems in its business. Demand seems to be a problem as it keeps cutting price. Cypertruck is difficult to produce and also has unknown appeal beyond Elon’s fanbase. FSD is still a vaporware.

CA is the biggest Tesla market. I don’t think people will have good impressions of Cybertruck owners here. They are basically shouting top of their lungs they are unapologetic Elon fanbois.

.

Regardless, modeling is better than baseless aggressive assertions by uber cultists.

Stock price is harder to guess because TSLA could issue tons of SBC ![]() diluting current shareholders. Market cap can hit $5T but share price might be lower than expected. $5T by 2030 is 30% CAGR, should be achievable for a high growth stock.

diluting current shareholders. Market cap can hit $5T but share price might be lower than expected. $5T by 2030 is 30% CAGR, should be achievable for a high growth stock.

Cutting price is to meet the production/ delivery target set by EM. EM wants to meet those targets rather than maximizing ST? profit (optimizing LT? profit).

Selling hardware at low margin or even at a loss only makes sense if they can make it up in software addons. The classic razor vs blade strategy.

I believe Elon when he said Tesla is worthless without FSD. Funny his cult members don’t seem to believe him.

Dave Lee, the one who became a $100 millionaire after he all-in TSLA, has this to say about FSD v12

https://twitter.com/heydave7/status/1699447813896335624

End-to-end learning. Zero-shot learning ![]()

Overall, v12 is not simply just another FSD update. Rather, it’s the start of a new paradigm in autonomous driving, one that likely change the future of transport forever. The end-to-end neural network will allow Tesla to improve FSD much quicker, scale much faster, handle edge cases much safer, and navigate complex traffic conditions with unprecedented efficiency.

I am clueless whether Dave Lee’s view is correct or wrong.

It does sound exciting. Can’t wait to see it released to my model Y.

However, I am doubtful as it seems too easy. Tesla released this hardware years ago predicting that it is sufficient to implement true autonomous driving, and now that they finally cracked it and it proved that their foresight was spot on. Somehow I find it hard to believe that they are that good while everybody else is completely clueless.

.

![]()

Could be true when comparing with legacy auto.

Can’t be true when comparing with Google, Baidu, etc.

Zero-shot learning sound too good to be true. If true, no need to spend tons of money and resources on training.

All these Twitter people drooling over end-to-end neural network are pretty idiotic to be honest. A complex system like self-driving needs to have different systems to act as guardrails. Saying you can just rely on one single system, a neural network that you cannot guarantee safety outcome, is complete BS.

Tesla’s system is years behind Waymo and Cruise. It can work 95% of time but will get you killed the remaining 5% of the time. You just don’t know when that 5% will strike. Waymo and Cruise both invested heavily to get their systems safe enough 99.99% of the time. Tesla just keeps going around in circles. Its cars don’t even have enough sensors and compute to make self driving work.

But whatever. Tesla’s main product is its stock. On that metric it’s doing fine.

lol no. these models are 99% accurate. Why would you store the irrelevant data you have already solved?

.

I don’t have expertise to assess, just thinking from a layman’s perspective. I presume you’re right.

![]()

Why is TSLA not a car company given that 95% of its revenue is from car sale?

Tevis said TSLA valuation included large premium for FSD/ Robotaxi.

Carlos said valuation has not included FSD/ Robotaxi. Carlos said included a little of charging stations, a little about solar/ mega packs.

I don’t understand why people said FSD is an iPhone moment, IMHO, iPhone moment is launch of Model 3. I think FSD/ Robotaxi doesn’t worth much in market cap, at best $1T.

Is EM = TSLA, TSLA = EM?

IMHO, Carlos is over-bullish. Tevis is more reasonable. TSLA = 50% of Tevis stock portfolio.

Price cuts?

Carlos repeats the reason that it will destroy legacy auto manufacturers faster, accelerate adoption of EVs (IMHO, merely inlined with EM’s plan of 50% yoy production increase). Operating leverage of TSLA is high… didn’t verify this.

ENPH vs TSLA solar

Tech of ENPH is superior but TSLA solar products are cheaper.

Carlos’s thesis: TSLA is an energy ETF and building up an ecosystem of products that work together.

Solar has little value without cheap efficient batteries.

Tesla is spread too thin and FSD is a lie… what’s next?

The robot, droid thing. ![]()

.

I am still trying to understand why there are so many TSLA cultists… still don’t understand why they are so uber bullish. I can understand why some are bullish, uber bullish is what I don’t get.

Notice most of the cultists are men? That’s a clue.

I sold my Tesla stock because Teslas are badly built and hav poor customer service. The cultists don’t care.