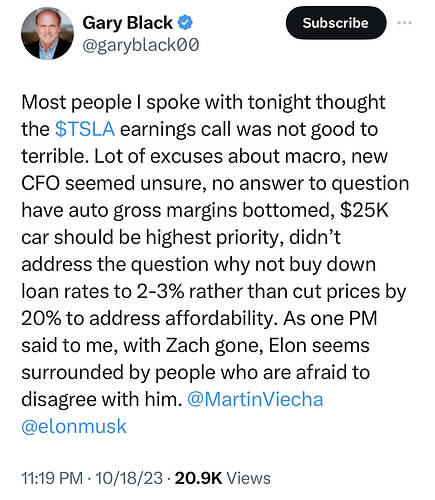

Should we trust the person who have made multi-generational wealth investing in TSLA?

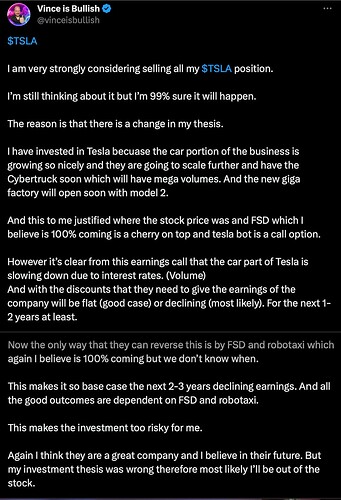

Either Vince is wise for selling and waiting for fundamentals to improve before jumping back in or;

Vince is foolish for selling and would miss the rocketing stock once FSD/Robotaxi is launched.

Oct 19, 2023.

2-3 years mean Oct 18, 2025-6.

Technical picture… hovering above 200-day SMA… slightly above mid Aug low.

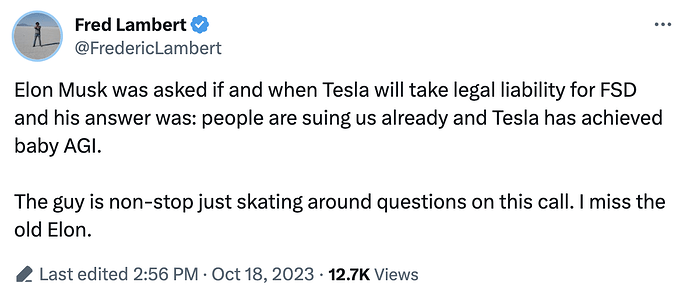

Pretty sure FSD won’t be “launched” by 2025, if by launched he means Tesla takes legal liability for FSD. Really don’t understand why so many believe FSD is close. It’s obviously not.

Elon was asked this question point-blank on the conf call, and he weaseled out.

…

Tesla won’t take legal liability for sure. He would persuade sucker politicians (aka Democrats) for USG to assume responsibility.

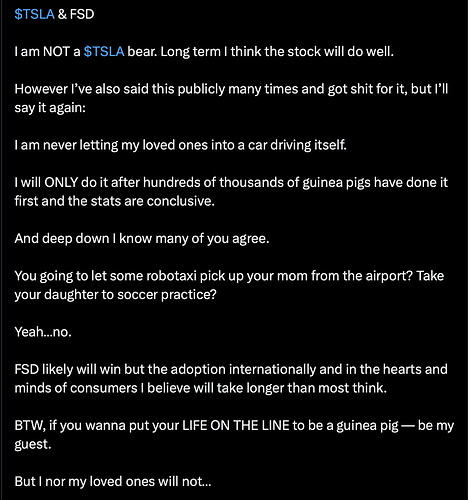

If the technology is there and it’s just a matter of convincing people, then have millions of robotaxis roam around all over big cities and you will have the data you need.

If the technology is there but for Tesla to be able to say that the technology is there, it would need to run similar experiments to have that confidence. If Tesla or some other vendor presents data that clearly show the accident rate much lower than human driver rate, opinion will change, and I think you’ll be surprised how quickly it can happen.

This is if the technology is there.

There are more risks than you think.

Self driving tech has already arrived. Waymo and Cruise have both been operating robotaxis in SF for a while now. They just work without drama.

Tesla’s FSD though won’t be ready for a long time, if ever. It’s a fundamentally different approach.

I just bought a 2007 Lexus sc 430 for $9k… less than sales taxes on a Tesla S.

Has 127k miles and will last to 300k… will out live me and won’t depreciate. Teslas are just status symbols for the the terminally woke. I will be much happier driving my convertible around Lake Tahoe and farm country. More importantly my dog loves sniffing the air in an open car. The smugness of driving a green car doesn’t cut if for me… besides a used car is fundamentally more green than any new car.

Engine of an EV is the battery. Max life is 15 years. Much shorter than the life of an ICE engine.

If not for USG forcing adoption of EV, EV is a non starter.

The Lexus 4.3 engine is bulletproof. A work horse for Toyota.

Other luxury convertibles that old are fully depreciated and all unreliable…like jaguar Mercedes BMW ford Porsche Corvette…

.

Mine is Lexus RX 3.5L. 13 yrs old. What is the engine? Better or same or worse than 4.3?

The 3.5 is a great engine. In my 4Runner and Highlander.

260 hp… not much less than 4.3 at 300hp

Investors piled into a leveraged exchange traded fund that bet on upside in Tesla’s shares as the company’s stock price sank following a weaker-than-expected earnings report.

The Direxion Daily TSLA Bull 1.5X Shares ETF, the largest single-stock ETF for bullish bets on Tesla’s shares, saw net daily inflows of $24.9 million on Thursday, according to Lipper data.

Rex Shares and Tuttle Capital Management launched a suite of hyper-levered single-stock exposure funds on Thursday, including the T-REX 2X Long Tesla Daily Target ETF, the T-REX 2X Inverse Tesla Daily Target ETF.

Did not know there are single stock leveraged ETF. They should put out 3X one asap.

Just buy calls with expiry more than 1 years. No need for etf.

Disclosure: Didn’t buy any.

Dave Lee, an early TSLA cultist who doesn’t understand why some bulls are selling. They didn’t get TSLA at dirt cheap price. Many got them between $200-$400. These investors are selling to protect any gains they still have. This is prudent for those who have “all-in”. For Dave, even if TSLA declines to below $70 as some bears claim, he still sits pretty.

Dave also didn’t comment whether given current fundamentals, the valuation is correct or not. Long term, if EM is still around and execute correctly, won’t be surprised TSLA is worth a lot more. Reiterating long term fundamentals don’t mean sh&! if you have bought at $200-$400. Declining to $70 mean a loss of nearly 70%.

Autos accounts for 95% of Tesla’s revenue. Energy is 5%. AI? Zero.

So I don’t understand how people can ignore the “hiccups” in autos business but say things are all good because of energy and AI.

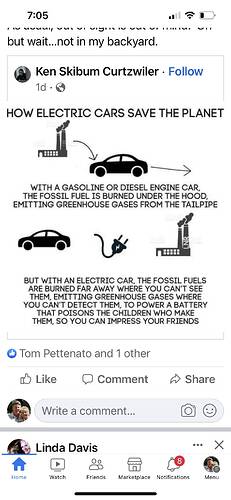

EV the ultimate in greenwashing…

Solar power has become so useless that PGE will not credit you much for feeding electricity back into their system.

In fact you have to buy batteries if you want to use solar…

Without effective storage or batteries Solar and wind can only provide 20% of needed energy… Nuclear power is the only effective carbon alternative…

Daren knows more about TSLA than Dave and more about China than @manch. He is also quite realistic… not many catalysts to drive share price for the next 1-2 years. He did lots of legwork ![]()