http://www.bloomberg.com/features/2016-vancouver-real-estate-market

The walls of Clarence Debelle’s Vancouver office on Canada’s west coast are lined with gifts from his real estate clients: jade and turtle dragon figurines; bottles of baijiu, a traditional Chinese alcohol; and enough special-edition Veuve Clicquot to fuel several high-end cocktail parties.

They are the product of Vancouver’s decade-long real estate frenzy. The city, with its stunning views of the mountains and yacht-dotted harbor, has long been one of the world’s most expensive places to live but price gains have reached a whole new level of intensity this year. Low interest rates, rising immigration, and a surge of foreign money—particularly from China—have all driven the increases.

Consider the latest milestones:

• The cost of a single-family home surged a record 39 percent to C$1.6 million ($1.2 million) in June from a year earlier.

• More than 90 percent of those homes are now worth more than C$1 million, up from 65 percent a year earlier, according to city assessment figures.

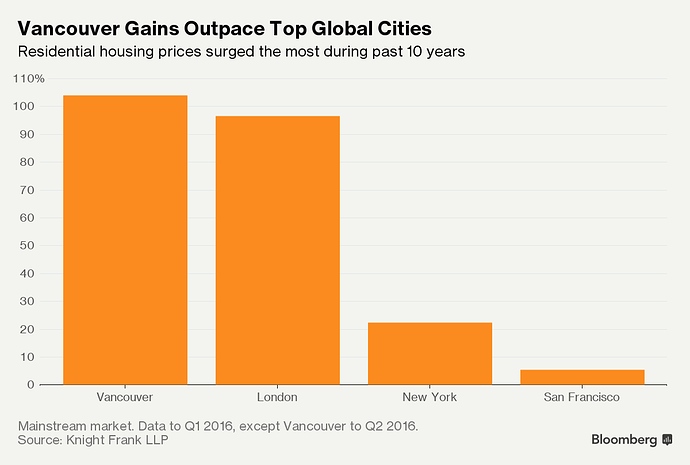

• Vancouver is now outpacing price gains in New York, San Francisco and London over the past decade.

• Foreigners pumped C$1 billion into the province’s real estate in a five-week period this summer, or about 8 percent of the province’s sales.

After copious warnings over the last six months, including from the Bank of Canada, that price gains are unsustainable, the provincial government of British Columbia moved last week. Foreign investors will have to pay an additional 15 percent in property-transfer tax as of Aug. 2 and city of Vancouver was given the authority to impose a new tax on empty homes.

As Canada waits to see what effect, if any, the moves may have, here are the stories from the city’s wild ride.