“The cooling Silicon Valley real estate market is less of a question and more of an acknowledged fact (we wondered about it in June, we are sure now).”

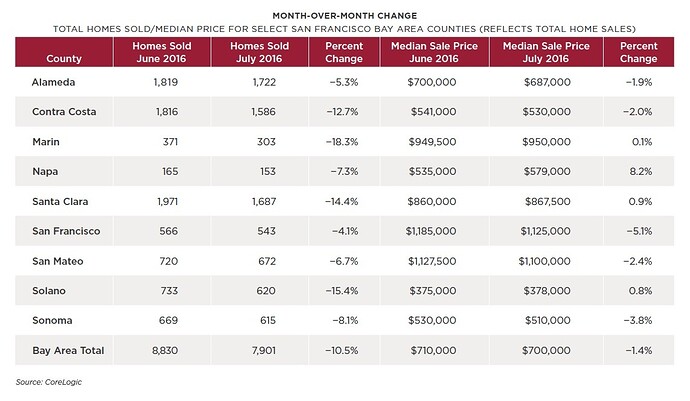

New data released today by CoreLogic® shows a total of 7,901 new and resale houses and condominiums sold in Alameda, Contra Costa, Marin, Napa, Santa Clara, San Francisco, San Mateo, Solano and Sonoma counties in July 2016, down 10.5 percent month over month from 8,830 sales in June 2016 and down 13.5 percent year over year from 9,130 sales in July 2015. Since 1988 the average change in sales between June and July has been a decline of 5.5 percent, and sales have fallen on a year-over-year basis for the past four consecutive months.*

The median price paid for all homes sold in the San Francisco Bay Area in July 2016 was $700,000. This was down 1.4 percent month over month from a record $710,000 in June 2016 and up 6.3 percent year over year from $658,500 in July 2015.* The average change in the median sale price between June and July since 1988 is a decline of 0.2 percent. While on a year-over- year basis, the median sale price has risen for 52 consecutive months

Sales have been constrained by waning a ordability, a low inventory in many markets, moderately tight credit and, speci cally last month, a quirk of the calendar.

As stated in the original post, I see these generally in year 2016

Houses taking longer to sell in much of Silicon Valley / Santa Clara County

Homes selling with fewer offers than 6 or 12 months ago

Contingencies for loan, appraisal and inspection becoming more common

More price reductions being necessary for than a few months ago

Fewer ALL CASH offers

Sale price to list price coming down a little

The money question is to buy before election or during winter after election or wait till next Spring for clearer direction?

Is an investment question. Buying to stay should be whenever you can afford it. Please don’t say buy every year, the difference between Jan and Dec is 10 months apart.

My thesis is that the market has bifurcated. The low to mid end is still hot, and the higher end has cooled. I want to see more data affirming or rejecting that thesis.

I myself am shooting for December '16 to March '17 just so because I need that much time to get ready. I still believe in buying whenever you are ready, for both personal and investment purposes.

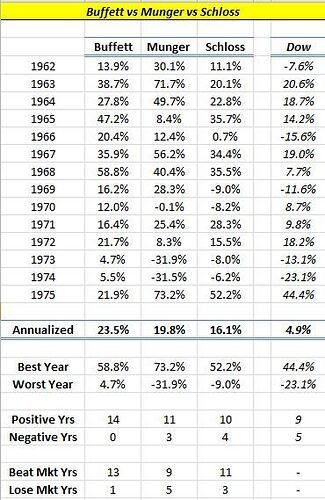

Investment needs strategy, see here buffet strategy wins over Charlie.

Buffet made $100k investment into $100 Millions in 13 years before 1960 !

Hey, what about margin of safety. Choose the right investment (RE in South Bay) but still have to wait (time ![]() ) for margin of safety, right?

) for margin of safety, right?

Same Seth Concept: Market has hidden treasure. Analyze, Find it, Strike silently.

Few choices

- Buy a large lot, expandable SFH fixer upper at low cost, fix it, rent it

- High Appreciation over long haul, but moderate cash flow - Buy a low cost condo/TH, rent it.

- Better Cash flow, Better Appreciation - Buy a multiplex, Better cash flow

Either choice depends on Location, i.e, good location.

Keep looking, you will find treasure.

Large lot doesn’t work in SV, very expensive and low cashflow. Work in Austin’s suburb though.

No doubt. But fixed upper, nice location, less competition, higher margin of safety. But we need strong cash reserve.

If financially not workable, then we need to go multiplex (better) or condo. I would prefer multiplex as we have issues with Condo HOA. But, lot of high cash down investors are behind multiplex.

Just gave a filter Multiplex, 2500 sqft less than 1M, this gave 3-plex. It says “All units are occupied with 0% vacancy!”

https://www.redfin.com/CA/San-Jose/501-E-San-Fernando-St-95112/home/872891

Rent:54000, Expenses 13000, Price 950k brings 4.25% cap rate.

(BTW: I do not know anything about this location etc)

It is on the corner of E. San Fernando and Eleventh St. Eleventh has very heavy traffic. Tenth and Eleventh are major routes for bypassing 101 into downtown. The good part about it is it will always be rented 10 of 12 months with SJSU students clamoring for housing. I don’t know if they will have money to pay market rents though. It will be hard to get year round quality tenants I believe.

Edit - It does say that current rents are under market. It could be it is not possible to rent them out at market price.

Very much agree with 1 & 3. I didn’t have good experience with Condo. HOA fees and always one problem or another from other units in the building. I am curious on why you think it is “better appreciation”.

HOA fees less than $400 is nominal with current standards. HOA restrictions are issue. HOA has to approve for rentals. HOA may have some surprises when they want to renovate buildings. HOA Legal issues may cause trouble. Better to be independent of HOA. You can do anything on your own in SFH.

Better Appreciations: Condos/THs are very much affordable range less than 800k. If you get them in good location, wherever people migrate or competition is high, appreciation is high being low affordable price.

How about this? The only issue is with the big tree. It is California protected Redwood tree, you can not cut down. This may provide break even with current interest rate assumption 4% investment property.

https://www.redfin.com/CA/Campbell/197-Cherry-Ln-95008/home/755631

For living purpose, first timer, this is nice one.

I do not know how many people really look into buying this property. I do not have sufficient money and time to work out a deal with these.

197 Cherry Lane can be turned into this kind of home in future when you hold 7 to 10 years. appx cost $200 * 3500

https://www.redfin.com/CA/Campbell/191-El-Caminito-Ave-95008/home/757199

Another potential deal is here

https://www.redfin.com/CA/Sunnyvale/443-Morse-Ave-94085/home/764668

This one is R2 zone, rebuild like the way ptiemann does. This will give you early results.

For both the cases, you need to have knowledge and experience like elt1 and ptiemann. Above all you need money and strong financial background to make it profitable.

The point here is that you always have hidden treasures in fixer uppers.

I find little incentive to buy now. Cooling could be the start of a recession or price decline, there’s no need to rush. The chance of a significant appreciation is minimal. I would hold off purchase.

On the other hand, there is no need to sell if you bought years ago and have a nice low tax base. I tent to agree with buy and never sell. However, timing the purchase in a flat or declining market is not a bad idea.

It’s only cooling at the moment. It could take a few years to have some significant price change.

https://www.redfin.com/CA/Campbell/197-Cherry-Ln-95008/home/755631

https://www.redfin.com/CA/Sunnyvale/443-Morse-Ave-94085/home/764668

Compared to this two homes, Morse will sell first and easily as this is no brainer for anyone.

For the second case 97-Cherry-Ln:

At high level, the safety is embedded with 20% price down in future, but may not have cushion on 40%.

The current cooling off is due to interest rate 0.25% happened in last December and fed planning to increase 3% level which is impossible for FED in USA with current global situation. They always threaten to raise, but they can not do it (do you own research).

I was actually responding to hanera call on “Margin of Safety”, esp on 197 Cherry Lane purchase. This home with bigger lot, fixer upper, 27 people crossed redfin (dislike) and redwood tree in front is a bargain deal, can be negotiated for a down price and purchase.

Key is 1) how much to buy, 2) lock rate (critical 30 years or 10 year ARM), hold for 7 to 10 year as rental for higher profitability. The profit can be reached 60% to 100% range at the expense of low mortgage leverage and rental depreciation. With 20k work, this can be turned into break-even rental. Holding provides growth (even with down or up market) at 5% level. Later part, if expansion possible (buyer needs to assess), remodel gives a good jump on profitability and a possible excess write off puts a large return. I would prefer 30 year fixed and ever lasting rent.

I can provide complete plan, but it beyond my scope as I am not going to buy this home.

I decided not to buy any more home and plan for my retirement or semi-retirement life.

My assessment may not be accurate as I have not visited the home and not analyzed it properly with current reports etc. If I visit the home, I may have better knowledge about expand-ability, current issues, fixes required etc. Until then, this assessment is worthless or 10% accuracy only !!!

Well, fortress only decline 15% from 2007 ATH. Outside up to 80%. Rally for most part of SFBA is more than 100% from 2009-2011 bottom. So if you are buying in fortress, is ok.

Inventory drops fast. Sellers who refuse to sell at lower price delist and those who have not listed refuses to list. Now we have to wait till Spring… Unfortunately, number of rentals in my target neighborhoods keeps creeping up… can’t ask for good rents… another year of stagnant rent. So much for fast appreciating rent… that’s why I hate median… occasionally some landlords manage to get a few suckers to rent at high price, push up the median but the rest still get stagnant rent.