Just meant to say that Warren would rather have high inflation so she is criticizing Fed.

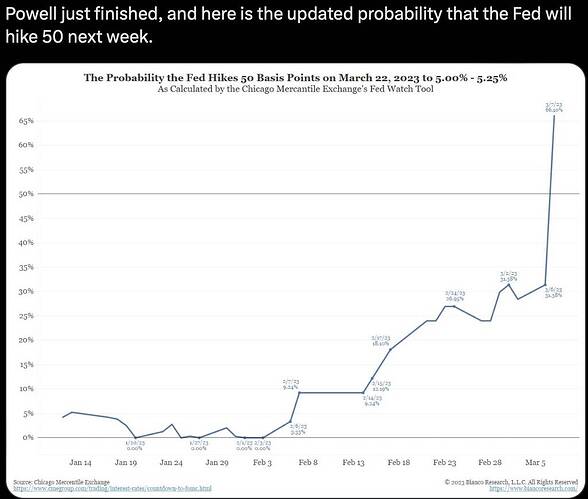

But stocks still went up after he spoke. As usual he’s not serious about fighting inflation and will keep jawboning.

.

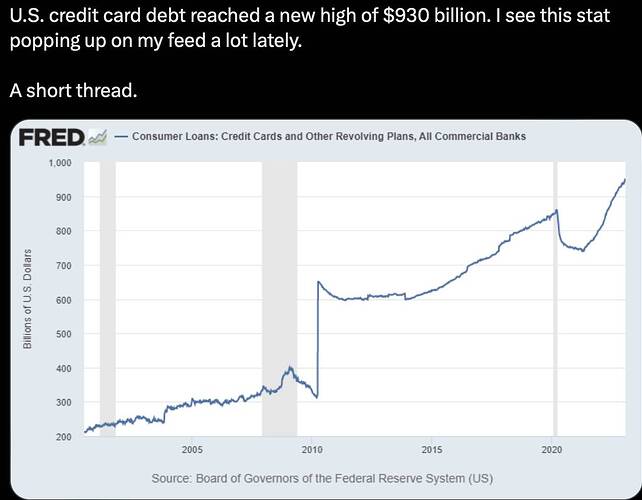

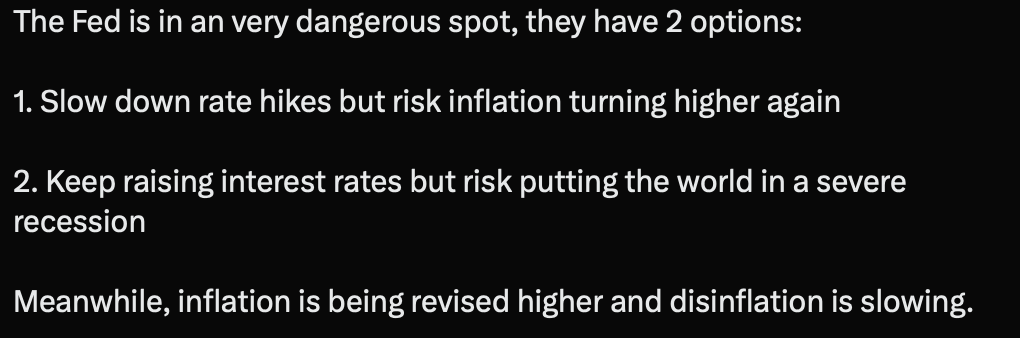

He is serious but can’t raise terminal rate too high. Debt level of USG and Americans are very high. Since many loan rates are based off Fed rate (even though not directly proportionally), raising Fed rate would push those loan rates up thereby creating a heavier debt load which could lead to defaults, foreclosures and bankruptcies.

From members of Fed comments, max terminal rate is 5.5% and JPow would try to keep it at 5%… 4.75%-5.0%

His words count as much as his actions. He has now even stopped to talk the inflation down. Shows his true intentions.

.

Can’t decipher your riddle. Speaking plainly… all except blue collar wages are deflating. I recall, can’t remember is Jeremy Siegel or Larry Summers or both said let blue collar wages rise since they are in catching up mode, their wages have been stagnant for a long time. So JPow don’t have talk inflation down anymore. What Fed need to do now is hike till terminal rate, hold till headline inflation is 1% below the Fed rate before pivoting.

Inflation is coming down and that is truth. Next CPI will show better year-over-year data. May be we can have a soft landing…

My 2 cents:

-

Since divided Congress will do its damage,Debt ceiling Drama will go until last 3 minutes before last day midnight, he is stopping it.

-

He is satisfied that he has done more damage already. The yield curve inversion will take it’s role to play when no one expects.

Not at all. 2023 and 2024 are not easy to cross. We will be going through recession without which market is not turning permantently bullish side.

This time, more damages (highest hit) to watch chip sector, then tech sector (high hit) and S&P (lower than these other 2 sectors).

Believe or not, FED had done enough (rate hikes) damage to economy.

Inflation keeps going down when you look at real time plots. This is actually silly. People are using noisy, infrequent samples to stir up uncertainty.

People are refusing the Powell hair shirt. Just like they rebelled against Carter’s piety. After three years of Covid its time to party, and spend lots of money

What does he mean?

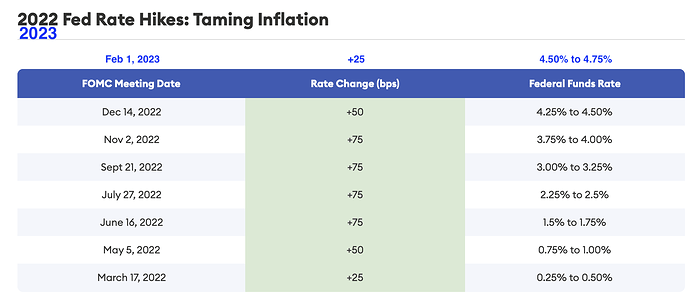

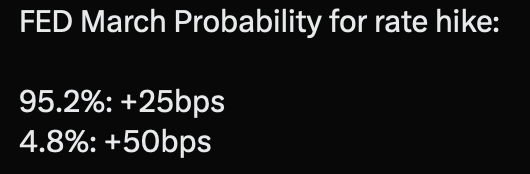

0.5% or even 0.75% in Mar FOMC? Thought will be the last hike.

He means they have no idea what they’re doing, and they’re making it up as they go along.

IMO, In order to preserve their credibility, they want to keep it vague so that it doesn’t come to bite them like “transitory” did in the past.

My 2 cents,

Those who believe daily news/media, after every week inflation report, telling FED will pivot soon, and try to be bullish, listen 5 minutes discussion of Senator Warren vs FED Powell.

You will realize what is going to happen between 2023 and 2024 !

Summary In short: This year 2M (1%) people will be laid off, next year another 2M (minimum 1%) and last 12 rate hikes period where 1% lay off or more, none of them escaped Recession.

This means recession is imminent and will wreck economy in 2023 and 2024. Cash holders will benefit when they time the purchases (either stock or real estate).

Good Luck!

Isn’t the new word persistently? Someone should buy them a thesaurus or something.

If Fed hikes 25 basis point and says will pause. I will laugh out loud… many events in between… Fed does as expected by the market… the more things change, the more things remain unchanged.