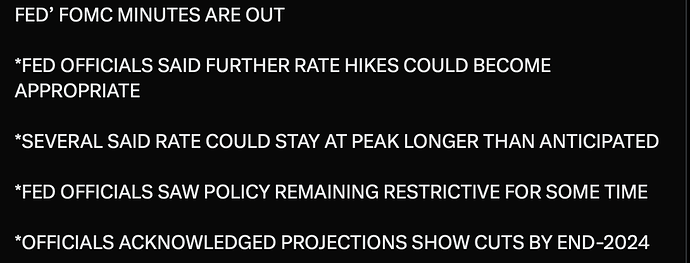

As of now, No rate hike further…

Now the fed almost has to increase rates to appear independent. Remember when Trump was critical of the fed and there was a massive uproar about how inappropriate it was? Now it’s ok if democrats send a letter to the fed and publicly say they did it…

Fed pauses and market keeps declining for 7 days.

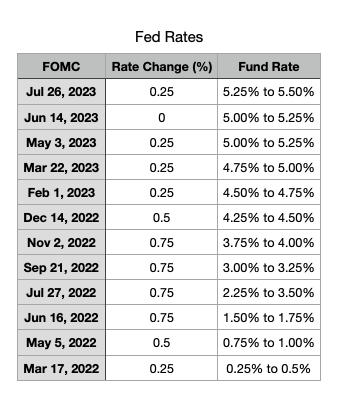

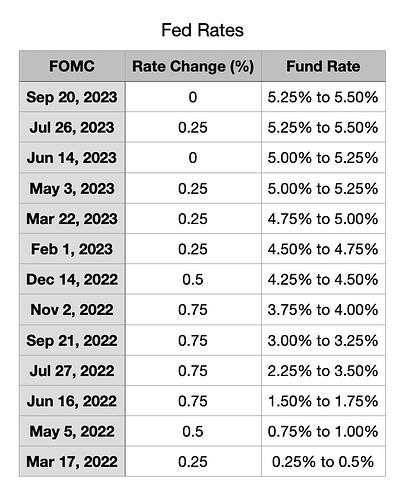

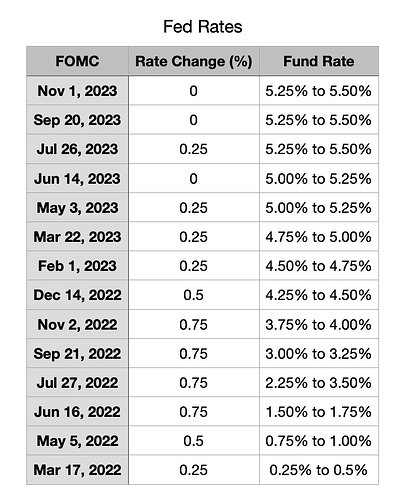

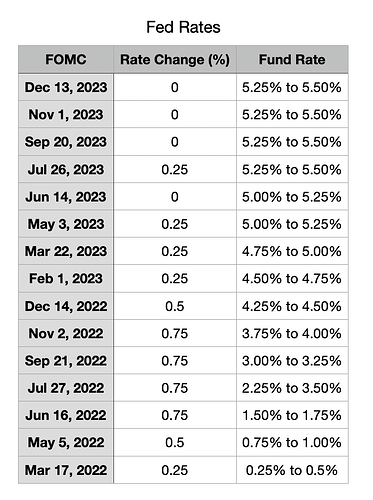

The Fed also signaled that it could continue to raise rates at least one more time this year, since most officials view this as necessary to bring inflation down to the 2% target over time. However, Fed Chair Powell has stated that the decision made during the November meeting will depend on the data that comes in.

The Fed acknowledged the looming risks of banking instability, stock market volatility, and a global slowdown, but it argued that the economic outlook remains favorable and that the labor market is resilient. The Fed revised its economic projections, expecting faster growth, lower unemployment, and higher inflation this year, but also seeing a rise in unemployment and a decline in inflation next year.

Richcession for high net worths while wage spirals for blue collars. Is this wealth redistribution, planned or unintended?

They have zero control over what’s going on in the economy anymore.

A lot of buyers on the sidelines waiting for bargain prices in RE stocks hard assets… used car and boat prices definitely dropped… maybe a lot more next year… bargain hunters are definitely looking at RE… maybe waiting for the vaunted 50% price drop?

Not a bad time to be sitting on cash at 5% waiting for Powells recession… Been a long wait… but may never happen…

I think interest rates are crushing used car and boat prices. It completely changes payment amounts and not many people are paying cash for them.

No rate hike.

1. Interest rates unchanged (00:00:26)

2. Inflation has moderated (00:00:46)

3. Committed to bringing inflation down (00:01:19)

Rally till end of the year or just one-day wonder?

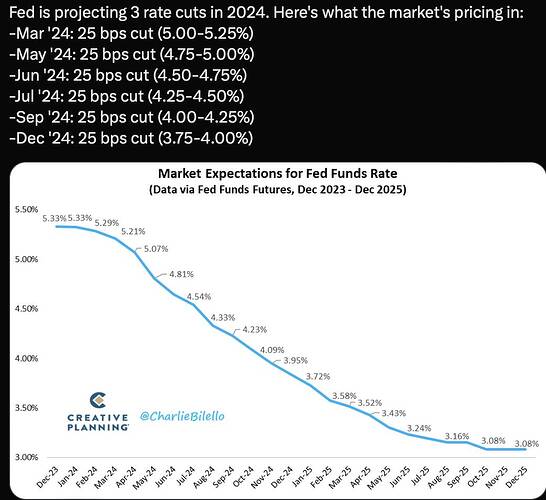

“Along with the decision to stay on hold, committee members penciled in at least three rate cuts in 2024, assuming quarter percentage point increments. That’s less than market pricing of four, but more aggressive than what officials had previously indicated.”

They are aligning to market expectations. The fed is useless and the market should just set rates.

I don’t see there being very many cuts unless there’s a recession. They will want to save cuts for when they need them to stimulate the economy.

.

Exactly. Wishing for cuts is wishing for recession.

I thought politicians weren’t supposed to try influencing the fed. The fact the fed is going to respond is even worse. Where are all the articles criticizing her for her? The “fair” media should criticize her just as much as they did Trump.

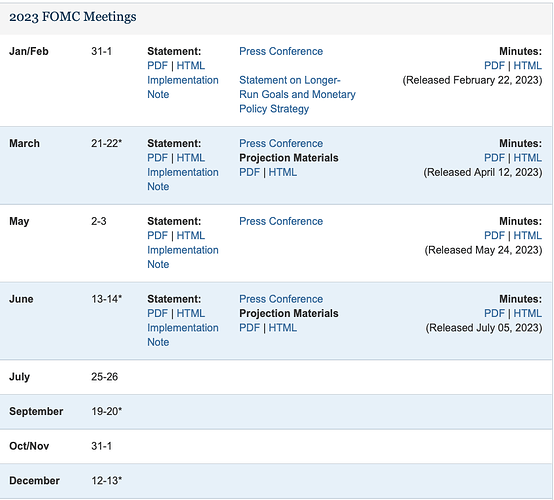

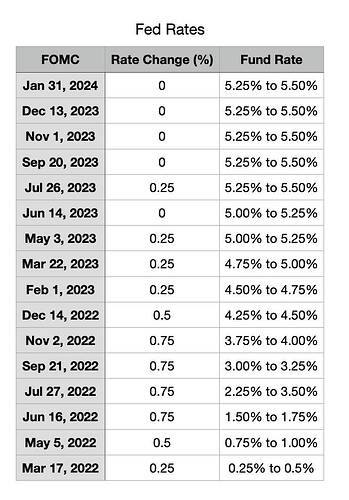

Rate pause. Next FOMC Mar 19-20.

Officials say they are still “highly attentive” to inflation risks.

Inflation risks are coming from frivolous spending by USG.

Fed officials noted that the risks to achieving price stability and maintaining full employment are “moving into better balance.” The Fed characterized job gains as having “moderated” over the last year but noted that job gains remain “strong.”

The central bank also changed language from prior statements that had previously left room for rate hikes.

On Wednesday, the Fed more broadly referred to “any adjustments” it may need to make to its interest rate policy in the future.

The Fed had, in prior statements, made reference to the potential need for “any additional policy firming” should inflation not continue moving towards its goal.

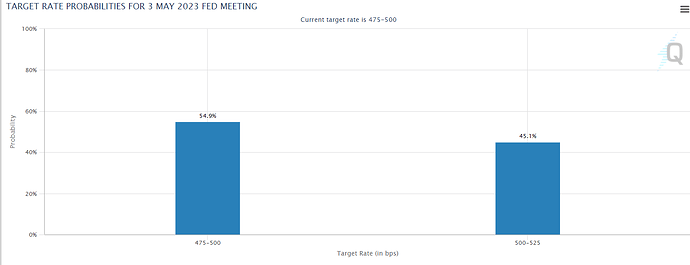

Following the Fed’s announcement on Wednesday, data from the CME Group showed markets pricing in a roughly 55% chance that the Fed begins lowering interest rates in March; as of Tuesday, this measure had suggested the odds of rate cuts beginning in March were closer to 40%.

The Fed also removed language qualifying the US banking system as sound and resilient while also stripping out any talk of how tighter financial and credit conditions would weigh on households.