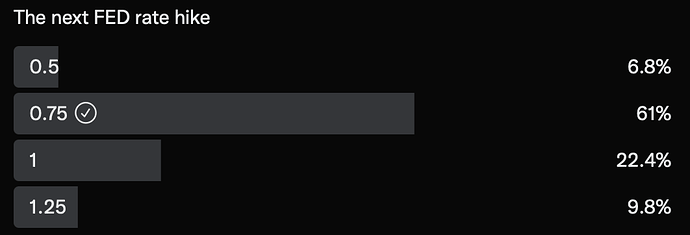

I voted for 0.75% ![]() Surprised to see 32% expect higher than 0.75%

Surprised to see 32% expect higher than 0.75%

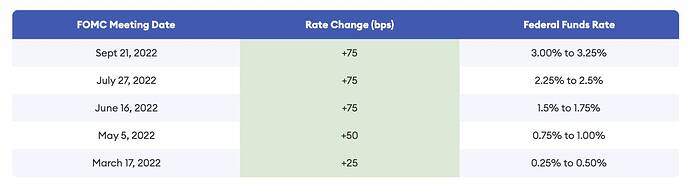

Raised 0.75% as expected.

Market red?

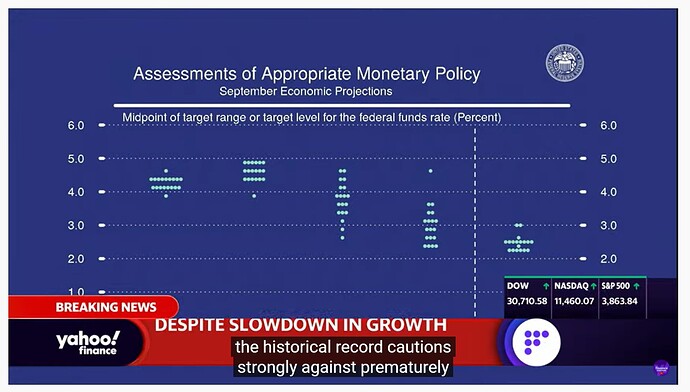

Along with the massive rate increases, Fed officials signaled the intention of continuing to hike until the funds level hits a “terminal rate,” or end point of 4.6% in 2023.

Good. No change in terminal rate.

The “dot plot” of individual members’ expectations doesn’t point to rate cuts until 2024; Fed Chairman Jerome Powell and his colleagues have emphasized in recent weeks the unlikelihood that rate cuts will happen next year, as the market had been pricing.

Guess market is not happy with no rate cut remark.

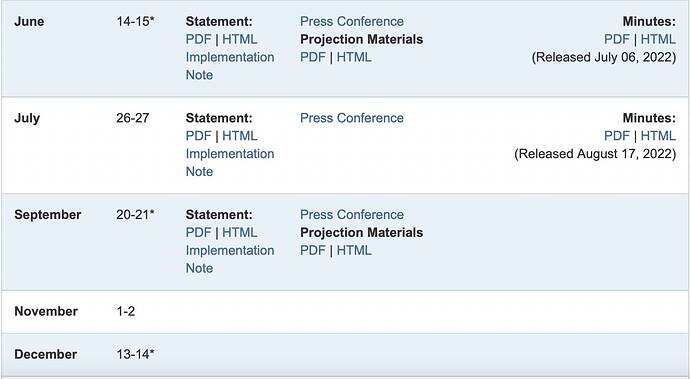

Until 12:30 PM PST (until FED conference) over, market will be volatile, then stabilized the direction. In 6 mins, Powell starts his conference.

See live here

Watching. For the first time ![]()

That is it !

Now, you do not need to read any news/media for rates, inflation or any other things !

If news/media writes the details biased, you will immediately notice the issue !!

Hi experts,

With fed signaling rates could reach 4.6 before slowing down, what will be the average expected 30-year home mortgage rate by then.

I know there is no direct correlation between Fed rates and 30-year mortgage i am looking for some estimated number.

Thanks

You have some mark up (2%-2.25% range) over this rate, appx it may be 6.75%-7% range. All guess work.

That’s about the right spread from a historical perspective.

If Fed also continues to sell MBS it’ll add another percentage point to the mortgage rates. So expect around 7.5 - 8% rates.

Not really.

If one lender sells the mortgage packages to another lender, there won’t be any change is rate. This is very common transfer issue between one secondary lender to another secondary lender.

It is just MBS rate auction that determines the rate, mainly by supply and demand.

If FED successful in selling the MBS, it is a good sign market is having sufficient liquidity of MBS.

Exactly. Plus, the fed isn’t selling MBS. They simply aren’t buying more when existing bonds reach maturity. The Fannie/Freddie auctions are the indicator of where mortgage rates are going. The federal government still guarantees them through Freddie/Fannie, so the rate should move much due to the fed not redeploying capital from maturing bonds.

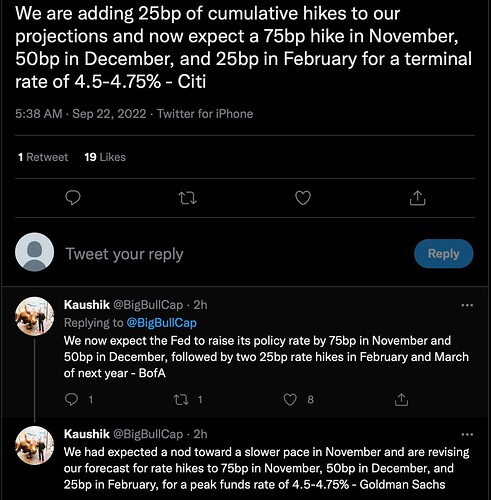

After yesterday’s FOMC, rate is 3-3.25% and expected rate hikes in Nov and Dec are 0.75% and 0.5% respectively. Previous expectation is 0.5% (Nov) and 0.25% (Dec).

Saying it out loud for those who don’t follow Fed closely.

Preconceived or unintentional?

Now Europe is punished, Russia is punished, China is punished, Africa is punished, … still want to talk about replacing USD as the reserve currency?

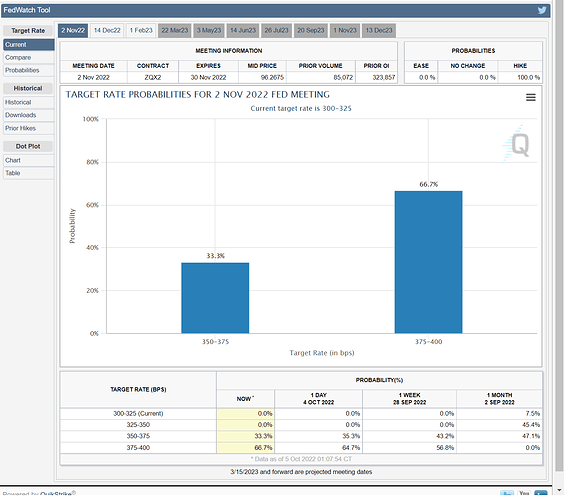

Some people view 50 basis hike as Fed pivot.

Edited for clarity

Can that show the trend over time of how expectations have changed? That’s the real key.