lol just got lucky ![]() Today I received interview request for 5 jobs in retail sector. May be next year it will go to dark gloom but we are not there yet.

Today I received interview request for 5 jobs in retail sector. May be next year it will go to dark gloom but we are not there yet.

I went into a restaurant on Sunday and walked out in 5 minutes when I realized I could get same/similar food somewhere else for 30% cheaper.

It’s ridiculous to spend 50$ on simple meals for a family of 4.

That’s actually a great deal. In Bay Area, average restaurants now charge at least 30-40 per person per meal. Not including drinks.

You can clearly see that I am a cheapskate and count my pennies ![]() .

.

.

Where did you work?

1 share of…

AAPL $135

META $105

TSLA $178

GOOG $87

Above $50 ![]() Just sell 1 share, can pay for a meal for a family of four.

Just sell 1 share, can pay for a meal for a family of four.

Nowadays Bay Area restaurants add in 18% tip at a minimum. What’s up with that? Even a couple of years back it was 15%. I mean % is based with the bill amount i.e. more your bill more you pay in $s, so I don’t understand the increase in %, and also in Bay Area/CA everyone makes min wage which is $15/$16?? and is going up and up every year.

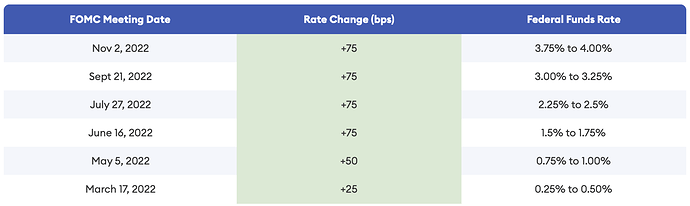

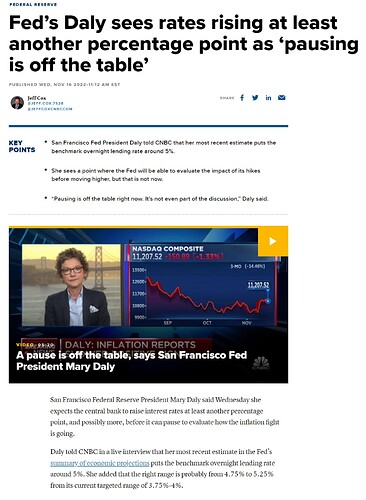

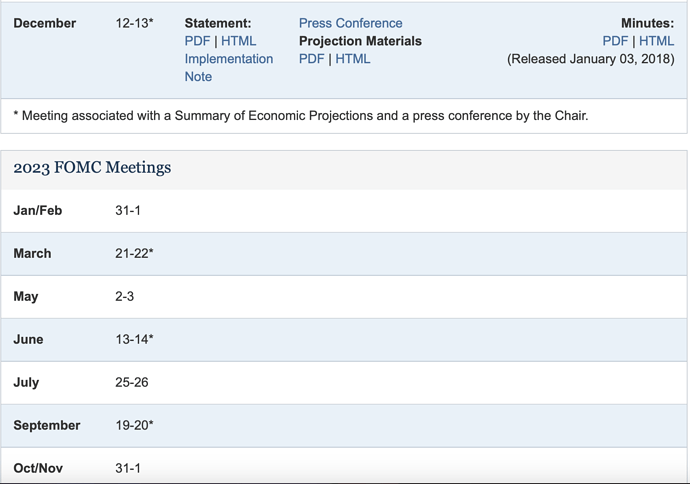

Expect Fed to…

Dec hike 0.50%

Jan hike 0.25%

Feb hike 0.25%

Terminal rate = 5%

Pause till end of year to early next year

Begin to reduce rate i.e. U-Turn

As for inflation, he said inflation as measured by the core personal consumption expenditures price index, which stood at 5.1% in September, should ease to 4.8% this year, 3.5% next year and 2.5% in 2024. The Fed’s target is 2%.

Harker said in his speech that he believes the U.S. gross domestic product will be flat for this year, rise by 1.5% next year and 2% in 2024. Unemployment should rise from its current 3.7% level to 4.5% next year before falling to 4% in 2024. He said there’s evidence the Fed can lower inflation “without doing unnecessary damage to the labor market.”

“This morning’s October CPI report also suggests some easing in overall and core inflation,” she said, while adding “there continue to be some upside risks to the inflation forecast.” Mester added she expects to see a “meaningful” slowdown in price pressures next year and after and a return to the 2% inflation target by 2025.

Extended Harker’s expectation of CORE PCE from 2.5% in 2024 to 2.0% by 2025.

She also said it’s possible growth might turn negative as well.

Recession ![]()

Easy for GDP to rise with these high inflation rates. Just won’t rise in constant dollars.

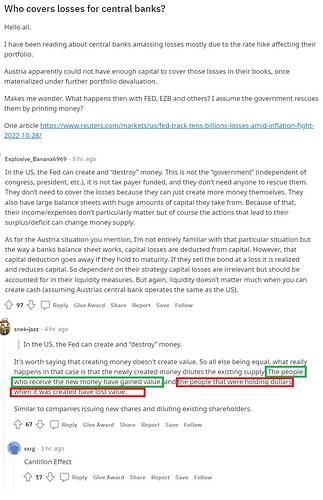

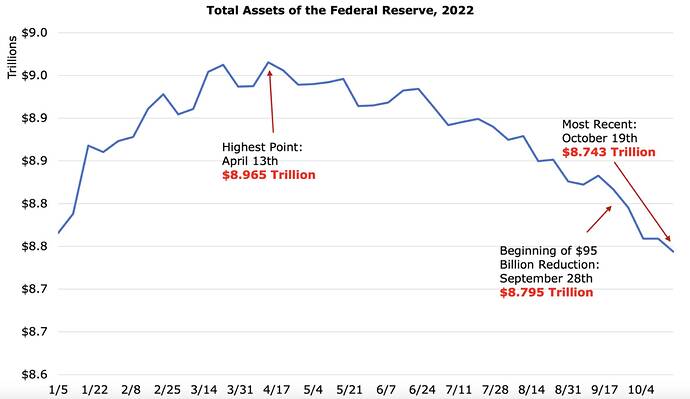

People still don’t get it though. They only lose money if they sell the assets after the price declines. If they hold to maturity, then they receive all the initial money back unless there’s a default. I have no clue why this is confusing for people. The fed isn’t selling securities. It’s letting them mature.

Just posting for awareness:

Since today market tanks, media publishes reports from bearish FED. If market is bullish, they publish post from bullish people.

The practice is followed across all news/media to publish interesting posts related to day today actives/market sentiments so that readers are eager to read such sensational stories.

Altogether, it is published for circulation, not necessarily what is happening or what is going to happen.

Yesterday Market was positive, they published Bullish sentiment news

Scott is late. Investors are in anger phase, long passed in tears.

When market corrects media publishes bearish posts like this

Mostly click baits

That is media, do not be fooled by them.

Reference JPow talk yesterday.

Anyone sense that he is expecting a Goldilocks economy next year and then 10+ years of boom?

Who cares what he expects. His expectations are garbage. We all know that.