Jil

December 1, 2022, 5:36pm

145

History…History…2001 and 2008…just follow history. What borrowing rates are high, companies are given term loans (not fixed), many Mom&Pop, small, medium and big debt ridden companies file bankruptcies.

J.P is going to maintain high rates for the whole 2023 and starts reducing in 2024 after seeing inflation comes down.

This is another major recession, after which we grow nicely for a decade.

hanera

December 1, 2022, 5:49pm

146

.

He talks about risk management

Jil

December 1, 2022, 5:59pm

147

All I know is that he may not tell everything, but whatever breaks now, he has to fix it later! Job Secured!

Here you go, oil crisis and why WB buying OXY madly !

hanera

December 2, 2022, 5:39am

148

I see JPow talk is consistent with…

That is, no change in Fed’s plan.

1 Like

Jil

December 6, 2022, 7:23pm

151

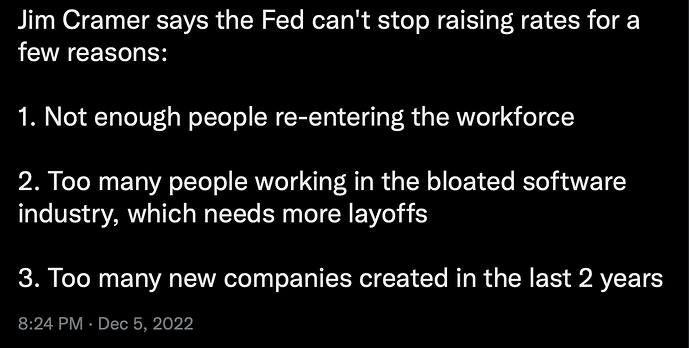

Jim Cramer (opposite is true) confirms FED is going to stop raising rates now.

FED will do 0.5% Dec and then one or two 0.25% next meetings, then pause for 2 to 3 quarters to see the effect.

1 Like

mcp

December 6, 2022, 7:45pm

152

Firstly, he should be laid off from mad money show for giving wrong prediction consistently

hanera

December 6, 2022, 7:54pm

153

Consistently correct = 1/ consistently wrong

Should keep.

Fire those who are inconsistent

2 Likes

hanera

December 14, 2022, 5:51am

155

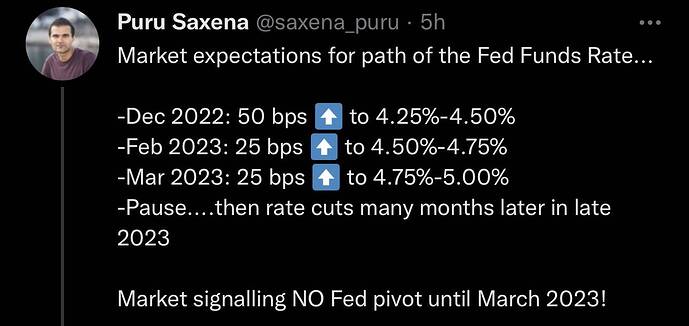

Puru got the message finally

hanera

December 14, 2022, 7:27pm

158

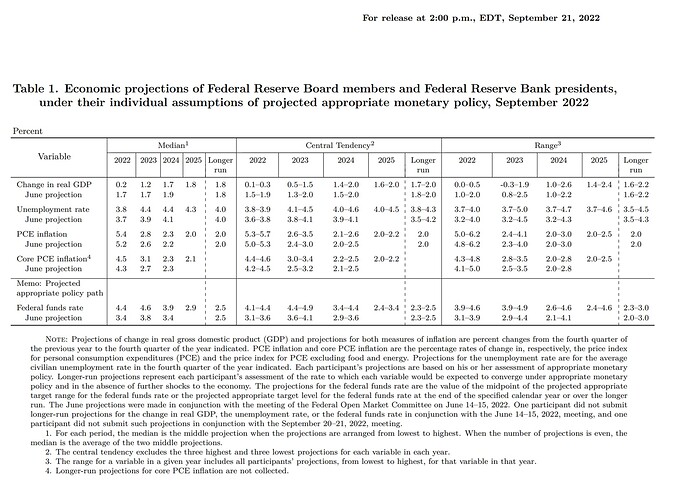

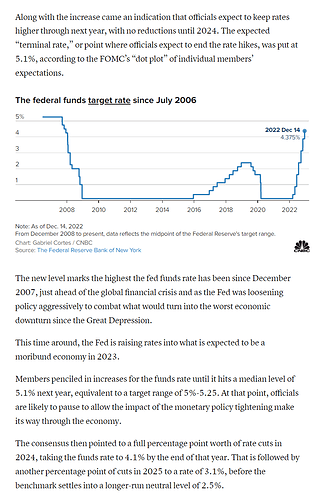

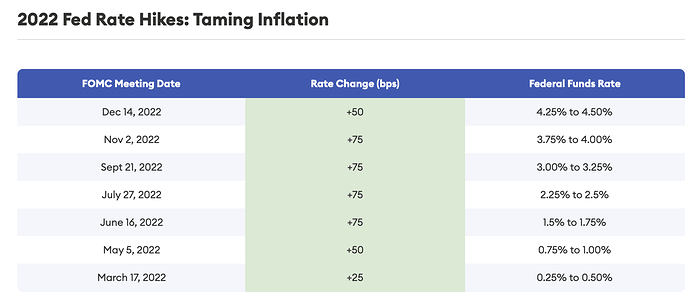

0.5% as expected. However, Fed indicates a terminal rate of 5-5.25% which is 0.25% higher than market expectation.

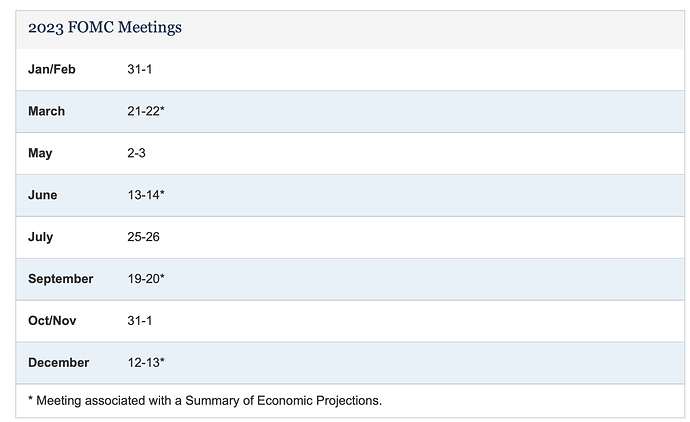

Next FOMC meeting is Jan 31/ Feb 1.

Wow, it’s almost as-if they have no idea what’s going on and never look at data. Even they admit it takes months for rate hikes to impact the economy. Inflation is already decreasing, and the economy hasn’t fully absorbed all the existing hikes.

2 Likes

Jil

December 14, 2022, 7:41pm

160

Each next two meeting, FOMC will be increasing rate at 0.5% instead of expected 0.25%.

FED said there is no rate reduction in 2023 at all!

1 Like

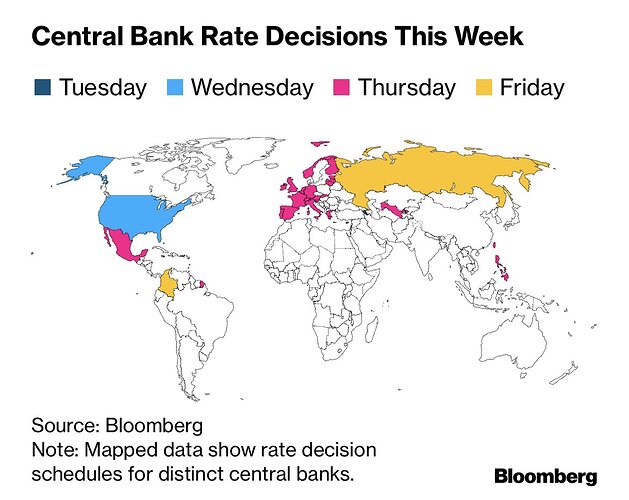

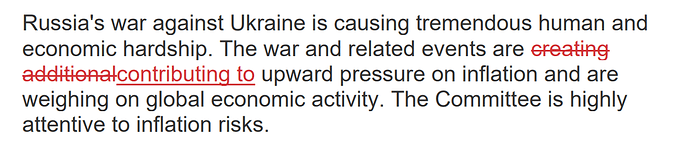

They are contributing far more to inflation in Europe than the US. Just look at our oil prices.

Jil

December 14, 2022, 8:32pm

162

No doubt, but our FED will account European impact on USA economy only, but never care if Euro is going deep recession.

hanera

December 14, 2022, 8:56pm

163

.

Inflation is slowing down for the first time in Europe.

hanera

December 14, 2022, 8:59pm

164

.

Jil:

Each next two meeting, FOMC will be increasing rate at 0.5% instead of expected 0.25%.

FED said there is no rate reduction in 2023 at all!

I have not watched the boring speech.