We will see if I’m right on bond ETFs. My hypothesis is their yield is adjusting MUCH slower than yields of bonds selling on the market now. The ETFs should be discounted much more than they are. The IV is very low, so puts are very cheap. Let’s see how September expiration plays out over the next 5 months.

Today’s action seem bullish. It was a huge reversal led by growth and tech stocks.

Which bond ETFs are you targeting?

HYG

IEF

MUB

SHY

TLY

I wanted to do MBB, but I received an error that I was trying to trade a derivative in a leveraged fund. I need to find out what that’s about, since I’m an accredited investor. I should have access to options on it.

High possibility that war will end by May 9. If China realizes its zero Covid policy doesn’t work and bite the bullet to let hundreds of thousands unvaccinated elderly die, the supply chain issues and hyperinflation would subside. Sound cruel but this is the reality.

.

What are pros and benefits?

I thought standard level accredited investor threshold is just like 1 mil liquid worth or 200k income, can access private investments. But I think there are different levels. Also I know Qualified Purchaser level requires 5 mil.

There’s no con. The pro is you getting access to investments that are closed to “normal” people. You just need to apply with your brokerage and prove you meet the income and/or net worth requirements.

https://www.sec.gov/education/capitalraising/building-blocks/accredited-investor

NVDA ![]() TSLA

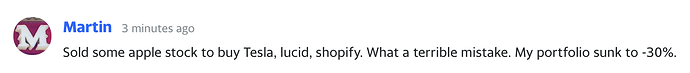

TSLA ![]() Left with AAPL, Apr 28 is a HUGE day. Not looking good, AAPL broke below 200-day SMA. Impending meltdown. If $150 doesn’t hold, I will go into a fetal position.

Left with AAPL, Apr 28 is a HUGE day. Not looking good, AAPL broke below 200-day SMA. Impending meltdown. If $150 doesn’t hold, I will go into a fetal position.

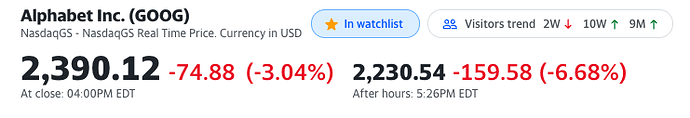

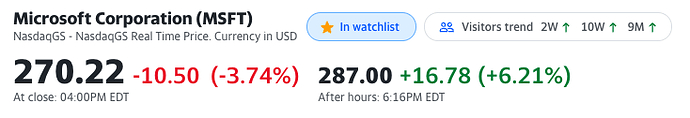

FAANMG is green. AAPL AMZN report after market close. ![]()

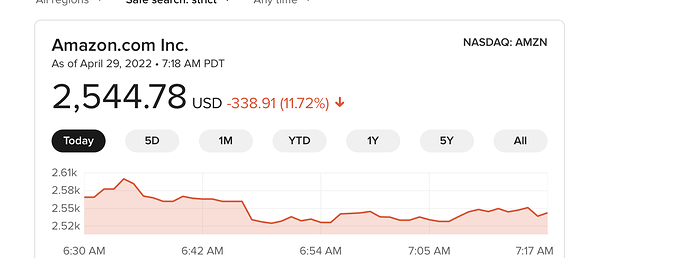

GDP was negative. I said it might be impossible to avoid a recession (technical definition) due to the drop in government spending.

FANGMANT as a group show sufficiently good result, so no stock market meltdown. From an optimistic point of view, bad news are known publicly e.g. War, Fed planned rate hikes/ QT, and China’s Covid policy. We’re in stagflation but officially/ technically is not. Unless some black swans, should be wavering at this level and begin recovery as good news emerge, first one is the ending of war by May 9.

Josh Brown said there is no way to hide but in cash because nobody care about fundamentals anymore. It doesn’t matter how good is the management or how good is the future prospect. Price is going down. However, as an investor, you have to start looking for stocks to buy. He speculated that WB would likely buy a huge chunk of AMZN soon.

Many fintwitters are going all cash. Capitulation?