I’ve been thinking the same. Dump 50% of my positions. And instead drip into tqqq

Whatever happening is computer algorithmic show down. See what Warren/Charlie told today as they even face the same pressure from computers. Computers can make or break any stocks.

I am 2/3rd in stocks, 1/3rd waiting for a morning dip on Monday. Market likely bottoming, may not exactly know as day-to-day future is tough to predict. Please do not follow this action as I can split second change decision using my algorithmic triggers.

Market volatility never goes out until we see FED action is over. Be ready to face it like 2008-2009 UPs and DOWNs with volatility, buy and hold fundamentally strong sector ETFs (not even stocks).

Since I wrongly (should not have done first place) started about market last week, I made this post to end/close it.

N O … M O R E … U P D A T E S.

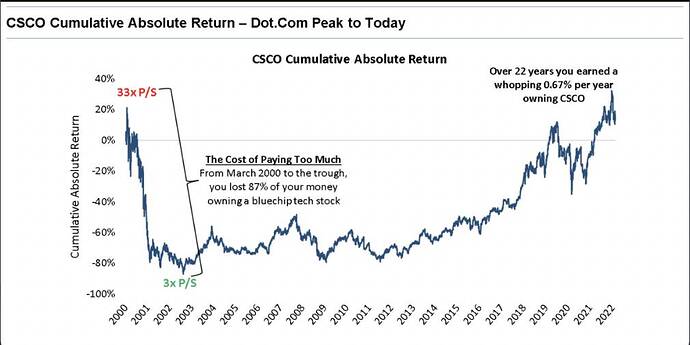

Suspect some of the growth stocks I own is like CSCO which is not bad. Hopefully none are YHOO! or SUN. I only need one of them to be like AAPL or AMZN.

Obviously current crash is dotcom like bust of cloud stocks.

Be Fearful When Others Are Greedy

https://www.cnn.com/2022/04/07/investing/premarket-stocks-trading/index.html

Buffett’s Berkshire Hathaway just disclosed that it bought almost 121 million shares of HP worth about $4.2 billion

Berkshire increased its stake in Occidental Petroleum (OXY) and announced an agreement to buy Alleghany Corporation, an insurer, for $11.6 billion.

BRK outperforms GSPC, AAPL and Puru’s active management portfolio.

This supports the thesis that bond fund yield are far too low. As yields increase, the price is going to plummet. Why buy IEF which is 7-10 year bonds at a yield of 1%? It’s completely irrational to own it.

Fake rally or double bottom?

You need to create a May thread.

We should be nearing bottom based on sentiment. Once the market goes up on bad news, then that’ll be the bottom.

That’s more bad news for bonds.

I bought some HYG puts. Let’s see where it takes me.

So much margin debt? Precarious!

Wow. Turns out SVB and banks were buying those treasuries. Oops. The fed is still equally clueless.