So bloody.

Open down big, huge reversal.

I expected to close green end of day ! Means, some small funds/retailers are selling fear of recession, but some big fish are swallowing the sales !

Dip being bought is bullish.

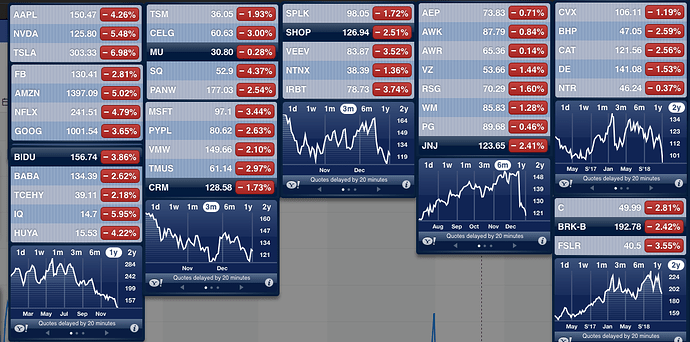

Over the weekend, I have glanced through quickly the EW picture of many stocks, nearly all of them have completed wave 1 or I around Oct and now in wave 2 (some might have completed). After wave 2 is a powerful uptrend wave 3 or III … hopefully wave 2 or II have been completed for most stocks. Wave 3 is a powerful uptrend where you can blindly BTFD.

Typical retracement of wave two is 50% (surprisingly FB is here only), 61.8% (many stocks have hit this), 76.4% (none is here). Looking at EW picture, the retracement is normal, not the scary 76.4% or 85.4% retracement.

Now, hype won’t play, but strong fundamentals play better. Buy only fundamentally strong companies.

Today’s data was awesome. Not only are we creating massive numbers of new jobs but we’re finally pulling non-participants back into the workforce.

Labor force participation has been slowly increasing. Now the biggest issue is needing to train more people for today’s jobs.

It also helps when Powell says he’ll be patient with policy. If we’re nearing the end of rate hikes, then that’s really bullish.

Wow. now Powell says he’d even stop or reverse balance sheet reduction if it started to harm the economy. He’s suddenly super dovish. Rally on!

Tell me how the rate hikes are destroying the economy?

I’m not sure I can explain it any clearer than before. The entire economy functions on issuing new debt to buy things. That’s why the great recession was much steeper and faster. Banks stopped lending. It’s also why the first priority was to get banks lending again. Bernake and Geithner both knew it and reacted accordingly. So unless you think they are idiots, lending is the key to the economy.

If new debt is more expensive, then people have less money to buy things. The couple buying a house has a higher mortgage payment, so they go out to eat less. The couple buying a new car has a higher car payment, so they go buy generic instead of name brand. The students graduating with debt have higher loan payments, so they spend less. The people with credit card debt owe more each month, so they have less to spend. I don’t get how you don’t realize higher interest rates means more money goes to interest expenses each month. That means there’s less money left to spend on products and services.

If rates don’t matter, why do we but them so aggressively when there’s a recession? That alone creates a refinance boom where people can lower monthly payments and have more money left to spend on other things.

With an economy growing at 3% real, it surely can handle a 0% real interest rate. Today’s number shows loud and clear.

It’s not that rates don’t matter. Clearly it does. Just like water is essential to a person’s health doesn’t mean you should drink 10 gallons of water everyday. There’s an appropriate level of water consumption, just like there’s an appropriate interests rate for certain economic growth rate.

If you think rate should be as low as possible, why not put it at 0 nominal and let asset bubbles blow to sky high? That’s usually the conservative critique of Fed policy. Heck, even Trump said that back when Obama was president when economy was wobbly coming from recession. I actually think Yellen waited too long in raising rates under Obama.

This chart on young women shows the trend even clearer. Late 2015 and the whole 2016 labor participation shot up.

You realize households don’t pay their bills with GDP growth, right? GDP grows because the population grows. It grows because productivity improves. GDP growth helps everyone by growing the economy, but household income is what determines what people can afford. Household income is finally just starting to increase. Households can’t take higher interest rates.

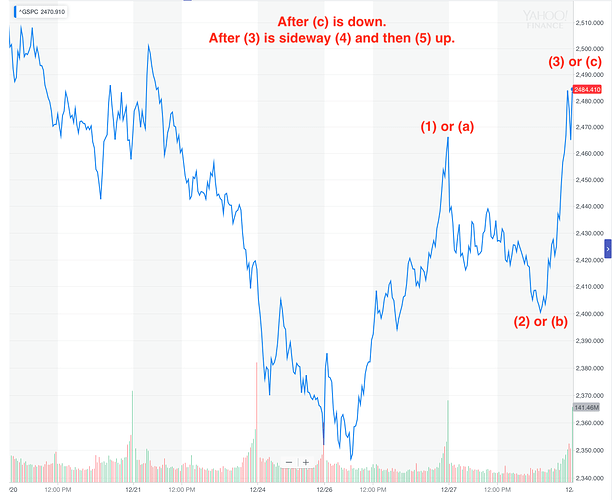

Technically, we can’t conclude anything yet, till the 200-day SMA is tested. From EW perspective, wave two (generic wave, I think is Cycle II for index and almost all stocks) is usually a zig-zag, in layman’s term, there should be a counter-trend rally that test 200-day EMA before resuming the downtrend (if wave two is not completed) or break above to confirm a new rally (powerful wave three) has begun (few weeks or months ago).