Huh? We are at the bottom of a trough. You mean there’s going to be a new trough? Why don’t they sell everything and hide it under the mattress then.

There’s a lot of positive news across multiple industries. United is a giant industrial operating across a bunch of industries. Dell and IBM are probably 2 of the worse tech companies out there and even they have positive news. Restaurants do well when consumers are confident.

I don’t think consumer confidence will be as high in 2019 compared to 2018. Reason: my local gym is offering 30% discount off monthly dues in January. January is typically the most lucrative month for gyms due to people signing up on impulse based on their unsustainable new year’s resolutions. 30% off is unheard of in the past few years. Weird metric I know but I treat these little things as small indicators.

It is hard to maintain near all-time record levels. Small business confidence is near record levels too. It’s interesting how little media play that gets vs. all the doom and gloom reporting.

A mixed market. Guess is good?

Have manch load up FB yet? FB has dropped to the expected retracement zone, can end anytime ![]() sorry I’m not good enough to tell when it would end, only able to tell is about to retrace and the expected retracement zone. Guess you can build on my “forecast” - no worries, I won’t consider that as stealing (IP?)

sorry I’m not good enough to tell when it would end, only able to tell is about to retrace and the expected retracement zone. Guess you can build on my “forecast” - no worries, I won’t consider that as stealing (IP?) ![]() I consider that as building on each other’s strength, leveling up together, not going to fight a lose-lose battle

I consider that as building on each other’s strength, leveling up together, not going to fight a lose-lose battle ![]()

No still observing FB on the sideline. I want to see more strength.

Also about @harriet’s point, consumer confidence fell much more than expected in the last print. But that’s a coincident indicator. Doesn’t tell us anything more than just looking at the stock market.

OK, it’s consumer sentiment, not confidence. Both from UMich so what the heck is the difference? ![]()

From Calculated Risk 5 days ago:

Consumer sentiment declined in early January to its lowest level since Trump was elected . The decline was primarily focused on prospects for the domestic economy, with the year-ahead outlook for the national economy judged the worst since mid 2014 . The loss was due to a host of issues including the partial government shutdown, the impact of tariffs, instabilities in financial markets, the global slowdown, and the lack of clarity about monetary policies .

Read more at Calculated Risk: Consumer Sentiment Declined in January, Lowest since 2006

Consumer confidence matters more in the forex market. For the stock market its impact is more visible in the outlook of B2Cs and less so on B2Bs.

UOP moves a massive amount of goods via rail for companies. Bullish.

Airlines doing well is also bullish, since people travel when they have extra money. Bullish.

Falling copper prices is bad. Bearish.

Silicon companies are killing it despite reports of doom and gloom. Bullish.

McCormick likely suffered as more people are dining out vs. cooking at home. Bullish.

That’s 4 bullish and 1 bearish. If you’re a believer in a services based economy, then you won’t even care about the one bearish item.

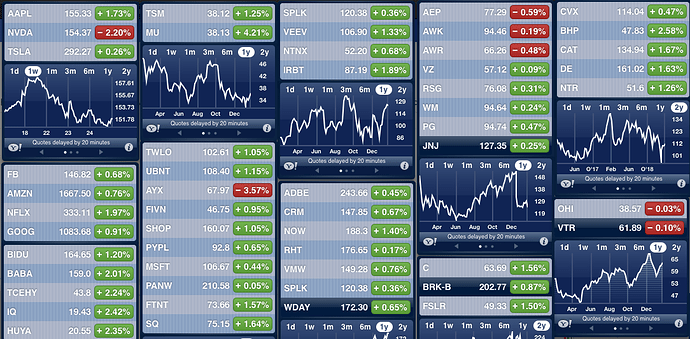

Open red because of NVDA’s revised guidance. Thought we know more guidance revision will be coming! Still so red? Why is Mr Market messing with emotion? I may snap ![]()

![]()

![]()

Calm down! You are too old to be so emotional…

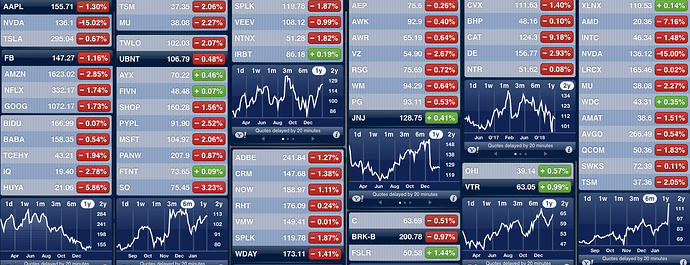

Today market makes me wonder whether the counter trend is over or a pause in the recovery

IMO, if you look at fundamentals, with technical you win. I reviewed almost 10-15 times fundamentals and bought PFE at its bottom yesterday, got positive.

Just chart alone will not help. Buy only when it is dipped will help. Only extremely good companies will be positive, hyped will fail.

Market reached 20 day high and testing the strength by company fundamentals, growth.

Make sure, no FOMO, never buy on FOMO. If missed, let it go as we may get better opportunity down the lane. FOMO is the worst enemy.

It’s over.

I do not understand what is over? Can you provide more info/explanation when you are giving such comment?

Dividend stocks are in vogue again ![]() Why PFE and not OHI or VTR?

Why PFE and not OHI or VTR?

I wanted to say bull market is over, but not want to disappoint many people.

It’s made ambiguous purposely. You can take it as either bull is over or bear is over, ambiguity can make everyone happy

Is it because a meteor will strike earth and extinct mankind?