What happen? Left for Costco, market is bleeding, now just login and is up up up?

CNBC touted today like this => Dow futures drop 200 points after worse-than-expected jobless claims.

They attached sensational headings for the market action. Now, they removed that headlines.

No co-relation between news headlines and market action.

Which ones are mid cap? ![]()

GOOGL is a goner right?

Only 3 of your list I am interested in accumulating for buy n hold (hopefully forever), SNOW, DOCU and PYPL.

Meanwhile, I continue to raise cash i.e. focusing on liquidation rather than trading. Trump says he would create trouble if he loses ![]() Time to buy some forex?

Time to buy some forex?

The midcap list varies, but look at TDOC,SNOW,STNE,DOCU,RUN,ENPH,LYFT,BYND. However, I always add TSLA whenever it dips, never look at anything, same with AAPL, MSFT, AMZN, GOOGL and FB. GOOGL is highly corrected among the BIG five, I will definitely get something.

Regarding Elections, never believe news/media create sensational stories, controversial poll results as they work for circulation purpose.

News/Media will always keep public in tense as they want more circulation using elections. They won’t tell the truth.

I still believe Trump is going to be next president, but not Biden at all. When trump simply outsmarted Clintons, it is easy for him to win Biden+Kamala.

Many do not like to hear but this will happen: IMO, Trump will get a clear mandate with congress also Republican full Majority.

Wait and watch the fun !

Tell me when it is below $1300 ![]() $1000 is ideal

$1000 is ideal ![]()

I lost $$$ trading BYND ![]() LYFT? This type of business model is … doubtful.

LYFT? This type of business model is … doubtful.

Business is just connecting passengers vs drivers using software/mobile platform. CA-Law and Covid has added more stress.

LYFT or UBER will stay, not bankrupt, pick up when it is too low. Since UBER becoming big, I choose LYFT. LYFT has less debt ratio than UBER, LYFT sales/Mcap is good, but loss is too much. The recovery for LYFT may be faster than UBER.

Worst case, if they are in trouble, someone will take over. LYFT may have better chance to take over than UBER (being big). Any price below mar low would be good.

Trading BYND => Your favorite Jim Cramer also asking people to by BYND (I think yesterday…).

Still more to go break our back ! However, this recession seems to be less than 2008-2009 as jobless rate is lower than past.

Employers added 1.4 million jobs last month, helping push down the unemployment rate to 8.4% from 10.2% in July, Friday’s Labor Department report said. The jobless rate’s decline—it has dropped from near 15% in April at the beginning of the pandemic—put it below the peak from the 2007-2009 recession.

The recovery after dip may be easier than past.

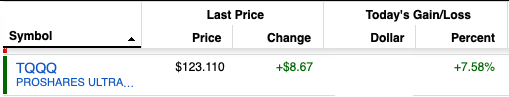

Preach recession, long TQQQ?

Good call! Yesterday was a sign when news broke house is going to work on a new stimulus bill along with extended talk with Mnuchin. I think short term very bullish to me until the talk breaks down which I expect it will in a few weeks.

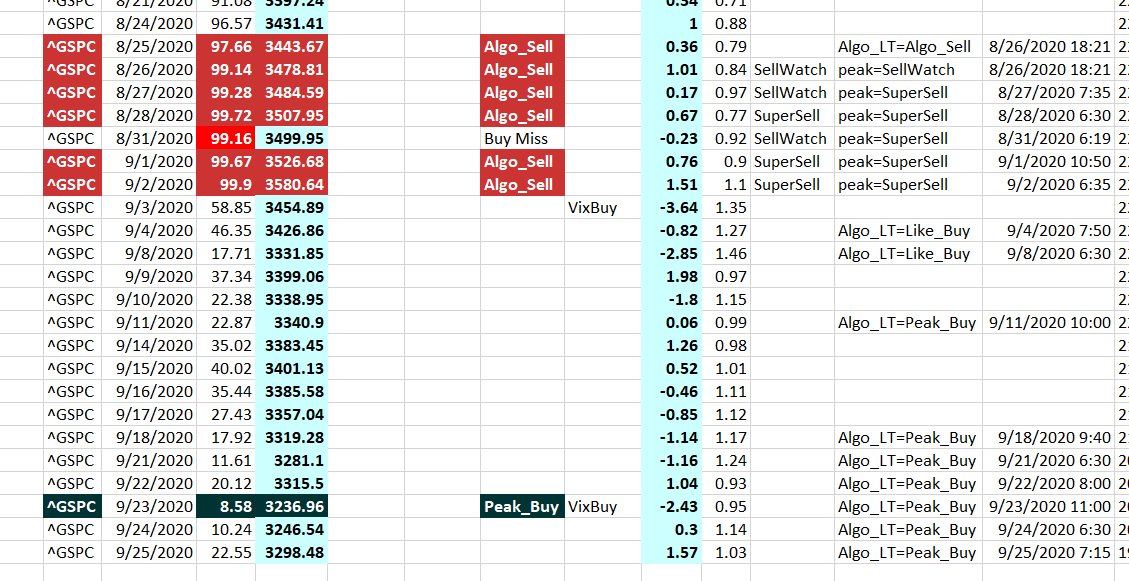

You are showing the results after the fact, but did not predict anything so far. It is easy for me to show 100s of proofs now or future - everything after the fact is waste.

First, do you have any clue (yesterday) whether TQQQ is going to be up?

Let me know, your prediction now?

Do you have any clue Monday is up day?

Do you have any clue that we will go above the last peak S&P 3580?

Do you predict that there is no recession next 2 years?

I want to re-enter stock market. Is this a good time? I went out (only 50%) in march and it has caused so much heartburn.

I went out (only 50%) in march and it has caused so much heartburn.

The stocks that you have invested all shot past pre-Covid high. So heartburn means missed opportunity?

yes. I am consuming a bottle of pepcid everyday.

FYI: My system is telling me last 6 days to buy at bottom, but that is not all reliable as I can not find/infer any bottom (even temporary).

Today, I had discussed with my partner and we finally decided that if Monday is going to be UP day like Friday (today), we have got a bottom on Thursday (yesterday).

In that case, we may miss the bottom - by now. On any case, this is going to be one stop now (EW one pass) and there are multiple stops next 2 years.

Here is the result of my crystal ball.

It is very difficult to find the bottom.

Or I do not have the logic to get it.

That is why I keep accumulating some shares slowly, not aggressively.

FYI: My system is telling me last 6 days to buy at bottom, … On any case, this is going to be one stop now (EW one pass) and there are multiple stops next 2 years.

Let’s me repeat what I had said many times, EWT indicates many tech stocks have completed wave 1 (from Mar low) of Primary (multi-months) degree. Wave 2 would retrace 23.6% (many stocks touch/ pass this) to 99% (test Mar low) of wave 1.

In layman’s term, might have bottom but could do what you feel (up and down to Mar low). Don’t know ![]() what fib the wave 2 would complete at.

what fib the wave 2 would complete at.

If trading, should be willing to be ambidextrous (long and short).

If buy n hold, can scale in using DCA purchase approach. Remember when accumulating, you want the price to be declining.

Btw, just to remind you, I have been doing trading. My buy n hold is AAPL (no sale, no add) and S&P index fund (DCA purchase since 2003).

For trading, I have three baskets.

-

No DD buy n hold. All hot mid cap ($2-$10B). Some appreciate to large cap ($10B-$200B). Re-balance occasionally. 5% cash. YTD ~30%.

-

Mostly semi. Currently taking advantage of Sep 29 earning to liquidate MU holdings. ~80% cash. YTD ~40%.

-

Anything go. Currently, holding TQQQ, MU and WDAY. 50% cash. ~25%.

Normally don’t short. So move between long and cash. YTD is not that great because of no action for 2-3 months and holding the laggards (WDAY, BABA, BIDU - didn’t liquidate till recently, lost BIG in BIDU, worse tie up $$$). You may have higher YTD ![]() feel better now? Number 3 was pretty underwater when I restart trading, make lots of $ trading TQQQ, SQQQ, UPRO and SPXU.

feel better now? Number 3 was pretty underwater when I restart trading, make lots of $ trading TQQQ, SQQQ, UPRO and SPXU.

@hanera and @Jil. How do you guys deal with discontinuity? In other words, if you did not follow the markets closely for some prolonged time, how do you make a comeback? Let me explain. At the end of June, all of a sudden I became very busy at work because we kicked off a new project. Working almost 12 hours each day. Working from home is actually making us work more, not less. That is why sometimes I feel companies would want WFH to continue in some form or shape. Anyway, after three months, only now I feel I have some time to visit this forum. What happened is that I got tuned out of the stock market. In the meantime, the market went up, and the stocks I had left behind appreciated in value. Now will start paying some attention again and wondering how to start.

Now will start paying some attention again and wondering how to start.

I suppose is not clear from my last post. When I resume around late Jun/ early Jul, wait for good opportunities to unload stocks that I have “behind left” such as BABA, BIDU, WDAY and MU - MU is the last ticker. Didn’t bother to buy new stocks, trade TQQQ/ SQQQ, UPRO/SPXU and SOXL instead.

Take too long to know a stock and want to join in the fun fast, so just forget it and look at charts of indices.

How do you guys deal with discontinuity? In other words, if you did not follow the markets closely for some prolonged time, how do you make a comeback?

You can not rollback time. Stocks are about future returns. At any time you want to enter, look at current situation and decide when to get in.

If trading I would choose TQQQ or UPRO.

If investment, I would prefer QQQ or VOO, just buy and hold until next big dip ( no trading ).

If confident on fundamentals, choose the stocks. My preference is 20-25% individual stocks and 80% trading.

Have your own plan whichever you are comfortable with it.