Your opinion could be true if QQQ breaks above the upper downtrend line later in the day ![]() or could be a bull trap

or could be a bull trap ![]()

9:00 am CST… now or never…

9:06 am CST… promising…

Your opinion could be true if QQQ breaks above the upper downtrend line later in the day ![]() or could be a bull trap

or could be a bull trap ![]()

9:00 am CST… now or never…

9:06 am CST… promising…

Truth is Market turns positive whoever wins as uncertainty about elections is removed. Whichever government comes, they need to vote for Stimulus and continues same protective policies to bring down jobless and try to eradicate COVID…etc.

Looks to me last week (10/30/2020) was the lowest - after the fact.

However, your Cramer says on the opposite

Not sure why he wants to time precisely. Just buy and average in if necessarily.

Precise time provides max return! But hard to find that.

My view is market was lowest last Friday, Moved cash to Market, but Jim Crammer says Market further dips !

I say “Market zooms whoever wins” while JC says “Stocks will dip no matter who wins”, see we are on the opposite side !

Let us see from now.

By end of day, if market dips from 2% to 1%, it is common. If tomorrow, market with UPs and Downs it is common, but over all the recent dip, Oct 30, 2020 - Friday, is established.

Market may take another turn after reaching a temporary peak which I have no way to find until that tipping point comes !

Hope so for my financial ego sake ![]()

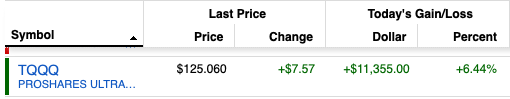

Holding 1500 TQQQs ![]()

Testing the downtrend line is common ![]() Not adding if it happens.

Not adding if it happens.

For QQQ, the bottom was yesterday not Friday. $266.97.

Now, do you see about Jim Crammer’s statement? He was not knowing about market actions?

Oct 6th, he said buy and Nov 3rd he said wait for bottom His timing was wrong.

He is supposed to be so called “Expert in Market”

I read ppl say to do just opposite of what Cramer says! btw still holding jan 2021 APPL calls avg. down to 4.6  picked any new calls?

picked any new calls?

Gap up or sell the news on Monday?

Watch the dollar. Steep declines can presage declines in equity prices although there can be quite a lag. Doesn’t work for black swan stuff like 9/11 but it did foreshadow the '87 and 2008 crashes.

All this money printing is creating moral hazard. No one will investing in developing real skills and supply chains. rather all the money will keep flowing to zombie firms. this will create jobless recovery with further potential of riots and complete loss of tax base.

We are not living in 1940s that we can BS overway out. competitors are investing to replace dollar.

German President.

Europe is soaring today even with the Euro rising. Stoxx 600 up almost 4%; some EU indices up almost 8%.

Cramer: Buy Airline Stocks On Rally Instead Of Cloud Stocks On Dips

Cramer said he would be “much more comfortable buying an airline stock up 10% than a cloud stock down 5%.”

Time to dump ![]() cloud/ SAH/ WFH stocks.

cloud/ SAH/ WFH stocks.

In our call of the day , Miller Tabak’s chief market strategist Matt Maley said some rotation within the technology sector was a good idea for the rest of the year, most notably into chip stocks.

Chip maker Micron MU, +1.45% looked “very enticing” on a technical basis, he said, as it was testing its June and July highs after being hit in August. Its peers Nvidia NVDA, -6.39%, Texas Instruments TXN, -0.96%, AMD AMD, -3.21%, and Taiwan Semiconductor TSM, -2.60% also enjoyed breakouts last week, Maley noted.

No worries. I own MU and SOXL.

“Too soon. … This is not the time to own the cloud stocks. We want them to come in. We want all shorts to pressure. We want people to think it’s all over, and then we will strike — but not yet.”

Cyclicals too. Even steel.

MU continues to moon ![]()