Been playing Unity for the last few days. Great company.

TSMC is a 400B company and it went up 6.5% today.

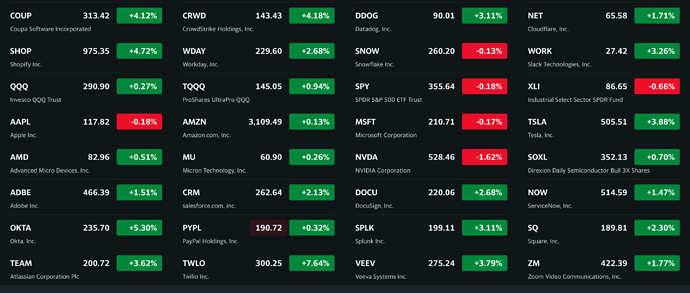

However, many cloud stocks in my no-DD portfolio keep falling.

CNBC’s Jim Cramer said Monday that a new type of investor is behaving differently during the stock market’s pandemic-era rally than what he has traditionally observed over his decades-long career on Wall Street and in financial media.

Time has changed.

“There’s a new young crop of buyers who do not sell on the news,” Cramer said on “Squawk Box.” “They’re very different from the older buyers. They don’t seem to want to sell. They see good news and then they buy, and then no one comes forward to sell. It’s rather remarkable. We haven’t seen this pattern ever.”

RHers are different.

Time for JC to retire ![]()

If we’ve learned anything from the stock market lately, it’s that conventional wisdom has been wrong at every step, Jim Cramer admitted to his Mad Money viewers Monday.

In this market, patience is not a virtue, research is irrelevant and discipline doesn’t really matter, Cramer said. The strategy that’s working is simply to buy the most obvious stocks you can think of.

I notice that2 e.g. TSLA ![]() no need for sophisticated analysis aka FA.

no need for sophisticated analysis aka FA.

One of the oldest sayings is didn’t fight the fed. The fed is making it easy for the market to go higher.

Started a small portion in GoodRx. (it dropped on the amazon pharmacy news)

https://seekingalpha.com/symbol/GDRX

The pharmacy news didn’t help AMZN at all but destroyed CVS and Walgreens.

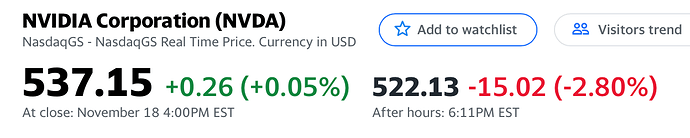

NVDA here we go. Crossing fingers for strong earnings.

NVDA reports strong earnings but stays flat. Interesting. It’s run up a lot so maybe there isn’t much room to run. Might just need to settle for a small gain.

Strong result from Nvidia. Interesting it doesn’t move at all.

Rotating back to tech?

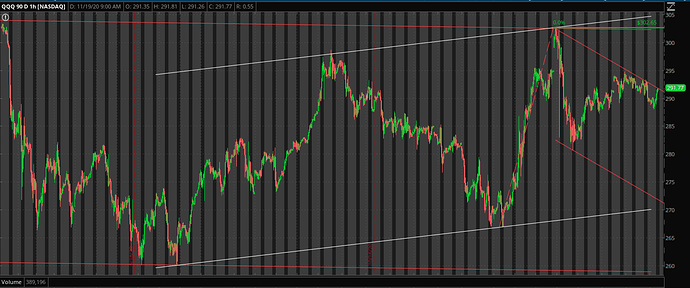

Crossing my fingers. QQQ challenging the downtrend line now.

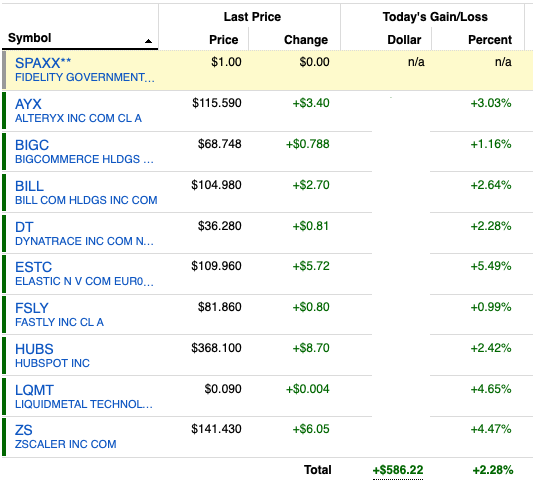

Reduce No-DD portfolio to 9 stocks, 3 of which are @marcus335 10x bets (BILL, ESTC, FSLY) - Thanks. 2 are wild (BIGC and LQMT). 2 are crown princes (AYX and HUBS). DT and ZS are recent Jim’s favorite.

IMO, market peaked on Nov 16, 2020 with S&P 3627 closing ! This is post facto statement, four days over.

This is my pure guess, posted for debate purpose, not a stock advice, neither financial advice. You are on your own with stock market.

How far do you think it may drop? is it going to be a slow bleed for a while?

I think there are too many bullish buyers and not enough sellers thus creating this back+forth balance. In this news and hope driven stock market, I do think there might be some news coming out for stimulus or from the fed that will drive it another notch higher. In a weird way, the worse the economic impact, there is more hope which drives the stock market higher. I’m leaning bit bullish right now (with buy the dip mentality) but it’s also a stock picker market. Cloud stocks are back and BABA had a monster 2-3 days.

This is the toughest part for me, finding the bottom. No idea how long it goes and where it turns upside.

For market to turn up or down, IMO, it is not going based on daily news. Most of the market is driven by big funds/banks…etc.

I just follow S&P and Nasdaq and related ETFs. I do not follow daily swings.

Going to be short lived. JC says coming Wed is start of a…

So buy with both hands ![]() if drops significantly on Monday and Tuesday

if drops significantly on Monday and Tuesday ![]()

Good Luck ! ![]()