Since it is like Dec 24 2018, did you go all in? Got balls?

The first shoe dropped. I’d expect more movement until the FED acts. The emotions on the move down wasn’t identical to 2018.

Yes, little aggressive 110% (i.e. 10% Margin). At some point of time, I may sell some stocks to match 10%.

110% margin mean?

Total cost of the calls = 110% of the worth of the account?

Total cost of the calls + shares = 110% of the worth of the account?

Total delta of the calls + shares = 110% of the worth of the account?

Total cost of the calls + shares = 110% of the worth of the account? ==> This is correct. Later sometime, when it comes to some peak, I will some stocks to meet 100% of account worth.

Within the total holdings, calls are appx 15%, shares are 85%.

But the rest can be put in the gold stocks because they are getting hammered - here I am thinking Barrick (GOLD) - run by Dr. Mark Bristow, the best miner in the world. You don’t want a gold fund; too many bad ones, you want to swap out of a hotel or cruise stock and buy a high quality drug stock with some yield like AbbVie (ABBV) or Abbott (ABT) which is more of a medical device play. You should consider Coca-Cola (KO) . It just reported an excellent quarter and it has lots of firepower.

If you own an oil company I can’t help you. They are cursed especially with oil down here. The likes of Occidental (OXY) are just terrible.

I would much rather own a supermarket staple or a Moderna (MRNA) . The latter does have a vaccine in place that will be put to use immediately because the vaccine is real. Before Dr. Fauci was silenced by the president he seemed optimistic something could work with it. I like that.

Zoom (ZM) , Etsy (ETSY) , Shopify (SHOP) all represent the stay at home economy that will blossom. So will Teladoc (TDOC) among others. They are all remoter affairs as is RingCentral (RNG) .

For yield I like that Verizon (VZ) and AT&T (T) are down. That may turn out to be a gift. I am confident that AT&T can maintain that yield because it has excellent cash flow. It’s really down way too much. Verizon is among the steadiest stocks there is. Buy one.

@hanera, Jim Cramer says TDOC and T - these two are my favorites, Are you in TDOC now?

no. focus is saying no to highly recommended rock solid fundamentals stocks and stay with 1-3 stocks.

The worst China manufacturing PMI in history will shock the market on Monday.

Do market expect this low? Previous month is 50.

The official manufacturing PMI in February was 35.7, worse than the lowest reached previously during the global financial crisis during 2008-2009 when the PMI was in the range of 38.8 - 45.3, and it is the worst in history since the data has been compiled.

Even if China‘s factory production can recover in March, it will still face the risk of a low level of export orders. This is because the supply chain will continue to be broken, this time in South Korea, Japan, Europe, and the US, where Covid-19 has begun to spread.

This makes me wonder which companies are heavily leveraged with debt where any disruption of revenue could cause bankruptcy.

Are you hinting at TSLA?

Buy cash rich companies ![]() Obviously, FAAMG. Plenty of cash to acquire those bankrupt businesses with great technologies and outstanding talents CHEAPly.

Obviously, FAAMG. Plenty of cash to acquire those bankrupt businesses with great technologies and outstanding talents CHEAPly.

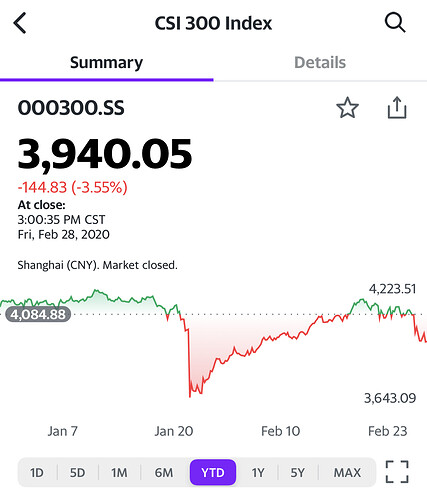

Most people will find it surprising, but one of the best performing markets worldwide this year is the Chinese market.

Doesn’t fit the doom and gloom headlines of China imploding. Are the Chinese investors fools? Or do they know something the headline writers don’t?

Index fits CCP’s narrative to get back to work after CNY holidays. Dead or alive.

They don’t have that much debt. There are companies with more leverage.

Chinese investors are pricing in a crap ton of policy support from the government. And I think they are right. Expect trillions worth of stimulus.

Long term it will make China’s debt load much worse, and the prospect of Japan style lost decades ever more likely. But now is not the time to worry about long term.

Future? We’re all dead.

That’s to be expected, otherwise why hasn’t JD tanked yet even though they defaulted on their debt.

Futures are down, let us see how closing tomorrow!

I noticed that too. I thought the down days were over after the Fed’s support announcement on Friday.

Still too much complacency. Fear index probably needs to fall all the way to 1.