The China car sales numbers indicate that Tesla had a bad month in China in Feb. Similar sales to Jan. If their hail mary was China was going to save them, they are in trouble unless they can paint a picture that China will recover for them in second half of the year. I was looking to buy a put on them this morning, but the puts were crazy expensive and I decided it wasn’t worth fighting their fanboys.

I may buy TSLA (model 3 car) not the stock now with the profits I made !

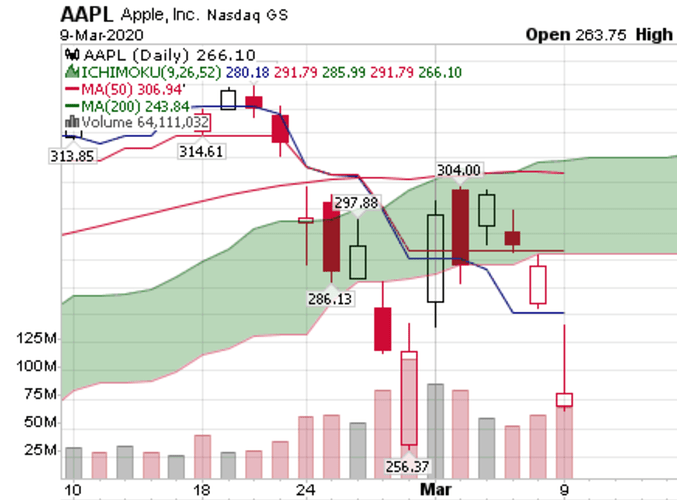

Bold call! I am hiding in a corner, noting there seem to be a bullish divergence developing - don’t @ me if it didn’t happen.

Shorting at the end of today could be risky because of above potential bullish divergence and the bullish inverted hammer.

It’s not much different than identifying a stock you want to buy and waiting for a price pull back to buy.

I’ve had my eye on OKTA for an entry point. $100 is almost a 38% from Fibonacci retrace from the high. I sold $100 puts that expire on 3/20 for $158 each. That may seem trivial, but the stock would have to decline another 16% to reach my strike. Meanwhile, I get paid $158 for selling each puts which are for a $10,000 total purchase. That’s a 1.58% return on the $10,000 in less than 2 weeks. My downside is if it goes below $100 and I have to pay the lower price to buy it.

A high VIX is why the puts get that much premium. Normally, those puts would be 1/5 that price. If you want more premium on the puts, then you can sell closer to current price.

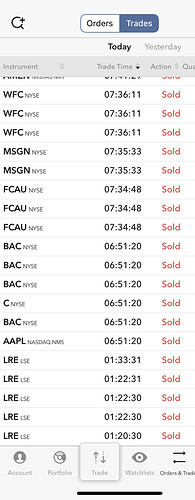

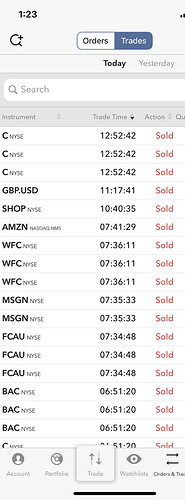

It’s even less risky if you sell a stock you hold. I sold SHOP at $430 then sold puts below that price to buy it back. The real risk in that one is the stock rebounds hard, and I have to pay more than $430 to buy it back.

I’ve sold puts on a stock for months before buying it. It’s how I kept adding to my SHOP position.

The math is a little better on doing puts now. Probably because of the fear bias. The option premium on puts is more.

Another bold call from me. I suspect the Chinese names may be the first to rebound. BABA only went down 3% and PDD not even 1%. China was the first to come down with the virus and it’s the first one to heal so to speak. I bet the Chinese government will inject crazy amount of liquidity into the system.

Again don’t @ me if it doesn’t work out. Just throw it out here in case I can look smart a month later.

My suspicion too, hence I didn’t sell any of my China stocks. Now pretty red. Didn’t buy puts because I am not an ambidextrous investor, only know how to buy (to open), sometimes sell (to close) but not short.

Thought you don’t own any China stocks?

I don’t own any Chinese names. Long term China seems to have more and more political interference. Too difficult for me to have a clear understanding. But I am pretty tempted by BILI and PDD. May succumb to the temptation one of these days…

I cut lost on BILI and HUYA. Overall green on BABA, IQ and TCEHY. Red for BIDU - stubborn me.

Zero-cost collar is not for traders. Is meant for investors with a large position. Reluctant to sell but would like to protect against disastrous decline, yet don’t have enough cash or don’t use margin. Suitable for investors like @wuqijun. Guess no other buy n hold investors here?

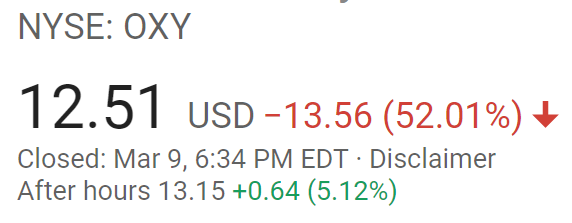

You will all be comparing past two years growth stocks, but this is recession, and will completely change all the equations. This is not right time to bottom fish.

Remember, how you were standing at the peak time of 2007 down turn, the stock wave went up and down until 2009 !

Similar to it, the current wave may up and down on roller coaster ride and finding a bottom is hard at this stage.

If stocks may jump zoom 5% tomorrow, it does not mean recovered.

See this message “Italy Virus Containment Measures Extended to Entire Country”, what is the sales/revenue impact…etc.

This is RECESSION now, like the way obama has seen, now new president has to face all challenges to bring the country ! Not an easy task !!

Mention of a payroll tax cut and Dow futures go from down 400 to up 300.

I think it’d be an administrative nightmare to do quickly, but helping people with lost wages due to quarantine or business closure would be good. I’m just not sure how you quickly implement, verify, and distribute the money. Fastest way would probably be to block grant money to states and use the existing unemployment insurance infrastructure. Pay the money now and verify eligibility later as work load allows. Those people need money more than a payroll tax cut for people that are still working.

Another approach might be to temporarily loosen up requirements for claiming unemployment benefits. You’re right - if you still have a job than you don’t need a payroll tax cut.

Past couple of week’s stock market drop reminded me of this small “story” which I read first in 2008/2009 ![]()

Why the Economy collapsed and how Investment Bankers make money

One day, an ordinary-looking man came with a stunningly beautiful girl, an office lady, to Louis Vuitton store in Causeway Bay (Hong Kong Island). He chose an outrageously expensive LV bag worth HK$65,000 for the

companion who then couldn’t stop affectionately smiling at him.When it came time to pay, the man took out a checkbook and wrote out a check. The salesperson was hesitant because the couple hadn’t shopped there before.

Discerning what the salesperson was thinking, the man said calmly: “I can understand your concern that this check may bounce; right? Today is

Saturday and the banks are closed. Let me suggest that I leave the check and the handbag here. When the check clears on Monday, you can deliver the handbag to this lady. How about that?”The salesperson was reassured and gladly accepted the suggestion. In

addition, he waived the delivery charges. He promised that he would

personally make sure that this gets done.On Monday, the salesperson took the check to the bank. The check bounced!

The irate salesperson called up the client, who told him: "What is the big deal? Neither you nor I have suffered any loss. Last Saturday night, I went to bed with that girl already! Oh, by the way, I thank you for your cooperation. "

This story also reveals the nature of the sub-prime mortgage crisis.

When people have high hopes for huge future returns, they lower their guard about the potential risks. This pretty girl thought that the HK$65,000 LV

bag was going to come home on Monday, and so she lowered her guard.Therefore, she believed that her investment in the ONS (one-night stand) was worth it even though it was based upon huge and highly uncertain risks.

Investment bankers are great at packaging high return (but high risk)deals. The stock speculators are like this pretty woman. As such, they deserve to lose money. Without people like these, how are people going to make money from the stock market?

As for the media and the stock analysts, they often play the role of the LV salesperson!

I use word “RISK” quite frequently in my writings.

Understanding the risk is key to understand the value of the security. if one can understand the risk, one can price the security correctly. Most often we think we understand the risk but most of the time we do not.

RISK= 1/(PRICE) = VOLATILITY = 1/ (PROBABILITY of SUCCESS ) =1/(COST) = FEAR = 1/(HOPE or GREED )

The way speculators make money is by not playing the risk but by playing the odds. Like when one buys a lottery one know one will not make the Jackpot but when one does, one will make it big. Therefore the speculators need to lose and lose big to complete the circle of finance, because most of the big ones make good money when they do .

I remember an incident from 2007 (or 2008) when an investment firm bought Washington Mutuals and it went bankrupt a few days later. I used to have an account in WAMU. Nothing happened to my money because it was a small amount and insured by FDIC.

2009 memory