Group? My family is my group, leader is my wife. I blindly follow her wish. Her wish is my command. She said go to USA, I quitted my job and followed - no question asked. She said buy a SFH as primary in 2007, as a good staff I advise accordingly that is not good, she insisted then I complied. Ditto for all the questions you ask - check with the leader. Is easy when you’re not the leader ![]()

Oops. Bottom or not?

I don’t see the Democrats cooperating with anything. For once that’s as good thing.

This will largely blow over before any further stimulative measures can even take effect.

I don’t see the Dems standing in the way. It seems it’s the R’s who are not so sure about the stimulus. Maybe too much money for people and too little for corporations?

I read somewhere that the Pelosi already has a plan but quite a bit different from the Republicans. Her plan (which I thought made more sense) was funding for vaccines, treatment, targeted aid to impacted industries, some leave coverage for impacted employees and stuff along that line.

edit: here’s something related

The emperor has no clothes. No concrete plans were presented by the WH. They said they will come back tomorrow to chat more. The republicans won’t do jack without air cover from the white house.

This is defunding social security and medicare via a 15% tax cut unless they only restrict it to a cut for the employee portion which is still half. Congress is insane if they pass this.

Debt.

Also it’s hard to do in a equitable manner. Some companies pay their annual bonus in the early part of the year, some in the mid, some in the end. Those who got theirs in the beginning are screwed as they may have already hit the max or paid most of the payroll taxes they are going to pay in the year.

TARP took time to pass and failed the first vote. Then they pivoted greatly on how to use it. It was passed to buy toxic assets from the banks. The actual action was to buy equity in the banks. They even decided to use it on GM and Chrysler, and there was doubt if that was even allowed under the rules of the bill.

Trillion dollar deficit flying into this crisis, no worries. R’s only worry about debt now that we are actually in a crisis? Great timing.

Last I heard Treasury rate has never been lower. Probably a good time to raise some debt?

Are they talking about permanently getting rid of payroll taxes? Or just stop it for one year? If so how’s that gonna bust SS and Medicare?

Structurally, I don’t see how we get below $1T deficits. Social security and Medicare spending are way too big now. There’s zero will to make meaningful change to either.

We seem to always collect a similar percent of GDP in taxes, no matter what the marginal tax rates are. Anything that would meaningfully increase tax revenue on paper would crash the economy and actually lower tax revenue.

Just imagine sucking $1T of spending out of the economy in taxes and replacing it with nothing except reducing the deficit. We average 1 job every $80,000 of GDP. That $1T gone would eliminate 12.5M jobs. That’d more than triple unemployment.

The only semi viable solution is to grow GDP and hope the deficit stays flat or declines as a percent of GDP.

We’re now in the era of massive government debt and low interest rates. When people realize that’s not ok, watch out. I think it’ll make the Great Depression look gentle.

Stopping it for one year is already a huge blow. The current structure is forecasted to go bust by 2037.

There is one fix. Massive inflation so that the old debt becomes serviceable. Print the way out of it. Feasible for the US as long as the USD remains the reserve currency of the world

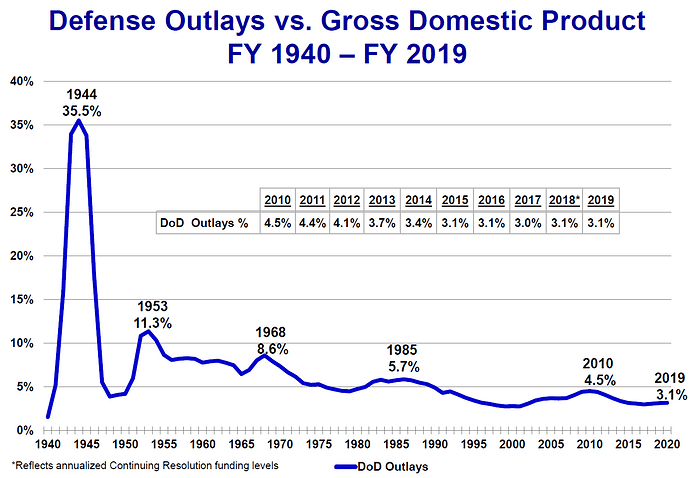

Another fix that nobody wants to do (because every time the Dem’s touch it they get demagogued about) is to prune back defense spending. We spend more then the rest of the world combined. let’s just drop to whoever #2 is. That should free up enough cashflow to service and maybe even start paying down debt

I’m amazed we haven’t had that yet with all the low rates and QE money. It’s really a shock and defies all the theory, formulas, text books, etc. My only counters are:

-

Globalization has driven companies to seek lower cost labor and automation efficiency which are deflationary.

-

The internet makes consumers more price aware than ever and is deflationary. The price awareness leads to more and more of #1.

People say globalization is due to companies seeking higher profits. Profit margins are pretty constant and not getting a boost from lower labor costs or efficiency from automation. Consumers are squeezing on price and getting the befits while profit margins stay flat.

Or why not let the economy run the old fashioned way. If someone took risk and now loosing. Suck it up. Government and the FED should get out of supporting the economic losers and the bad investments. This is the mother of all problems, particularly that the financial markets cannot with stand minor shocks like corona virus or oil price drops. That is how miserable the situation has become.

It would help, but defense is only 16% of the total budget. Even if we cut it in half, that’s $300B in savings. Defense spending is historically low as a percent of GDP.

Defense spending is 50% wages. A massive spending cut will hurt a lot servicemen and women