Trend setting is a quickest to a heart attack.

Time for the high flyers to take a break.

I am steady with AAPL MSFT FB

Trend setting is a quickest to a heart attack.

Time for the high flyers to take a break.

I am steady with AAPL MSFT FB

I am over picking individual stocks. Outside of TSLA, I keep money in index funds. When there is a correction, I will move a certain % either into leveraged funds or ITM LEAPS of index funds. The % will increase if the correction gets bigger.

Then as market recovers, move out of leverage back into base indicies.

Upside is just have to pay attention to macro trends and can get great performance.

Downside is if recession keeps equities valuations low for 2+ years. Then the LEAPS could get messy.

covid is back and so is mrna.

.

Individual stocks are fun. You will know a lot about the company businesses.

I have four portfolio:

RE - On average, buy a rental SFH every year

S&P Index fund - DCA purchase regardless of stock market condition

AAPL - Do nothing

Trading portfolio - Individual stock trading, this is a fun thing to do.

Back from errand, market is recovering? Wondering is DCB or truly recovering…

Must be something wrong in what you are doing if you are experiencing 10% decline in portfolio on a day when stock market is broadly up. My portfolio has been steadily increasing in Oct and Nov - it’s mostly in SPY and QQQ, with a little bit of bonds, gold, crypto and TQQQ.

I don’t know what dip you are referring to. You can’t BTFD close to ATHs ![]()

.

Broadly up? Is mostly red in my screen. Nothing wrong with 10% down… growth stocks are hyper volatile… and its call even more so, on steroid… now is -7%, open is +3%. Calls of growth stocks can swing from negative 50% to double or triple in a day. One more thing, for options, what the screen indicated is not the correct value… always indicate the worse e.g. long call, it indicates the ask, because of heightened volatility, the ask become very high, actually you can normally sell in the mid of buy and ask. So if I closed them, the decline should be less than what is indicated.

Did a calculation. Actual decline is -2%, screen display as -7%.

You don’t know for a fact until it declines!

My trading portfolio is +20% since Oct 1, yes, despite today drawdown.

If you want to see green today… well, look at my AAPL gain… 2+%

Amazing that QQQ is at an ATH, while so many smaller tech companies are so deeply in the red compared to their own ATHs.

Shows the power of big tech aka FANGMANT in powering the index.

DCB or resumption of bull market?

Err on the safe i.e. STFR or hold or be bold and buy ?

This don’t trigger your sense of safety?

At the start of the bear market, third tier declines first before the blue chip declines.

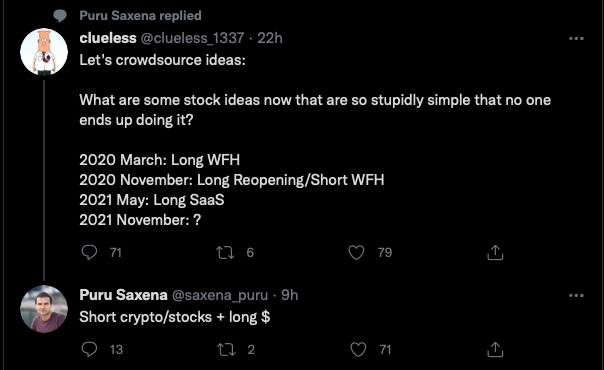

Don’t think I want to short crypto and stocks. I will long $ by selling stocks to raise even more cash ![]()

Yes, I think it may be time to exit my TQQQ position and return that to QQQ. But I will probably stay in QQQ long term

.

I prefer S&P even though all studies show return of QQQ is higher than S&P. History of QQQ is too short when compare to S&P. Also, S&P is best 500 companies ![]()

I have both SPY and QQQ. Actually own more SPY than QQQ, and it is growing because I DCA into SPY, whereas I put no fresh monies into QQQ.

.

Steady hand. Look like QQQ/ TQQQ is your fun thing to do.

Good that you have a process. Is hard to beat the return of your strategy of swapping between QQQ and TQQQ.

Yes, QQQ to TQQQ is my fun/risk thing to do, I have currently moved about 25% of my QQQ into TQQQ, hoping to reap benefit of Santa Claus rally and move back into QQQ by January.

But all this inflation and rise in 10 year treasury yields may be ruining the Santa Claus rally for tech/growth stocks. Hence, I may have to get out of TQQQ sooner.

My SPY is in current employer’s 401k, to which I am DCAing by contributing max plus getting generous employer match. This I plan to continue no matter the state of the market. I have almost 15 years before I can withdraw any money penalty free, so it’s a long term holding and DCAing plan.

QQQ/TQQQ is in an IRA which I don’t DCA any fresh money into. That’s why I am trying to grow it by going into TQQQ, taking profits and moving back into QQQ. This too is at least 15 year holding plan - HODL QQQ, but not bold enough to HODL TQQQ.

Shorting crypto now is suicidal. If one has to short maybe March next year is a better time. But in general never short.

All those things on the first person’s list were only obvious in hindsight. And things are always obvious in hindsight.

I am starting to think maybe the next stock crash will be triggered by TSLA unwinding. Read an article saying there is an insane amount of options trading on TSLA. These kinds of speculation never end well. Shorting TSLA now may look obvious six months later but nobody will do it because so many people got burned. It’s a trade that ends careers.

.

Many retail investors are piling into TSLA thinking it will one day beat AAPL and MSFT to be the largest market cap company. May be is true but not so soon. The near term uber bet is there would be a split on Dec 9. From the experience of last split, stock price shot up 100-150%. So, if no split is announced on Dec 9, … your forecast of TSLA unwinding may happen… I have put on my calendar to long put QQQ for long SQQQ on Dec 8.

It’s not my forecast at all. My point is just that one can’t forecast such a thing. If TSLA indeed goes down in the future it will look obvious after the fact. But maybe it doesn’t go down? Who knows.

The Big Shorts guy thought TSLA was obviously overvalued when he shorted it. Turned out wrong.

.

Outcome doesn’t mean his decision is wrong ![]() He needs to update his knowledge of current market shift… widespread of knowledge that used to be known by specialists only, influencing power of social media and risk appetite of millennials and Zoomers.

He needs to update his knowledge of current market shift… widespread of knowledge that used to be known by specialists only, influencing power of social media and risk appetite of millennials and Zoomers.

I agree. In 10 years, these crypto will either be worthless (if more Governments like China and India successfully ban and quash them), or they will be worth a whole lot more than today (if software/technology eats the financial system, just as it has eaten advertising, retail, entertainment etc).

Personally, I am making the bet that blockchain technology will march forward into the financial sector, rather than the negative bet that Governments and the Wall St establishment can quash this.

So, I think at this point that it is more risky NOT to take a position in crypto, compared to the risk of getting in close to all time highs.

Though, knowing my market timing luck, cryptos will probably go down for a couple of years now, before they go up again. I just hope I have the will power to HODL for the long term.

I would be very surprised if cryptos are going down for a couple years. Anything could happen but I don’t think that’s the most likely scenario.