Did not know Netflix has stock buyback authorization.

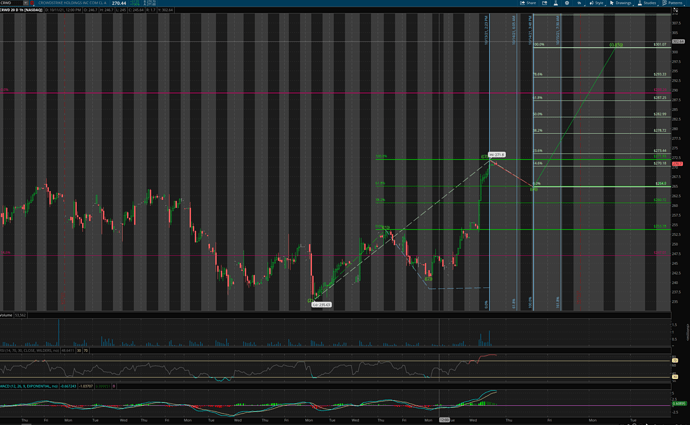

Many growth stocks are putting up a strong multi-day wave three… look like time to be aggressive, to be full on margin ![]() … to FOMO in… Just look at CRWD… easily hit $300 within a few days.

… to FOMO in… Just look at CRWD… easily hit $300 within a few days.

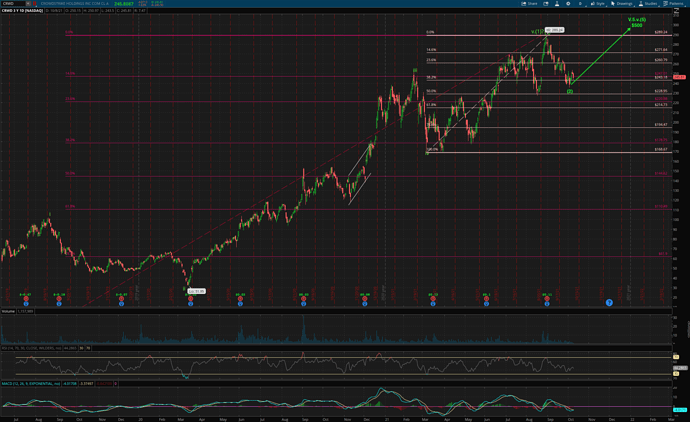

3+ months later, near $500…

Should I max margin? Now or regret later?

Just thinking aloud, not a financial advice.

I was hoping for one big final dip but we may not get it.  Either way, I’m

Either way, I’m  for the final massive rally of everything!

for the final massive rally of everything!

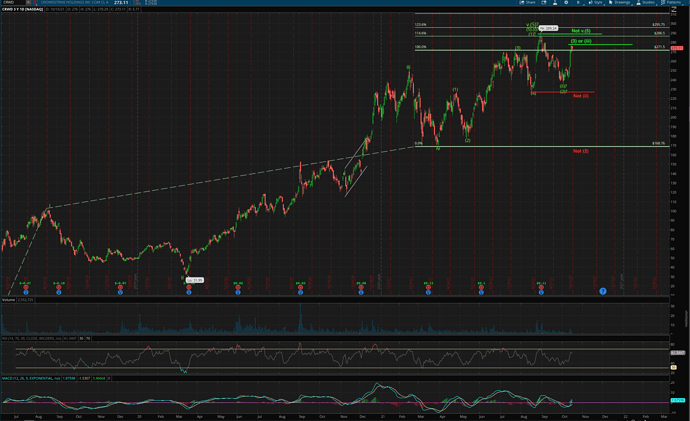

After closer look, might or might not be all the rosy for CRWD… two bullish counts and one bearish count… better wait for price action to tell us…

Yeah, but on the other hand we are starting to see Greed. Coincidentally almost at exactly the same level as a year ago today:

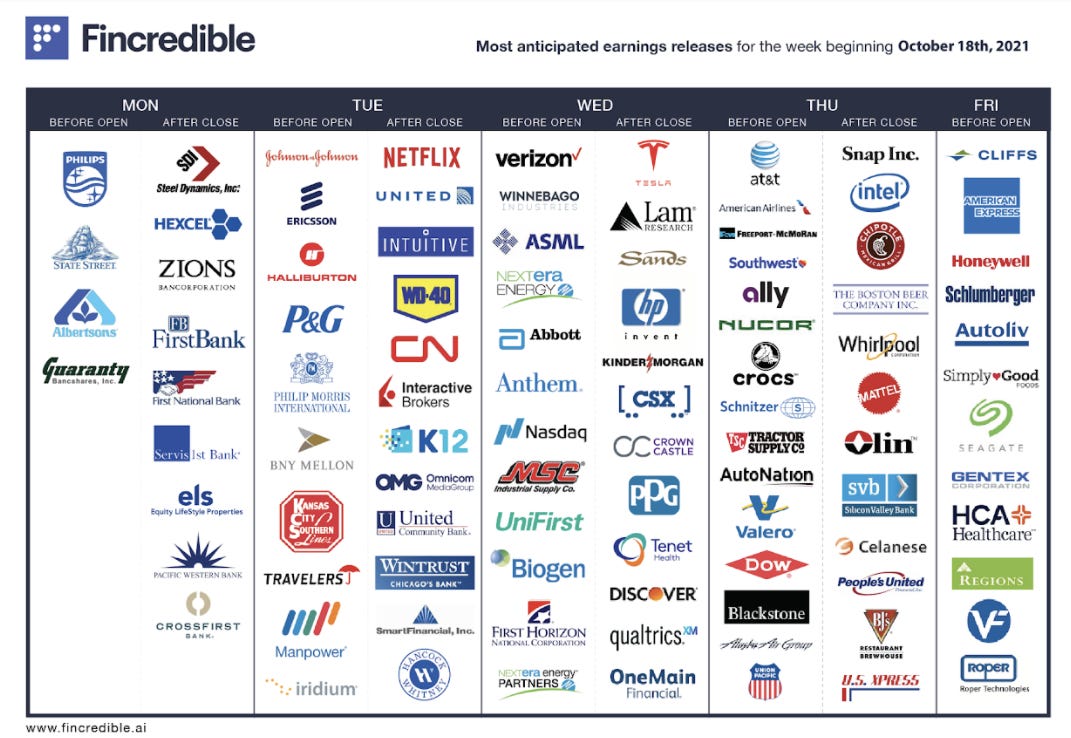

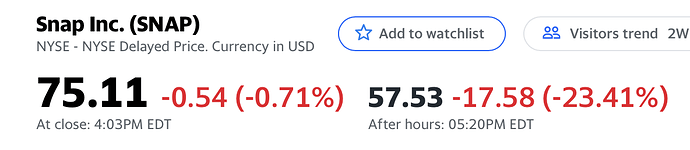

This is unbelievable:

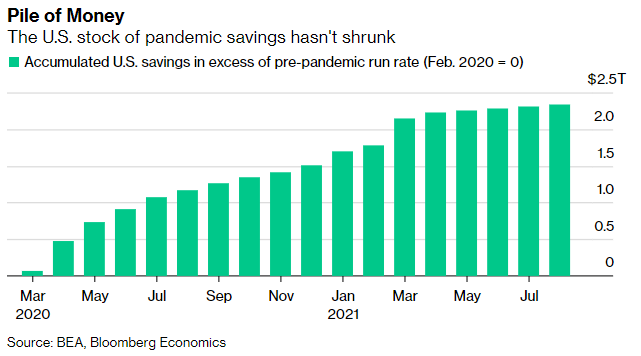

There is still plenty of dry powder sitting on the sideline.

In suburban Minneapolis, financial adviser Mike Leverty says his affluent clients want to dip into savings to buy new cars or swimming pools, but can’t because of shortages of goods or labor.

“A client wants to do a kitchen remodel, but the contractors are booked for a year,” he said.

.

Put all in stock market and let’s it rip. As face ripper said, is EVERYTHING rally time. What does UPST do? ![]() No need to know. Is only a ticker.

No need to know. Is only a ticker.

Many stocks appear to have completed multi-day wave (1), so some pull back is expected. Should be over or at worse by 2mrw. BTFD is the motto, if you have cash or willing to use margin.

Above is not a financial advice.

Using my newly learnt stock picking skills, I picked two stocks that have done great lately.

veri - up 9+% today, took 14% loss during the dip but the position has gained 5+%

apps - up 3+% today, 33% since I opened a position.

how to know whether it is a beginners luck or real deal?

Stock of a vaporware company is far better than those who have real business especially those who make money because making money means can apply valuation metrics.

DWAC, just some vague presentations of what it is all about.

If you have real business, tough…

DWAC is some Trump crap. Will implode soon.

Agree with Josh here. Inflation is over hyped.

Wtf? You believe in crypto and don’t believe in inflation?

I don’t think we have sufficient evidence yet we are having structural inflation. That is the type of things that will keep spiraling upward at a fast pace. Of course we will always have 2-3% inflation. But anything more than that? Because of some supply chain issues? Nah. No convincing evidence yet.

Keep an eye on wages and rent. Those are the key things. Not how many container ships are waiting outside of LA.

My response is always do nothing regardless of economy because I have thought about all these issues and the best way is asset allocation to deal with them rather than thinking of responses everyday.

AAPL for all market conditions.

S&P index for bull market.

RE for inflation.

Cash for deflation and bear market.

There is nothing to do except continue life as it is.