Monster earnings week!

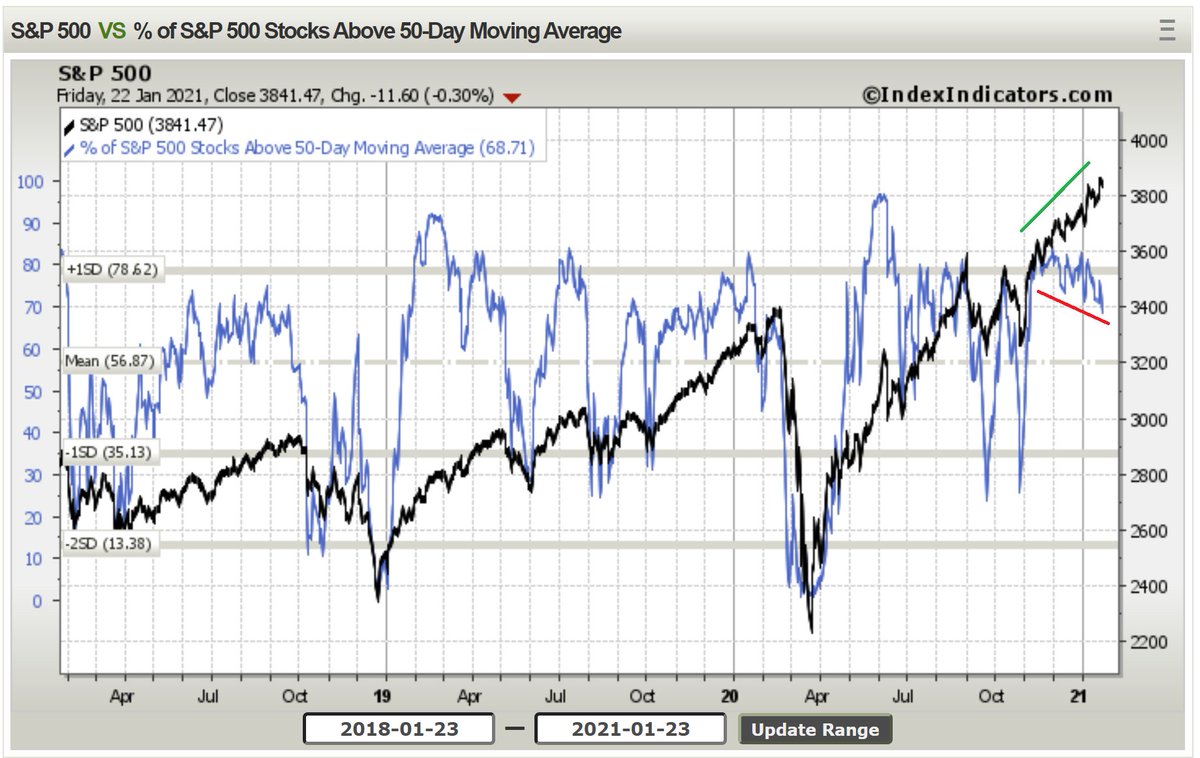

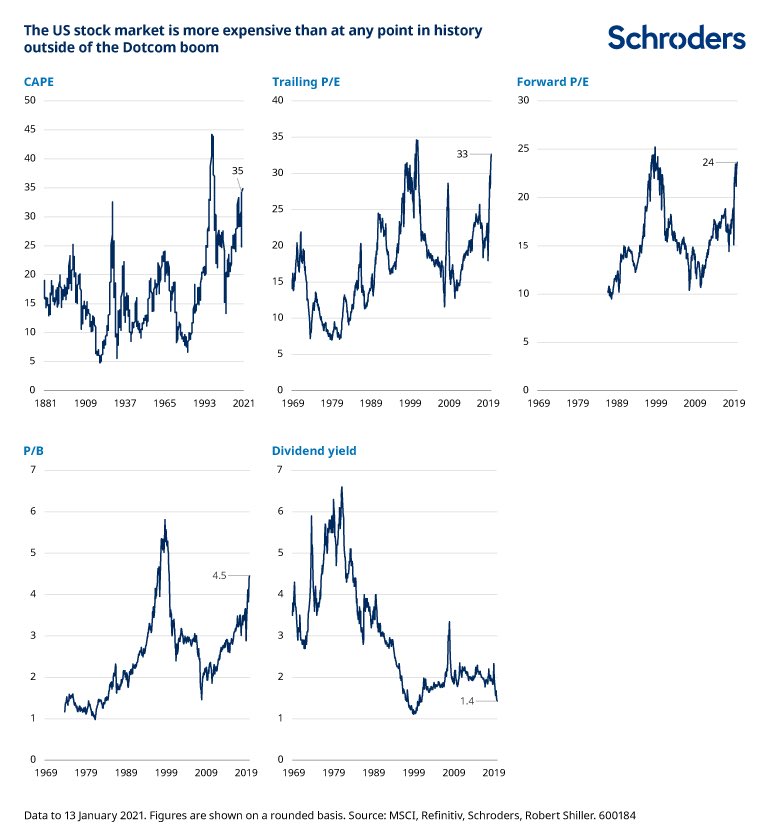

Various valuation metrics historical charts. Not sure we can compare today’s PE with the past, because of our record low interests rate.

Of course there will be a correction. Only a matter of time

Just FYI GME is 138% shorted - the most shorted stocks in the history.

Archive link: https://archive.is/JLccc

Melvin Capital Management is down 15% just three weeks into 2021, thanks to a series of wrong-way bets that stocks including GameStop Corp. would slump.

One stock that has dinged Melvin and significantly hurt New York hedge fund Maplelane Capital, which is also down for the year, is videogame retailer GameStop Corp.

GameStop’s stock has soared 245% this year through Friday—including a 57% gain on Jan. 13. Its share price doubled from its Jan. 12 close to its Jan. 14 close. It was up almost 70% midday Friday from its Thursday close before stock exchanges temporarily paused trading in the stock to rein in volatility.

But members of Reddit’s popular WallStreetBets forum, who have been touting the stock and noting its substantial short interest, have taken victory laps as shares surged, The Wall Street Journal reported. Some of the posts specifically call out Melvin, which disclosed in its most recent quarterly regulatory filing that it held put options on GameStop. Put options are contracts that give investors the right to sell stock at a specific price by a certain date and limit an investor’s potential losses.

A person familiar with Melvin said its GameStop puts expired last week.

Told you, in the current environment, RHers (just a label for RHers/millennials/ general young investors/ Redditers/ Twitters) trump big fish (just a label for banks, hedge funds, whatever big boys you know). Forget those old stuffs that you have read. Swim with the time.

Yeah, everyone said the same in the dotcom era too. This will eventually end very badly. The question is when.

Market can remain irrational longer than we remain solvent.

Opposite is true.

No point guessing when the irrationality would last. Just ride the euphoria. When the clock strikes 12 then respond accordingly.

Btw, I recall many big boys went belly up just like retail investors. They are also humans even though big funds use machines with algo, still humans… in fact bankrupt faster.

Euphoria in Tahoe market has hit the stratosphere.

Only 18 sfh listings active in South Lake Tahoe.

Normal market 250.

My neighbors house by my farm has three offers in three days. No inventory and lots of buyers with BA money and stock winnings.

Sell Bitcoin and Tesla and buy something real.

Market is always wild, people praise RHers only to make RHers fool, this is hypocritical world!!

Most of the news are not forecasters, they are just commenting after the fact.

They will praise…praise…until RHers dumped by market funders!!

Did anyone of you confident about AMC when it was $2, see now $3.5 in 10 days!

Do not believe the short term price.

Ultimately market price = value of the company as a long term efforts.

Do you see GME at $65 worth? It may still go up to $200 or $300 or $400.

If you still believe RHers are the way try selling 1/5th of AAPL stake and put it in GME! ![]()

It will be reincarnation of dot.com.

How will you know when the clock strikes though and can you move fast enough to protect yourself?

Worry about it when the time comes. How do you know I can’t?

IMPORTANT: Remember always trade with the money you can afford to lose. That is, afford to lose the trading money.

Corollary: Stay out if you don’t have any money that you can afford to lose.

Is my answer to your challenge as well. I told you that many times ![]() Your challenge is not smart as you are proposing to use money that I can’t afford to lose. Get it? Don’t make me say the same thing some time in the future

Your challenge is not smart as you are proposing to use money that I can’t afford to lose. Get it? Don’t make me say the same thing some time in the future ![]()

The problem with some retail investors, they use money they can’t afford to lose… thinking trading is the way to build wealth fast. Want to grow wealth, do like @wuqijun and how I invest in AAPL. I have always treat trading as entertainment… I have repeated many times, people still can forget… so bad memory? So hard to internalize? My view is people tend to use their own worldview and yardstick instead of listening to what other say and where they are coming from. Ofc some people manage to grow wealth through trading. Some people wisely take some winnings from trading out now and then to buy something real as suggested by @elt1 (I bot rentals in Austin ![]() )

)

It will be incredible when everything comes down. In the meantime, it’s fun trading with RHers. I have 0 problem putting in 10-20% of the total capital to chase multiple 10x crap stocks. The free trading, information highway (herd effect), mobile apps, pandemic, stimulus money have unleashed a stock market beast. The way it’s going, it might be bigger than dotcom in terms of the appreciation.

The clock has no hands. You will only find out when it’s already 3 in the morning.