Good challenge. That happened in Mar last year. All of us are still around ![]() in fact many manage to grow the worth of their stock portfolio in spite of that, some of them multiple

in fact many manage to grow the worth of their stock portfolio in spite of that, some of them multiple ![]() Don’t be a scared crow

Don’t be a scared crow ![]()

I know 100% about your AAPL investment. Even in my dream, I won’t say - seriously - to sell your AAPL. I did not tell you (neither WQJ) to sell your AAPL and buy TSLA. We told you use your excess cash on TSLA. Your AAPL is frozen for inheritance…and you enjoy the dividend returns for life !

Then, why I say that? You are praising all RHers when you see some trading success. They take reckless bets, some may get millions and most lose entire stake.

If you really find a company better than AAPL investments, then only you will really make a move. If Rhers trades/buy and hold are better than your own holding AAPL, IMO, then they deserve a praise (they are right). Betting on GME or TLRY is about timing and not a sound investment objective !

Exactly, no doubt.

I know this too. Whatever you make bet is small and fun, but brings some add-on cash flow.

If Hanera never sells Apple then he gets no benefit. I am sure his heirs will sell immediately.

He needs to start spending some of it.

He got it near zero price. Anything he sells now, it is subject to Long term capital gain 20% IRS (Texas zero tax).

Unless he knows AAPL will be tanked more than 20% ahead, there is no point in selling. He should have sold it in Jan 2020 before stocks went down 30%.

He gets yearly dividend almost like one bay area home rent. This is more than enough. Inheritance, his kids will get all money without tax.

Long time before this home was sold. Originally, grand dad bought the home for $5000. Owner sold it through trust inheritance !

19950 Hale Ave MORGAN HILL, CA 95037

hanera AAPL is like this, there is no point in selling any portion of it. He makes better money through other smaller fun stocks too which is enough for his lavish life (IMO).

Quantitative measure of WallStreetBets. Sentiment on WSB is sky high.

This one even drills down to the level of individual names.

https://swaggystocks.com/dashboard/wallstreetbets/ticker-sentiment

![]()

For speculative trading, trade some of the counters mentioned.

For higher long term return buy n hold investment, avoid those in the list till they are dropped out of the list.

The two I linked are just examples I happened to see on Twitter. No doubt many quant funds are scrapping r/WSB and monitoring it real time for trade ideas. It’s not just the small RHers pumping up individual names. No doubt many big money funds are fast followers as well.

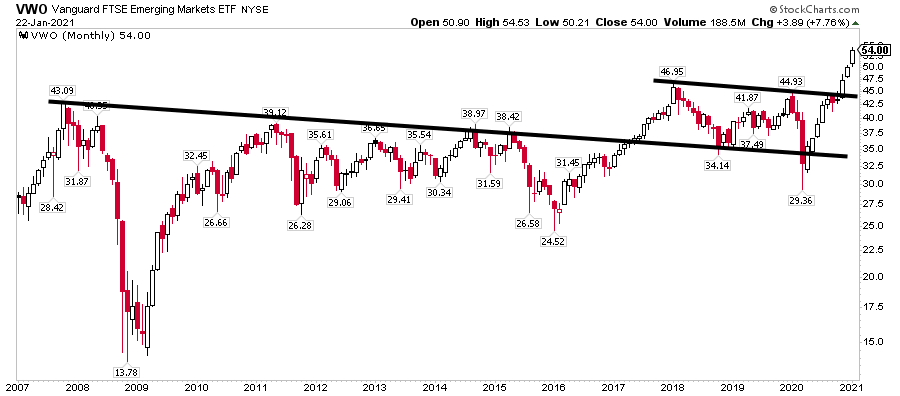

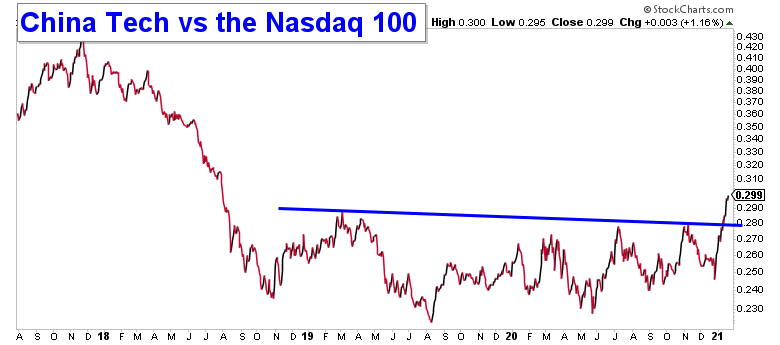

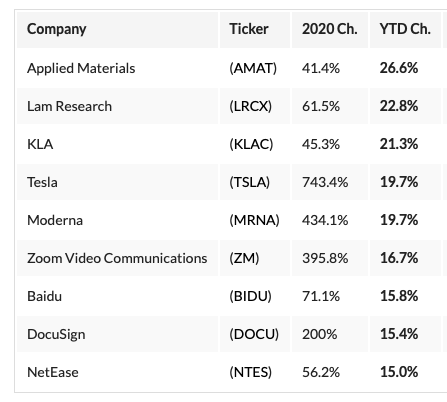

Every time I see BIDU I am angry ![]() with myself - missing another big rally of a stock?

with myself - missing another big rally of a stock?

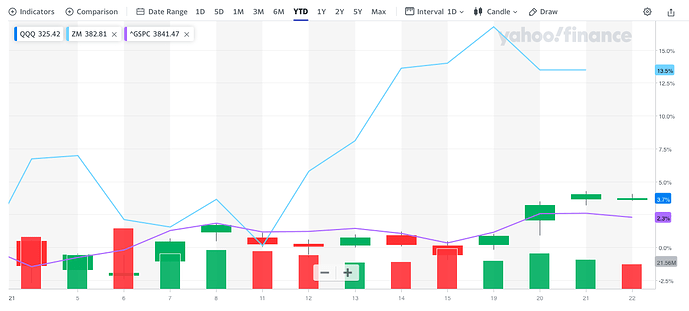

Three of the tops are semis and I own none ![]() of them.

of them.

Own MRNA and ZM, however portfolio up only +8%, too diversified? Anyhoo, better than QQQ 3.7% and S&P 2.3%

I see sometime you are having FOMO like this. First get rid of it.

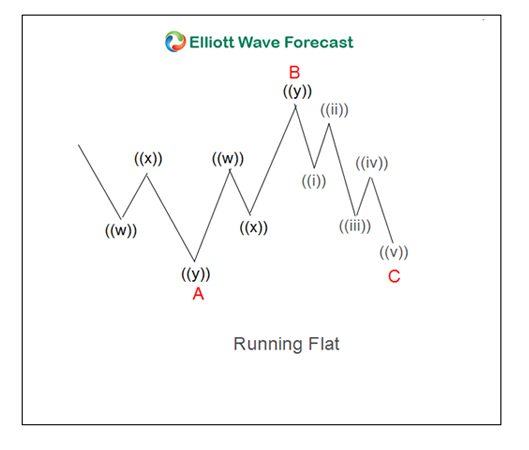

Simple, use your EW skills, find the bottom ( wave 2 or wave 4) and hold. Never have fear to buy when they are too dipped, it will be back.

Never go behind FOMO as you will get low return long term.

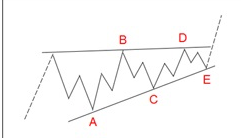

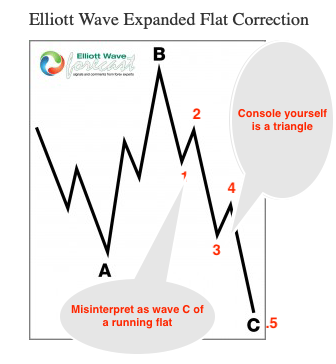

That’s what I did with BIDU. But the pattern as I told you is very difficult to read, don’t know what it is like, can be a running flat (or triangle or combo) or an expanded flat. Holding when it is an expanded flat, feel like a f… fool. I gave up and it rockets! Difference in prices between the two wave C is HUGE, the higher the degree, the bigger the difference. When you’re bullish, easily misinterpret wave 1 of wave C of an expanded flat as wave C of a running flat. Add and lose more ![]() Then you console yourself, is a triangle, add more and you goes deeper underwater.

Then you console yourself, is a triangle, add more and you goes deeper underwater.

IMPORTANT: Is prudent to get out if you suspect is in wave four of higher than Intermediate degree i.e. multi-week corrective wave.

Running flat

Triangle

Expanded flat

Tencent shot up 11%, meituan 5%, baba 3% in Hong Kong. Gonna be ripping tomorrow.

Cathie knows her stuff. Her finger is on the right vein.

BABA is a compressed spring waiting to explode. Jack is too much of a symbol for Xi to punish too severely. Value of Ant may be a lot lower than before but the core of Baba is still executing extremely well, especially its cloud division.

Unfortunately I have unloaded all BABA TCEHY BIDU + many China stocks - use to own a lot of these stocks. Barely get out green. Screwed the ex-POTUS.

Joining the 1T club soon…

Reuters said Baidu will have a second listing in HK in March.