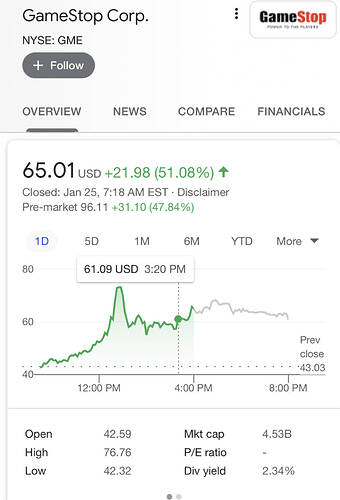

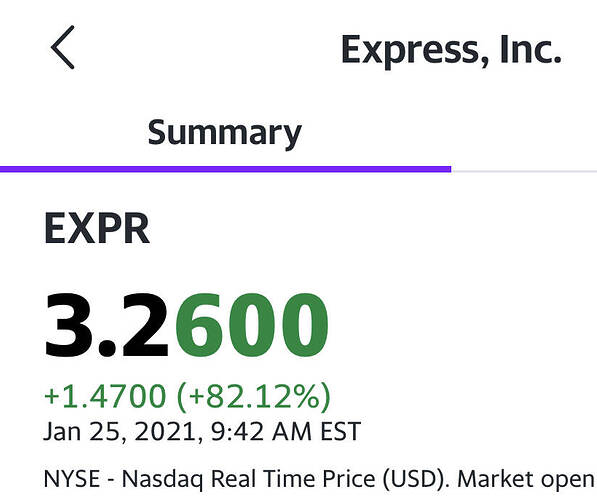

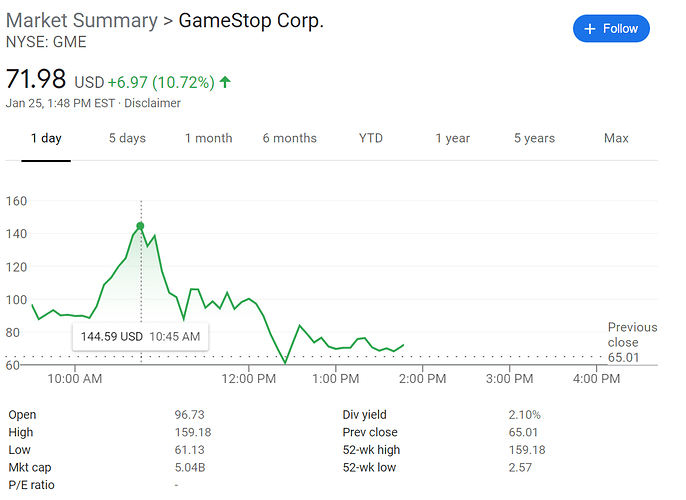

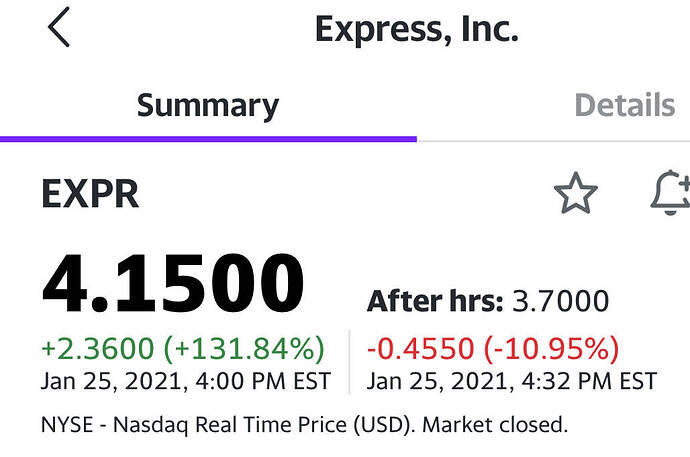

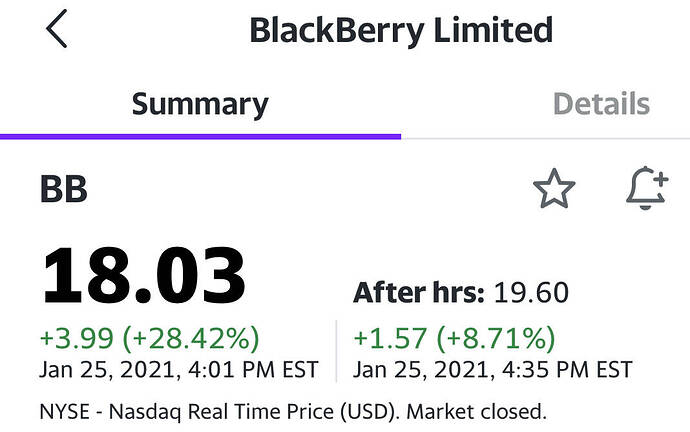

look at power of speculative stocks

People can’t buy stocks fast enough.

This means that their backend service provider, HFT, has issue.

However, I traded today at Robinhood, TDAmeritrade and Fidelity, but noticed some hiccups in TDA, but not in others.

One trader on Reddit turned $53,566 into more than $11 million. This is how WallStreetBets pushed GameStop shares to the moon. Its subscription, but title says it all.

Proof was yet to come out of WSB on 11M, may be some real or hoax.

However, max proof provided was below - so far

All these are already heavily shorted stocks, going up. However, there are brighter chances that market dives down this week, starting from tomorrow (possibly).

I am not 100% confident, but may happen. If that happens, all such high-fly stocks wiped away from the flood !

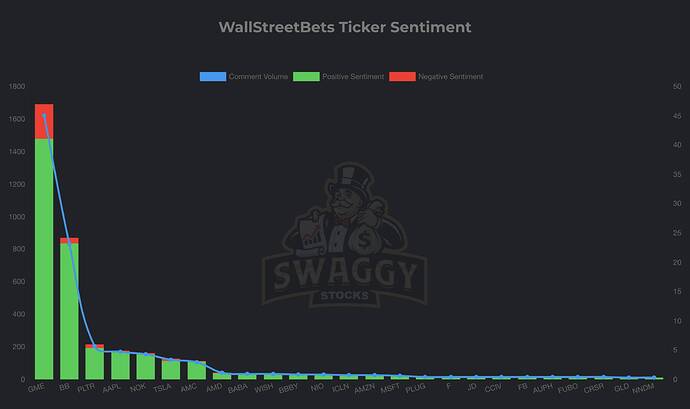

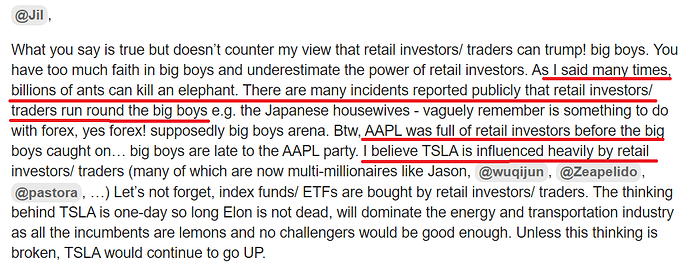

Explains why AAPL has been outperforming the other FANMAG. Number 4 favorite for the r/WSB gang, even ahead of TSLA.

WSB can’t rocket AAPL, no1 is shorting and is already owned by millions of retail investors. WSB can’t influence AAPL much. TSLA is owned by Elon and his friends, and short heavily (at one time) by jokers.

I don’t want to start a thread for this, so just going to post it here.

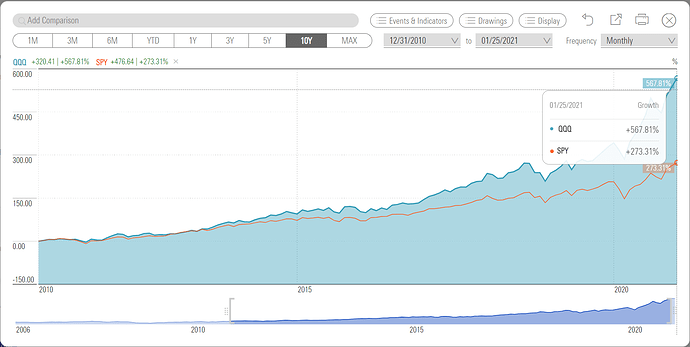

My son has $200 of Patriot Bonds EE Series issued in 2004. They are worth about $143 right now, and can continue accruing interest until 2034. Any reason he should hold onto these instead of cashing them and buying SPY?

I think the biggest reason to switch to SPY is that your son is young. Bonds only make sense for people near retirement age and want less volatility. Otherwise stocks will give you much better returns.

Stock is also a great learning device. May encourage your son to learn more about the market.

Ha ha ha, when it comes to AAPL you are realistic !

Remember, you were telling me WSB are like group of ants, powerful force, that can win over elephant (Market) !!

AAPL is one among the 500 stocks of SPY. When WSB can not dent AAPL itself, how can they make big stride over S&P?

SPY is 500 companies weighted average, QQQ is 100 companies weighted average. The long term SPY is 8% appx, while long term QQQ is 10%.

For small investors like us, Invest in QQQ which has cream of SPY. Here is morning star comps.

Quote me out of context.

TSLA

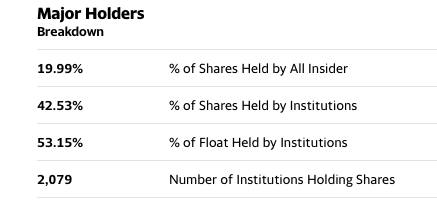

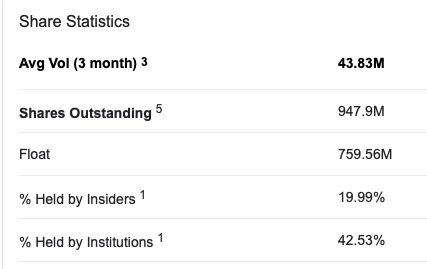

Number of shares in float held by institutions = 0.5315 * 759.56 = 403.71M

Number of shares in float held non-registered as institutions = 355.9M worth 313.5B

Don’t know how many friends of Elon not registered as institutions.

AAPL

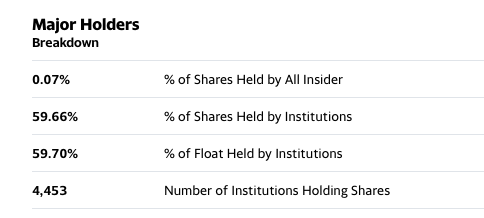

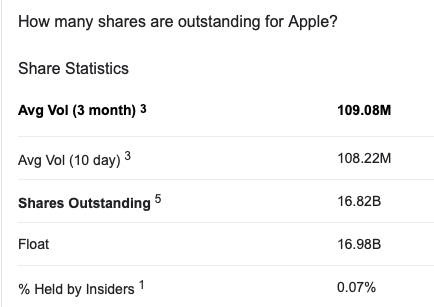

Number of shares in float held by institutions = 0.597 * 16.98B = 10.138B

Number of shares in float held by non-registered as institutions = 6.84B worth $977.6B

Tell me which one is easier to manipulate?

I am not arguing TSLA vs AAPL!

This is ants vs elephant ! Ants can temporarily dent as winners, but really they can not match elephants!!!

I didn’t say permanently ![]()