“Because it’s WRECKABLE, that’s why!”

Awesome line!

who’s the Gordon Gekko in this forum?!

Looks like correction is temporarily over…

See now mkt positive, had I bought puts everything wasted!

I want to be safer than riskier bets!

BTW:I may be wrong or right, careful

Looks like GME and AMC are in the toilet where they belong

Who wants to buy dividend stock at a cheap price?

KO , PG and VZ

are in good place to buy at low price, get ever lasting dividend.

First review and analyze your favorites and then decide.

BTW: It is your money, your risk and your profits.

I have 100 shares of PG. Planning to sell them… tired of holding a slow appreciation stock. Ofc, my situation is different, my AAPLs pay me enough dividends already and is growing at 10-15% p.a. In fact, I have been saving my dividends-paying stocks, no longer serve any purpose, I bought them for passive income but since AAPL is paying dividends, no longer need these stocks.

You would have bought those stocks when peak and getting tired by seeing negative holdings.

KO , PG and VZ

Are in possible low. This is the time to buy not sell them. If you are negative with pg, time to DCA. The turn around is happening.

Looks reached support level. Look at finviz.

BTW: As I said, it is individual risk/reward. I bought these 3 stocks today, as I feel bottomed and may be right or wrong.

I bought during the scare ![]() Can’t remember what happen. It went down to $66.

Can’t remember what happen. It went down to $66.

Anyhoo, agree with you that PG JNJ KO are must have in a dividend stock portfolio.

I used to have VZ KO JNJ, all sold. I am selling all dividends paying stocks, no need for them ![]()

Assume AAPL likely reach $150 in 2 months,

the ratio is = (150*100/134.5-100) = 11.5% + dividend 0.61%

Assume VZ likely reach $61.75 in 2 months,

the ratio is = (61.75*100/54.88-100) = 12.5% + dividend 4.62%

I just bought these 3 as diversifications+dividend and potential low price.

I don’t doubt your maths but I don’t need any more dividend stocks, AAPL is paying me enough. The proceeds from those sale are put into an account for building funds for buying rentals, temporarily suspended acquiring rentals, but building up funds continued. Occasionally I put some profits from trading to that account too.

I can suggest one, but it is left you to decide. If you have any of these stocks on negative, you can DCA now and sell it at break even instead of taking loss.

got some VZ after some reading. Seems like it’s in wave 1? thanks!

Today I came out with 48% return on this GME puts. I should have waited more, but I felt boring to hold further !

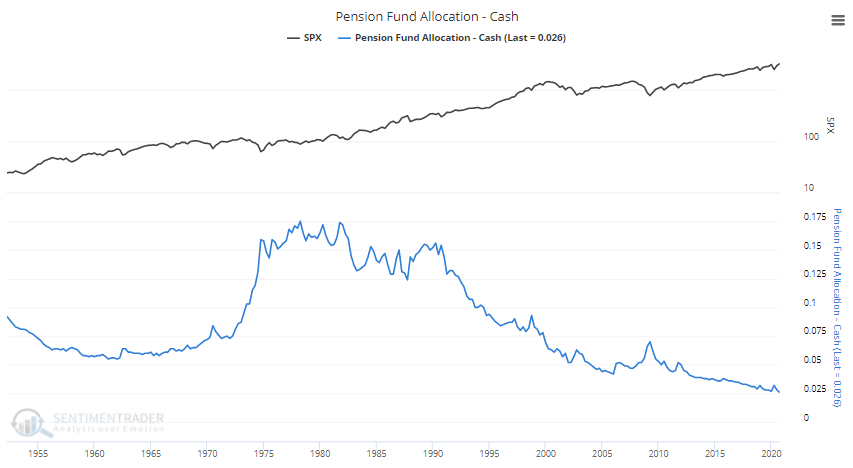

SentimenTrader (sentimentrader)

Portnoy is a priggish self important weiny