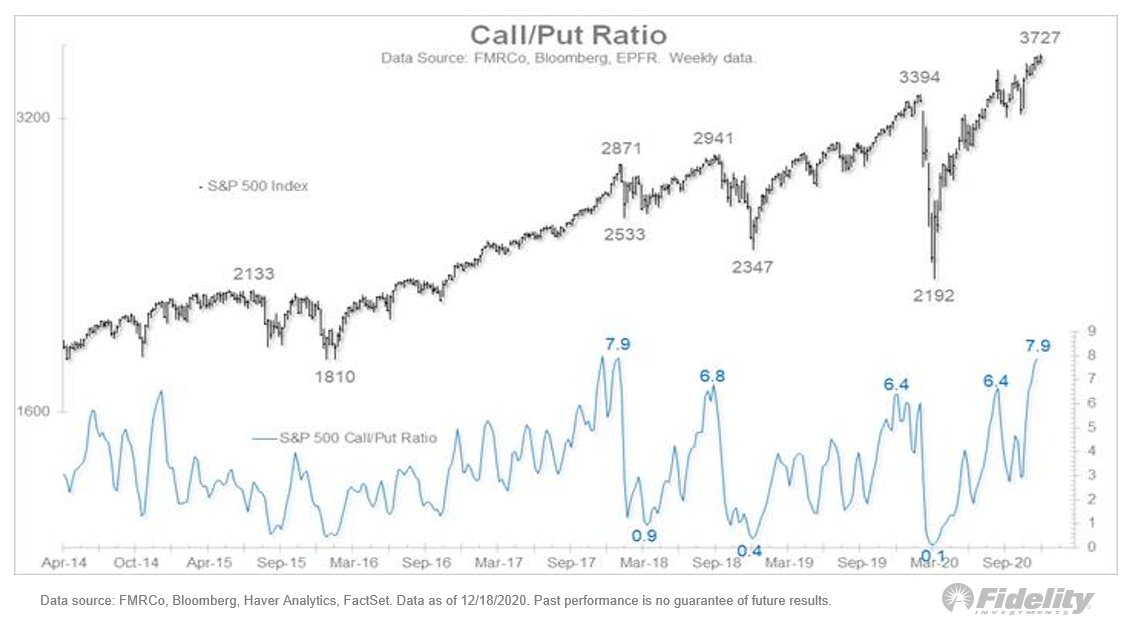

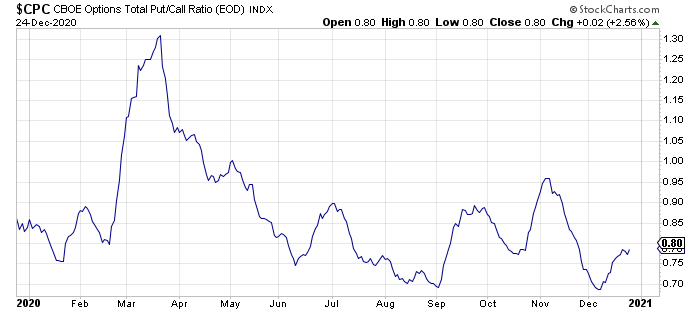

Santa Claus Rally? That bearish breadth divergence still hangs in there…

1 Like

These charts help myself more than anyone else I guess, even though I don’t do anything to my portfolio on most days of the year.

2mrw will be a good day.

1228

2 Likes

Good day for you means huge drop for the market?

Which are the following stocks will turn back soon? They are possible/potential bottom last week (12/22 or 12/24).

| SYMBOL | PREV_DATE | CURR_DATE | PREV_CLOSE | CURR_CLOSE | Percent Down |

|---|---|---|---|---|---|

| CI | 12/8/2020 | 12/22/2020 | 218.67 | 194.97 | 10.84 |

| DISH | 12/3/2020 | 12/22/2020 | 37.17 | 28.88 | 22.3 |

| INTC | 12/4/2020 | 12/22/2020 | 51.99 | 46.17 | 11.19 |

| SBAC | 11/6/2020 | 12/24/2020 | 306.62 | 275.02 | 10.31 |

| PPL | 11/24/2020 | 12/24/2020 | 30.68 | 26.89 | 12.35 |

| AMC | 11/24/2020 | 12/22/2020 | 4.58 | 2.59 | 43.45 |

| RCL | 12/3/2020 | 12/24/2020 | 84.4 | 70.66 | 16.28 |

| ES | 11/16/2020 | 12/24/2020 | 94.43 | 84.15 | 10.89 |

| ETR | 11/16/2020 | 12/24/2020 | 112.77 | 95.35 | 15.45 |

1 Like

Let’s dance ![]()

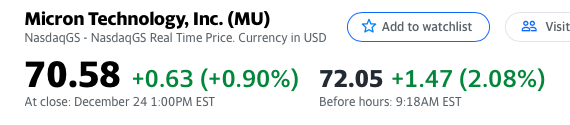

Target: $78

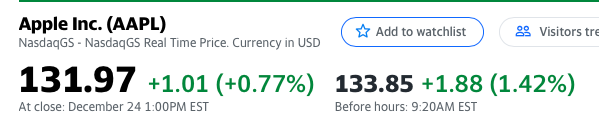

Target: $325

Target: $155

If I guess further, very likely market swings down tomorrow, yet to reconfirm by 1 pm closing ! ( guess work )

Just normal fluctuations, not the start of deep pull back.