This week’s earnings calendar:

This has some financial/fundamental details about QS, know before you buy this stock.

https://investorplace.com/2021/01/qs-stock-is-worth-just-43-26-or-20-below-todays-price/

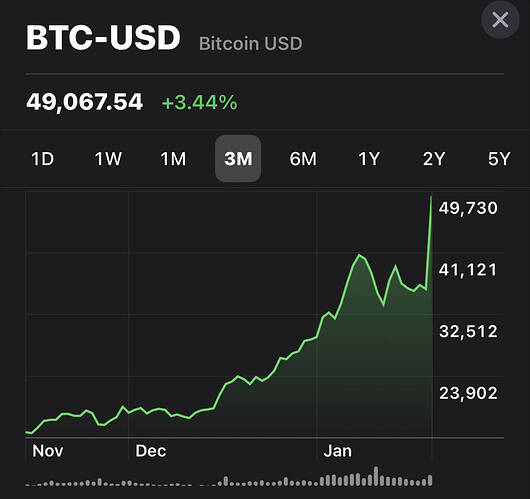

Hopefully 60k very soon and I’ll cash out majority. It should dip from there…I hope.

Yes, I agree!

I was hoping to buy some at 40, and pull a wuqijun and hold forever and let it rise like Tesla when their tech starts working in 4 years and retire a millionaire.

All joking aside they have some MAJOR technical challenges to overcome. they are literally trying to operate at the edge of material science and physics, so not even sure they will succeed.

Nowadays millionaires are a dime a dozen. A million dollars can’t buy a decent SFH in SV.

I read somewhere, a middle class family of four should be able to afford a SFH with 2 cars with one parent working. If both parents are working, should be able to own two SFHs. Regardless of your net worth now, you are not a middle class family if you can’t do that. In SV, middle class mean $5M per parent ![]() no where near rich

no where near rich ![]()

Once it cools down worth the bet.

Single income families haven’t been able to afford homes

since the seventies when women hit the work force en mass

Too much money after too little supply. House inflation

has been the norm ever since. 3.5 million house shortage in CA

Plus another 100k shortage growing every year.

No vaccines available. LA had to shut down their main vaccination center. Cruise ships are death traps. In the best of times they were only for the nearly dead and newly wed. I will never go on a cruise ship.

RCL Pre-covid max is Appx (Jan 2020) $134 (current $67.63), this has no dividend.

There is another choice CUK pre-covid max is (Jan 2020) $48.72 (current is $17.66), this has 11.33% dividend at present price.

BTW: I own this stock CUK since $11, I may have bias too ! I keep accumulating every dip.

Bay Area counties like Santa Clara is already vaccinating 65+ seniors. They say they will move on to the next stage mid March, which is to vaccinate people with health conditions regardless of age. So by April all 65+ people should be able to get vaccines if they want it.

I don’t think cruise ships will go away. It’s the lazy ass way to travel, and we know Americans are all lazy ass. Heck, even I want to take a cruise. It’s a convenient way to travel with small kids. I want to do the Mediterranean cruise that stops at those small Greek islands.

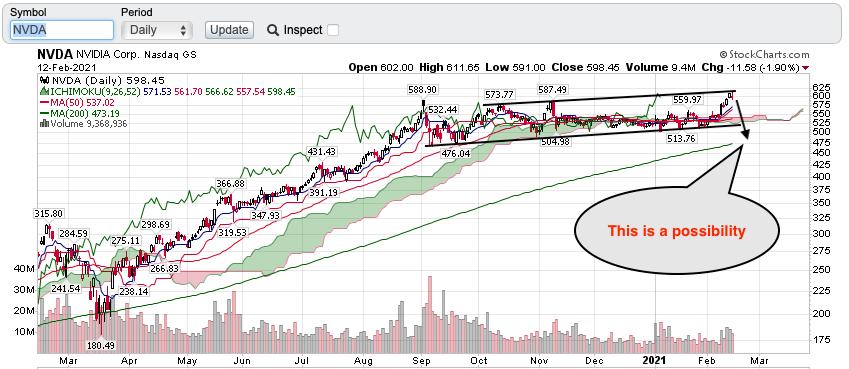

![]() Minimum target is $678. But… a risk is lurking…

Minimum target is $678. But… a risk is lurking…

A descending wedge is always bullish. Obviously UP ![]() Give us a harder question.

Give us a harder question.

The Falling Wedge

Regardless of the type (reversal or continuation), falling wedges are regarded as bullish patterns.

My guess. Total investment < $50k.

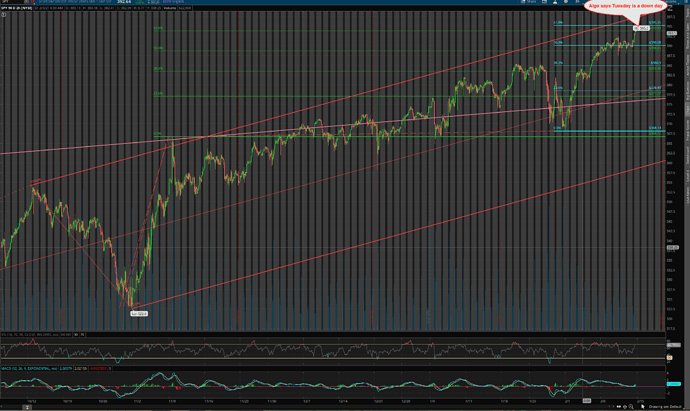

A growth investor who uses FA + EW ![]() He feels a correction of ~15% is possible within 1-3 months (translate to Mar-May). In EW term, retracing the rally from Mar 2020. I think this is a high probability event.

He feels a correction of ~15% is possible within 1-3 months (translate to Mar-May). In EW term, retracing the rally from Mar 2020. I think this is a high probability event.

Too many people calling for corrections within the next three months. According to the theory of maximum pain market will rip higher just to frustrate these people.

But in this forum, I am the only one. According to the theory of the crowd is always wrong, correction should occur.

What do those people say about corrections? What I mean is drop to what level? EW gives probable targets. Do those guys say say but no hard figures? But the way, I read quite a few articles/ videos that say explosive rally into Jul, and may be end of the year. I didn’t know which camp has higher number. According to the investor that I have linked, 53% don’t think there is a correction. 53% is the crowd.

Algo says Tuesday is a down day. Not the same algo used by @Jil.

If the raging bull is not tired yet, should decline to the price zone of $378-$368. Lower than that means bull is a little tired. Below $340 means retracing the rally from Mar 2020. Bull may still be in strong shape, that mean not lower than $388 ![]()

Lol, Biden is pulling out the Obama playbook. He wants a big infrastructure spending bill to stimulate the economy. That’s was an utter and complete failure last time. Even the White House’s own numbers calculated we spent over $400k spent per job created or saved. Remember when they changed the goal post from jobs created to created or saved? That’s horrible compared to 1 job created for every $85k of GDP growth that is normal.

The massive spending isn’t going to create the GDP growth people are expecting. It’ll be years before most of the projects even get started. Stocks are running because people are expecting all this stimulus to grow GDP which would grow corporate revenue and profits. We’re likely in for another mediocre recovery that’s well below historic standards. I guess the upside is it shouldn’t create inflation either.

We might as well just cancel all these idiotic ideas. Then take the amount they are going to spend and just distribute it evenly among households. The government deciding how to spend it is an awful idea.

Most of his first term will be spent on removing covid-19 issues and reducing unemployment. The task is huge for his term.

Second, he won’t even reduce China tariff, rather use the money for his projects. You can not expect any different from Obama! They worked together and have the same mindset!

Your EW? I am on the opposite side, having few spy $400 calls to sell on Tuesday !

Sell calls mean down day! Otherwise should be buy. Do you mean buy or sell?

Open up then down. So your algo could be indicating the opening but not the subsequent action. Or you know this “open up then down” so fool us into buying your calls or buy SPY/QQQ/shares while you unload your SPY calls! Wicked ![]()