This week’s earnings calendar:

I started to see people saying maybe last week’s short sell off was the “correction” everyone was predicting.

It seems like the consensus is calling for a 10% correction. Even though we didn’t experience an actual 10% correction, many of the common elements associated with this type of correction happened two weeks ago. For example, many hedge funds lost 10-20%, and the spike in the VIX was similar to surges we’ve seen during 10% corrections. It’s possible we had a compressed, correction on steroids beneath the surface as a result of the massive hedge fund deleveraging.

So maybe that was it?

![]()

Already said that market will be negative tomorrow, but I do not know when it comes up, all depends on how deep the fall is 1%, 2% or 5%…I do not know.

Like hanera…Moved to max cash today…!

Market’s strength seems under appreciated. It’s incredibly strong.

Whatever they have shown is theory or back testing the concept. When we actually work, it may be a disaster as their back test concept has bias, esp buying at right low price and selling at high price etc.

There are 100s of such ideas in reddit algorithmic trading site, very few are working well.

IMO, hanera’s EW is far better - openly available well known, at least proven concept of trading.

@hanera’s stuff doesn’t look actionable to me. It’s either going to go up because it’s wave number X, or it will go down because no, it’s actually wave number Y.

I noticed GME’s biggest up days were all where it opened MUCH higher than the prior day and closed quite a bit lower. So people pumped it up, then they spent the day dumping it.

Do you agree with his comment?

Yusko also pointed to how Apple’s (AAPL) annual net income has barely budged over the past five years. But per-share earnings, which drive share prices, have climbed sharply because the iPhone maker has aggressively repurchased its shares.

“That’s just financial engineering,” he said.

Maths. Is he saying share price moves more than it should (by the share buyback)? The reasons for share price increases are…

. Share buy back reduce number of share, hence eps and share price increases

. Fed prints tons of money, so discount rate used in valuation model is reduced (to practically zero), hence valuation skyrocketed… yes, skyrocketed but investors are more sane, so didn’t bid share price to the moon.

. Historically AAPL is undervalued, it kind of stay fully valued now. This add a little to the share price.

. Increase investment towards indexes and ETFs result in higher share price (you could say it overvalues a stock, whatever, it distorts the “pure” market price).

All above reasons add to share price increase. Obviously the increase would be more than if the reason he quoted is the only reason for increase.

You have selectively read the posts. Or you are unable to prioritize ![]() Primary count is the trade. Alt counts is for placing stop-loss. I have posted a long story by a blogger on how to use EW to trade, somewhere, forgot where, searching in forum is hard. In any case, I didn’t post how to trade because this is not a financial advice on trading… you can search the web on how, plenty of articles and YouTube,

Primary count is the trade. Alt counts is for placing stop-loss. I have posted a long story by a blogger on how to use EW to trade, somewhere, forgot where, searching in forum is hard. In any case, I didn’t post how to trade because this is not a financial advice on trading… you can search the web on how, plenty of articles and YouTube,

Look out AMRS, they made some acne breakthrough and keep going up and up !

This is kind of small cap, may have chance to go up. I did not do fundamentals or anything.

Risk is your if you buy, do proper analysis before you buy!!!

BBIO I have 30% gain so far !

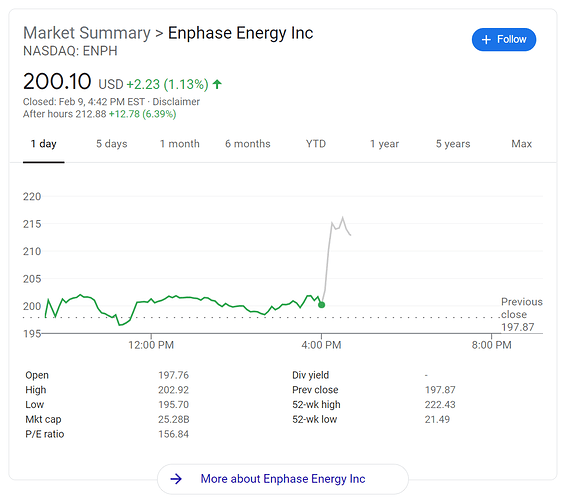

Any takers or holders of ENPH today (AMC results)?

It’s not hard to do proper testing. Not “backtesting” per se, but cross-validated testing. Then you have more assurance that your algorithm is robust to out-of-sample data

Are you into algo trading too?

I read an interesting explanation why Simons’ public longer term fund lost money last year, but the private fund that trades staff’s own money was up like 70%.

The longer term algo has vastly fewer data points to train on. Think daily closes or similar stats that have frequencies in terms of days. Compare with the short term algo that train on ticks. There are orders of magnitude more data points in the latter.

Another explanation is front-run longer term fund ![]() and whatever data long term fund has, short-term fund has + more.

and whatever data long term fund has, short-term fund has + more.

Their private fund - called medallion fund - restricted to 300 employees and is maintained by algorithms. This algorithm is kept secret - concept is modified Markov chain. No individual employee knows what is being bought/sold and everything is controlled by computer systems. When they generate reports (after the fact) everyone will know what they own.

They charge a hefty fee of 45% (The Medallion fund, available only to Renaissance employees, has generated returns of about 40% a year since inception in 1988. And that’s after a 5% management fee and 44% performance fee, which dwarfs the industry-standard 2% and 20%.)

This algorithm is really tricky, developed by Jim Simon and his Ph.D mathematicians and put into work. The amount of data it handles may be big as the fund is $10B+ level now

Whereas there is no secret algorithm applied to public systems, but maintained like a hedge fund. It is bound to flow with market cycles.

In that case, what is the attraction of the public fund? TQQQ or Cathie is better.