Chopping till FOMC?

Since the day count down started, market is slowly going down and down (fluctuates at sidelines, but also going down).

Even if there is one- or two-days jump, even if companies meet the expected results, market is in no mood to go bullish unless two issues, FED rate hike stops (Expected May last rate hike) and Debt ceilings signed.

With high yield curve inversion, potential market drop is higher than market bull run!

.

?

Multi month or multi week decline? New low lower than Oct 12 2022? If no new low, is a multi month bull trend from Oct 12 from EWT perspective.

In 40 years, last time in 1980s.

Economy just refuses to die, and everybody is waiting for a recession.

The PMI Manufacturing index from S&P Global is back above 50, signaling a rebound in US manufacturing.

It’s not just the US. Europe is also growing:

The composite PMI (manufacturing + services) is in growth territory, driven by services.

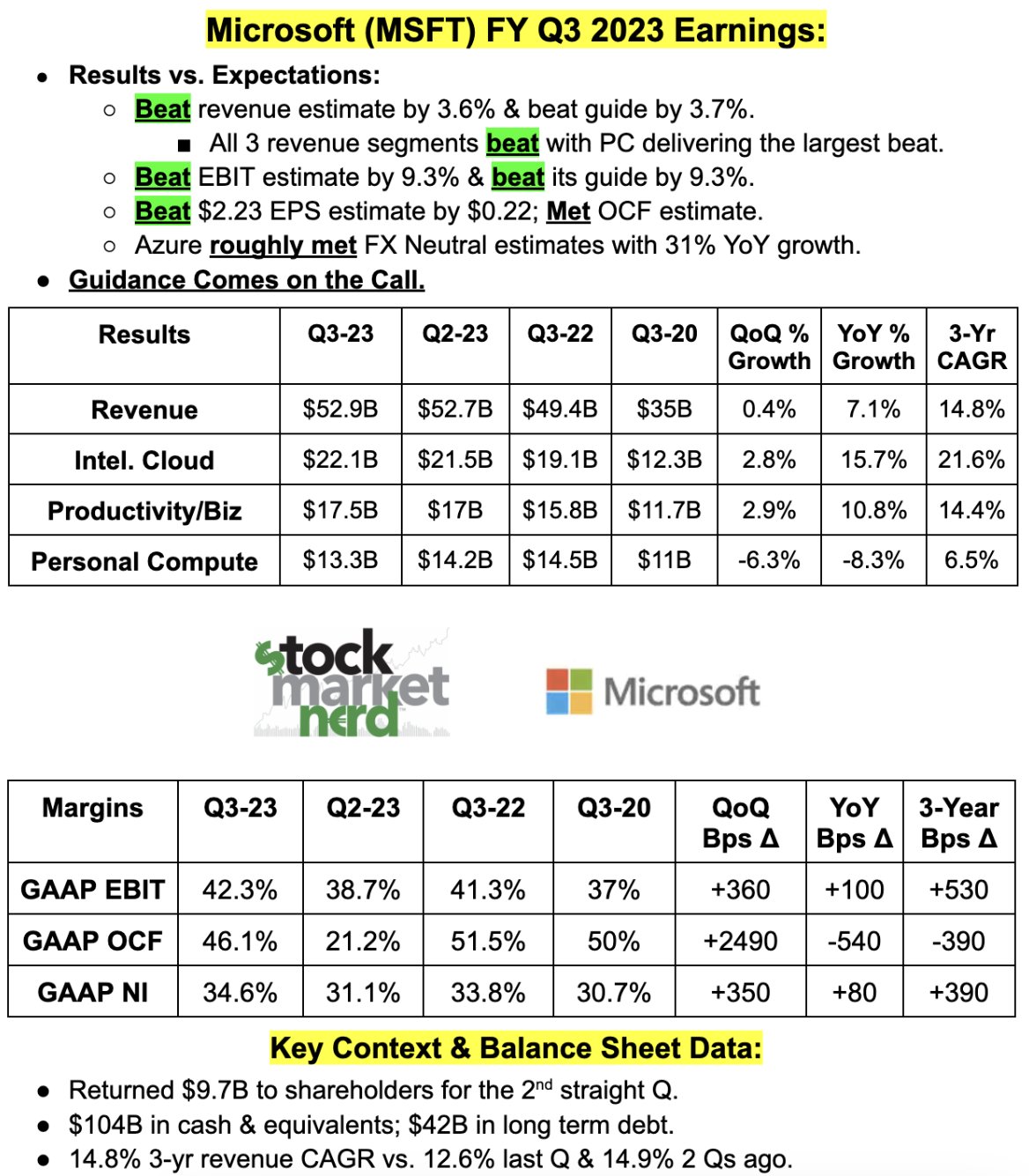

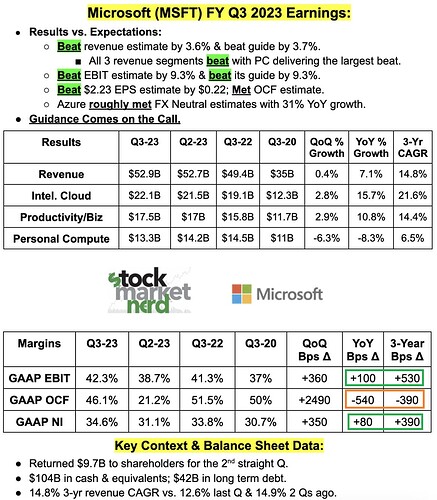

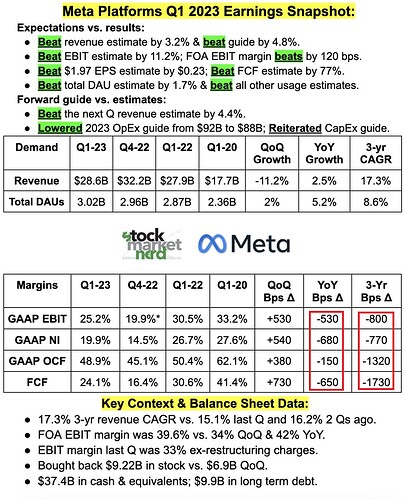

Both Google and Microsoft beat this afternoon. Google also just authorized a 70B buyback.

The trick is they set aside some cash to buy their own stock at low price. This will stop the stock price slide as well as given them an opportunity to buy their stock at low price.

Potential downside is higher by end of the year than Market unlikely go to bull run!

Crypto’s are equal to junk bond, speculative asset, not a good investment vehicle. It can fluctuate purely by supply & demand and market manipulation.

When FED raises rate, USD hardens as borrowing cost is high.

Among all the world biggest economies, mainly USA, EURO and China, still USA leads and no way Cryptos topple USD.

After some time, they vanish or low liquidity issue etc.

It is the income and income growth of a company that drives the market price.

Better to stay away speculative assets like crypto and keep investing top 20 companies of S&P.

I would rather have gold than crypto. At least after Armageddon you could throw gold bars at the marauding hordes.

Gold guns and bullets…. Choices for survivalists.

RGR… Ruger is a pure gun stock. The only one my stocks that went up today. A misery index stock. Better than owning gold. Pays a 3.44% dividend. I haven’t been able to find a pure bullet manufacturer stock. They are all conglomerates like vsto and Olin

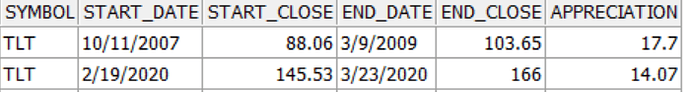

Wherever I am not allowed to buy/trade leveraged ETF, I moved to TLT as it is already corrected heavily and always better during drastic slide in S&P, esp rate holdings or rate cut duration.

Here is seeking alpha post which I think already shared.

I have never seen any point in buying bonds. My advisor at Wells Fargo was big into buying bonds last summer. I took out all my cash and put in In Fidelity money market accounts. Interest went from .1 to 4.5%today

.

I am a non-believer in bonds too. Might as well leave in money market or buy property or invest in S&P. The last two have growth in addition to passive income.

I found a pure ammo stock. Near its lows. Might be good for speculation…

Imagine if they weren’t lighting billions on fire each quarter.