I’ve been buying leap TLT calls slowly last few months. Might need to consider a spread since the calls are expensive.

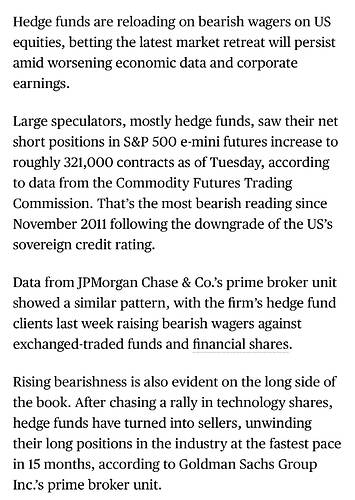

JPMorgan’s investors survey. Over 70% of investors expect S&P to be lower than today’s level (4151) by year end.

Overwhelming majority is bearish.

Over 90% expect recession to come before mid year 2014. Damn. It really is the most expected recession in history.

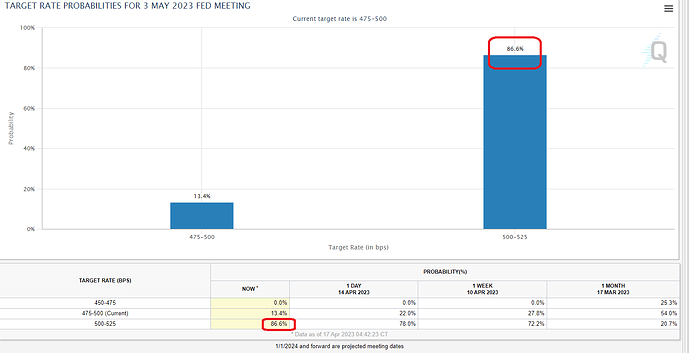

If FOMC future tool is correct, 86% probability for 0.25% rate hike in May 3, 2023, S&P next down stop will be appx 3775 and 3875 range, and will never recover thereafter.

??

2024 !!!

Anyway, that looks like wrong, market will be sliding mode from here, except some unexpected DCB jump.

It may be Feb 2nd is SPX peak at 4179 or if there is any better peak in next 15 days, that is all for stocks.

If they raise the rate 0.25%, FED knowingly push the market from a peak as they do not want to see coming upside!

Good Luck to All of you. I may not be posting often from here, but fun to watch the market now.

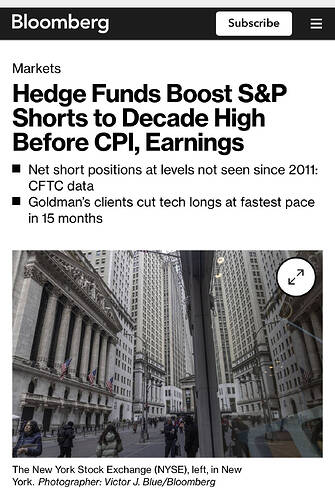

Institutional investors are mostly bearish. That means most are already positioned on the bearish side. I’d take the opposite bet. Won’t take much to short squeeze the mother f**ker out of them.

Actually I am not making any bet. I am always long.

Institutional investors are mostly bearish.

I’d take the opposite bet.

I am laughing at this statement as you do not realize the power of institutional investors!

Even Warren buffet can not bet against them as they are so big ( combined force ) to him almost trillion dollar holders!!

Very first time I witnessed their power in 2020 recession, just in 2.5 months, dropped 35% simply!

We are like tiny fly challenging Boeing aircraft !!!

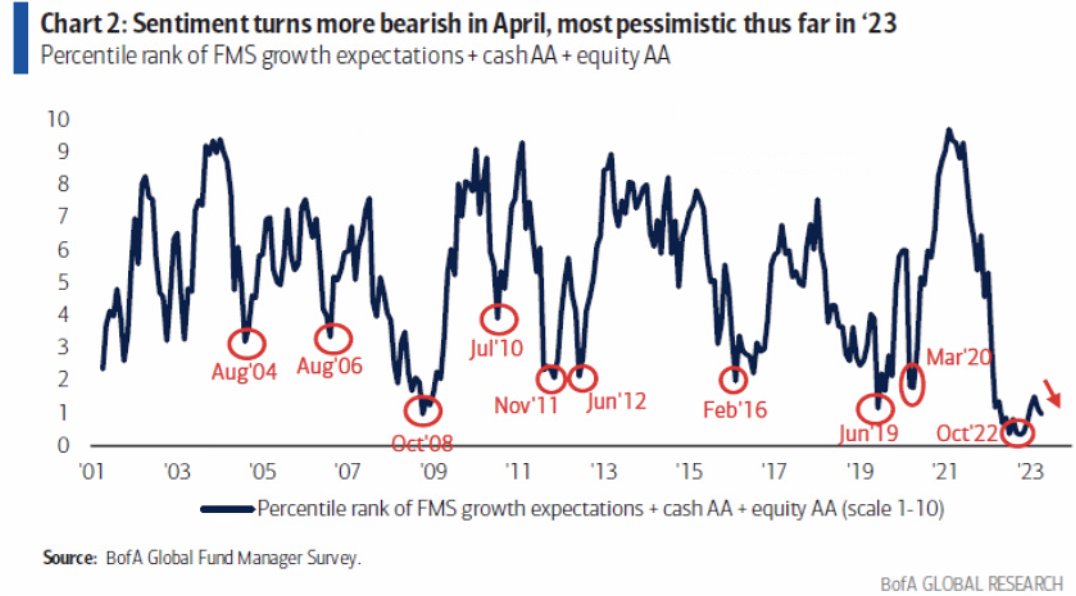

Sentiment more bearish now than at the depth of Covid fear. About as bearish as during the GFC.

Are you kidding me?

I honestly don’t understand all the inflation fear. I saw tech layoffs are on pace to exceed 2001 though. That’s crazy. Inflation isn’t causing that though. It’s the crazy irresponsible spending.

.

…It’s the crazy irresponsible spending.

To be more precise… talent hoarding…

I saw tech layoffs are on pace to exceed 2001 though. That’s crazy.

Correct, this will completely destroy the economy by recession.

Inflation is muted as of now.

Whether or not people expect recession or not, economic down cycle is imminent.

With 0.25% further rate hike in May 3rd, FED pushing/forcing recession in next 6 months starting from May 2023.

I see both stocks and real estate bottoms in Dec 2023.

Satisfied

I was even guessing that market can touch between 4200 and 4400, but with the way market behaves it seems already in top & struggling to go up.

Since this has ended positive finally, neither SPX nor NDX will be in bull run now. This is bound to go down in next 45 days (occasional jumps are possible) and eventually leading a bear run from here.

Count Down Day 14 !

A bull is a bear with horns?

Satisfied

Not satisfied! Very likely, if spx/ndx market closes negative (even slight negative), tomorrow will have nice bull run (yeah, they need one hurrrrrayyyyyy)!

It may be TSLA stock, that may make market up!

Hmmm, market slightly went up positive today.

With results next week, neither SPX nor NDX moving up from here next week. Let us see.

Just started buying LEAP QQQ 320 puts Mar 2024 expiry ( I May sell ahead not having any plan to wait long ). If market goes up, I May DCA that puts.