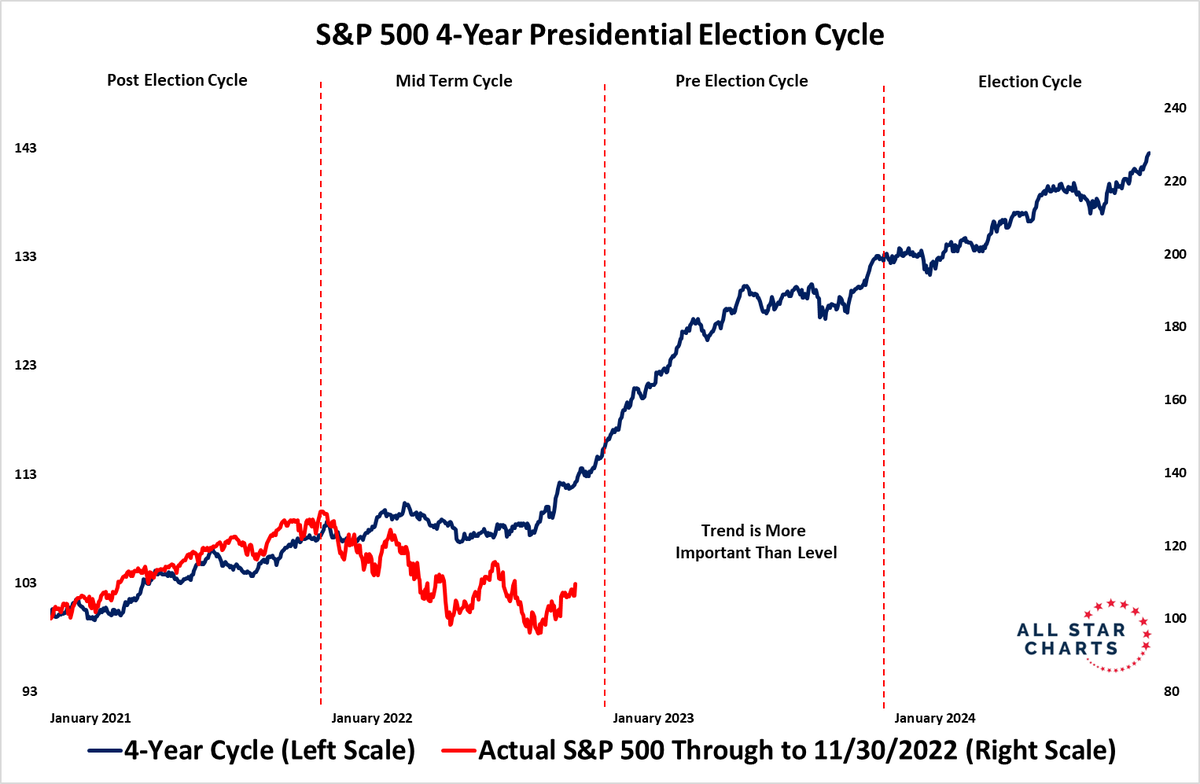

Year 3 of the presidential cycle is usually good for the market.

If Presidential cycle is true, always 3 years bull follow by 1 year bear.

S N A F U * * * * * O N L Y

All I understand from the market actions, it is heading for some kind of explosion soon. To hide everything, it is trying to keep it at peak now.

This market is not trustworthy now and this is not a bull market. We will witness the explosion in 15 to 120 days’ timeframe.

Nothing guaranteed as no one knows about future.

I receive all the analyst coverage that the IR team summarizes. The consensus is SaaS companies will struggled to grow revenue in 2023. The headwinds are:

-

Customers aren’t adding more seats due to slowed hiring or layoffs. New seats at existing customers are the #1 revenue driver.

-

Customers are pushing out new purchases unless they are a consolidation play to eliminate other software tools. This means single-function tools are in the crosshairs for elimination.

-

Software that provides automation to replace people is increasing in priority.

The IB community is realizing the long-term growth projections were total BS. A lot of markets aren’t big enough to maintain the growth for as long as the models suggested. That crushes the valuation. Now they are prioritizing free-cash-flow over growth rate.

Traders like @Jil continues to trade.

Investors have a beer and watch the show for a few more months.

Market is full of pessimism.

The earning recession is coming

Fed would only pivot in 2024

Russia is going to nuke Ukraine

China would invade Taiwan

World is entering into a global recession

The VIX is very low though, so we aren’t seeing large amounts of put buying. We usually get a good VIX spike with this much pessimism. We’ve ready had non-stop pessimism since Feb or Mar though. At some point, people will just be tired and move on.

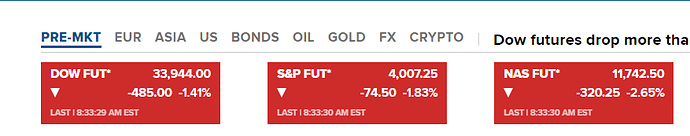

I filled 40% so far, 10% by end of day and rest another 25% tomorrow. This is tax loss harvesting year-end sale.

My partner & I are debating whether today is bottom or tomorrow is bottom. We do not know.

What about SOXL? Anyone buying?

Tax loss harvesting or window dressing? Hedge funds sell losers so it won’t appear in the book when the book close.

Purchased SMH, QQQ, SOXL, TQQQ etc. watch out tomorrow morning may have additional panic selling first one or two hours.

Next week (Tuesday) is when you may see some green. Just a blind guess

Correct, you will see green from Tuesday onwards for all stocks.

Going back to 2017, I made such wild guess. It came true. Now, I can confidently say current Market sell off ends either today or max tomorrow morning (not even evening).

Then I thought something my mind calculates, based on some reasoning, why cannot I program it?

At the same time, few members here questioned me “How do you say market turns up and down, do you have crystal ball?”

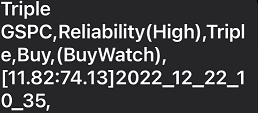

On Dec 24th night 2017, I started programming and completed first cut after 18 hours. This was primitive, but showed me market topped Jan 26, 2018 and bottomed Dec 24, 2018 exactly like this scenario we have now.

Again, on Dec 25, 2018, I spent whole time revamping the code, found that night market bottomed previous day. It was 19.5% market down.

Next day, I purchased bulk. There after every recession/correction cycle, top and bottom, I am able to find it.

When I have such edge, I will not be continuing the trading mainly.

.

Billionaire in the making. Please share your signal after you become a billionaire. I also want to be in the billionaire club.

Ha ha ha ! That signals are known to me only. This signal came at 11:35 AM PST and market recovered from then onwards.

Even my partner asks me to explain every day. Without my translation, it does not give any edge!

Hear this true story: One my friends, knowing this algo trigger, came behind me, ready to share 20% of his profit. Even though I denied many times, he was insisting me to share. Finally, I gave up but with few conditions

- He should not ask me about my personal buys/sells

- He should not ask me to rescue from any loss

- He should not ask me how much to invest and what to buy/sell

If that happens, I will stop the signals as I need to step in for him!

This means he is on his own, and I am not the decision maker of his position.

Trained him 10 days and then left his own decision.

Then I told him to try these signals, if comfortable then we can discuss, gave him 90 days’ time frame.

He got such signals regularly. As soon as this trigger comes, he used to buy $10k worth of stocks, sell it profitably.

He made it 7 times, but 8th time he purchased 200k, next day market went down like today, he saw 20k loss in his account! He was stunned/confused, finally came to me to rescue him.

Then I said it is going against agreement, he agreed not to use the signals and accepted me cancelling my signals.

I gave him two options, either hold or DCA and sell when he is profitable. He did not accept that advice, sold all his stocks taking loss.

His unfortunate time, all the stocks went up after he sold, and market (S&P) went up 15%. He would have made $100k instead lost $20k. Nowadays, he is not even calling me…!

The day he got signal was Mar 11, 2022, the day he sold was Mar 12, 2022. Market zoomed 15% after that.

Do you still want to use my signals?

BTW: I am always giving future is unpredictable and my signals are unreliable (can be broken any time).

.

After you become a billionaire ![]()