Silly and Ignorance…Ignorance…No intention to go endless, good bye.

Goodbye… and you can throw away your algorithm because it obviously failed to predict.

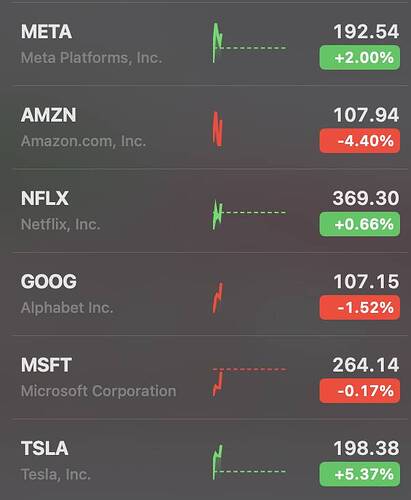

Sold my dogs in December for tax reasons. But kept Meta. Should have put it all there. Bought some Airbnb … done very well.

.

My avg purchase price is $160s, so I am still in the red. 200 shares.

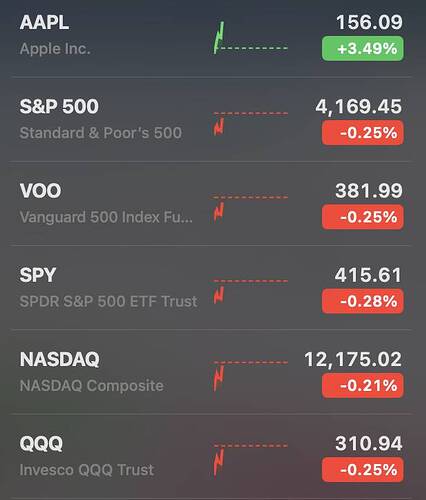

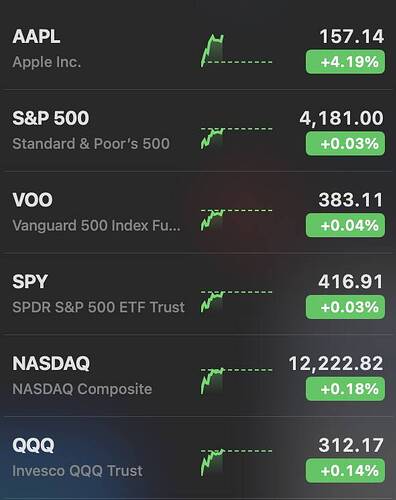

AAPL and TSLA carry the market up ![]()

Bought at 120 in September?and 87 in December. Always been a fan. It started at 150 unless you were an insider then went to 220?.

Still has legs. Especially in the roaring 20s

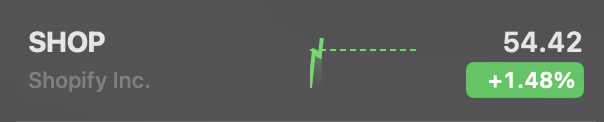

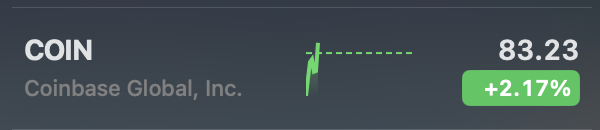

Focus is not in ABNB. My focus is metaverse and related stocks SHOP and COIN (metaverse will have tons of virtual commerce) NVDA (metaverse needs GPU AI Datacentre). My top four (in $ invested):

SHOP

NVDA

RBLX

COIN

I almost sell many other stocks to plough into META… hesitate because can’t decide which stocks to let go… sentimental ![]() All this stocks are in the speculative growth stock portfolio which I have limited budget… don’t want to add new cash (reserved for buying rental SFHs). I enforce strict discipline in asset allocation

All this stocks are in the speculative growth stock portfolio which I have limited budget… don’t want to add new cash (reserved for buying rental SFHs). I enforce strict discipline in asset allocation ![]() YTD 60+% for growth, 20+% for AAPL, 9% for S&P, 10+% for NW, negative for RE.

YTD 60+% for growth, 20+% for AAPL, 9% for S&P, 10+% for NW, negative for RE.

I’m sure a lot of AWS customers are now hyper focused on cost optimizations to improve margins. It means they are finding ways to spend less with AWS.

.

I heard exiting cost from AWS is very high. If they still exit, very bad for AMZN.

We definitely want to reduce our Redshift spend. Databricks may end up getting some of those $.

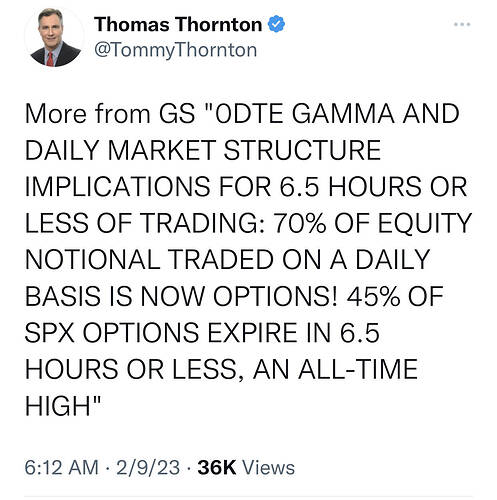

I saw that tweet. TLDR. People can’t write idea in a few words or one sentence.

People say retail is driving the rally. But according to their own data, retail only accounts for 23% of trading volume. Why aren’t they calling institutions, that account for 77% of volume, driving the rally?

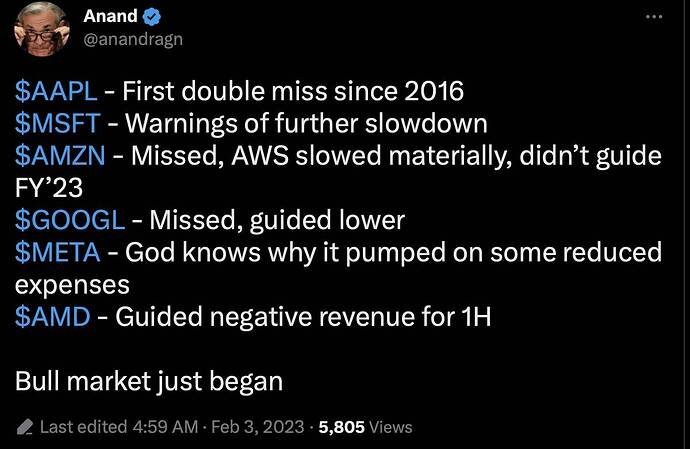

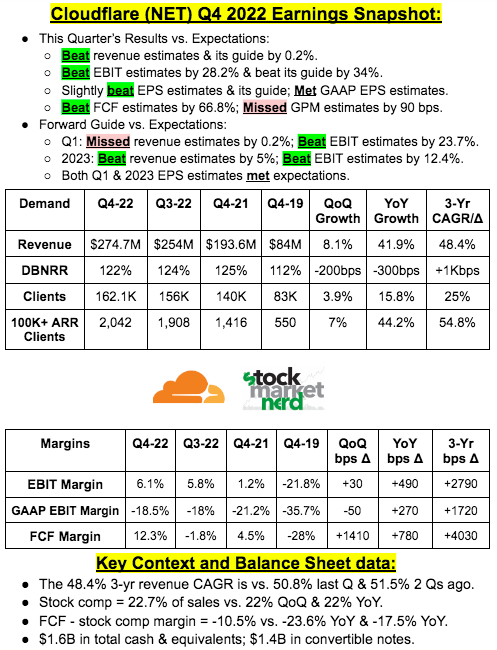

Great summary:

Market Offsides . Heading into the year, the market was positioned quite bearishly. From the S&P to software, consensus was 2023 estimates were too high, and set to fall meaningfully. Exposures were low. Not much software was owned. But what’s happened since? There’s a real chance the fed funds rate isn’t going >5%, and a soft landing or delayed recession is certainly possible (maybe even being priced in). Let’s imagine a world where we don’t have a recession in 2023. We started to see software optimizations and cutting starting more in earnest in Q3 ’22. How long will these optimizations take? More than a year? Doubtful. What I’m saying is at some point all the cutting / optimizations will have worked their way through the system, and that point it probably Q2 this year or sooner. Then – in the scenario I’m talking about where we don’t have a recession in 2023, the setup for software in the back half of ’23 actually looks great (but to be clear, I do expect Q1’s to be suspect / not great). Rates are not going higher than feared, earnings are not falling off a cliff (there is clearly softness everywhere but nothing catastrophic), and fed is more confident in a soft landing. In this scenario we could see software fundamentals accelerating in H2 ’23 with a Fed that’s no longer going against you. Quite the nice setup… And it’s becoming increasingly possible. If the market thinks the setup for H2 is great, it won’t wait until H2 to “price it in.” Market will move ahead of this, which is what we’re seeing now. The tricky part mentally is knowing fundamentals in Q1 won’t be great, but looking past that the H2 seems to be the market consensus. At the start of the year the consensus was bearish on rates + fundamentals, and so far neither of those bearish scenarios has played out. As a result, 2 things have happened. Folks positioned bearishly have missed this rally to start the year. The Nasdaq is up 17% (!) YTD. That’s insane for only 1 month! If you missed it, you can’t afford to miss the next leg and we’ll see a lot of chasing. As a result, we’ve seen a lot of people moving to add back some software exposure given the setup for software in H2 I discussed. This has only pushed the market higher.

…cont:

Net net - at the beginning of the year positioning was super bearish. The consensus view was soft landing not possible, recession coming sooner than later, and software fundamentals are about to fall off a cliff with ‘23 estimates way too high. So far the Fed has gotten more dovish, signaled a soft landing is possible, and earnings and guidance (while weak for sure across the board), haven’t been catastrophic at all. Consensus (or what’s being priced in) has gone soft landing not possible to soft landing now somewhat possible (but still lower odds). This is catching the market way off guard. In the soft landing scenario the setup for software in the back half of the year could be amazing (as described above). So even if you entered the year super bearish, you maybe went from thinking 0% chance of a soft landing to 15% chance of a soft landing. And now need to adjust exposures accordingly (ie add software exposure to account for this). At the same time, starting the year bearish means you probably missed the huge rally to start the year. So if the soft landing scenario does play out, we could have a lot more room to run. And if you missed the first leg of the rally, you can’t afford to miss the next leg. All of this to say - impossible to know if soft landing or recession is coming. But this rally has got a lot of people offsides who are now trying to get back onside, and its pushing the market in the direction of most pain which is up (because people weren’t position to capture value with market moving up)

Ties back to the top post on this thread. FOMO is on. Institutions need to play catch up. Missing the rally is an fireable offense.

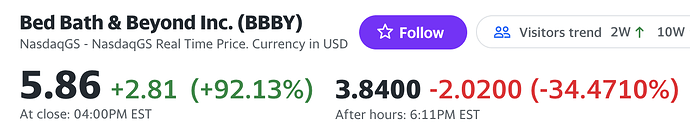

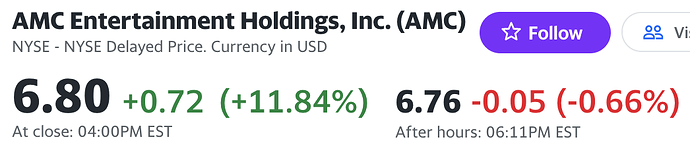

Not a good sign meme stocks like Bed Bath & Beyond and AMC are back in the news. This correction may have more room to go down than I expected.

Yo-yo