Dear comrade Jack Ma.

I know you are smarter than the trumpeters. ![]()

Actually that’s a bullshit statement from Jack Ma. He should’ve said “we’ll thrive in face of adversity”.

Did you talk to these guys?

http://www.chinadaily.com.cn/china/images/attachement/jpg/site1/20170628/b083fe955fd61abd937019.jpg

They betrayed their race…

Somo wrestlers?

Hmm, China is cutting business taxes to stimulate economic growth.

Also, they are cutting bank reserve requirements to increase lending to stimulate growth.

Wow, lower taxes and increase lending to growth the economy.

Different stages of development and business cycles implies different economic policies. Are you saying American economy is as weak as China’s? Trump wouldn’t agree with that.

People should not have any sex when they are 13. They can have as much as they want at age 30.

Even after cutting China’s tax is still much higher than America’s. They should cut even more.

There are two ways to see.

-

Making weak economy into strong

-

Making Strong economy Great again (Make America Great Again) ==> Trump way

Which period was America the greatest?

1880s-2010s.

1880s: America eclipsed China to become the world’s #1 economy

2010s: China took it back from America

That’s completely irrelevant…

Tax cuts = growth

Increased lending = growth

It doesn’t matter which stage of development. Those 2 actions cause growth.

Tax cuts always equal growth? With no limit? How about zero taxes?

Since when are conservatives so gung-ho on deficits and debt? 2017?

I’m sure you’d have even faster growth with no taxes. The US didn’t even have income tax until 1913. The US became the largest economy in the world around 1900.

8% spending growth is the problem. Most of that is mandatory entitlements. I’ve posted all the spending as a percent of gdp graphs. Military spending is actually lower than historical average. It’s entitlement spending that’s sky rocketed.

People complain about the rich not paying taxes. The tax base used to be much flatter with more people paying income tax.

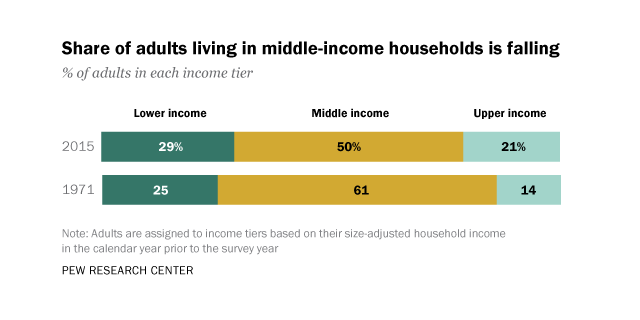

Meanwhile more peoole are moving up and out of middle class. So how is it we have more people doing better, still have a huge middle class, but far fewer people are paying income taxes?

Why so fixated on income tax? Even a person below proverty line pays sales tax and payroll tax.

Government spending doesn’t just disappear into the vacuum. It buys goods from private companies, pays wages and benefits for tens of millions. In other words it goes back to the economy.

Too high a tax burden suffocates private enterprise. Too low just means underinvestment in welfare and infrastructure. I have never seen any credible theory saying lower tax is always better. That implies anarchy. There is a certain Goldilocks level.

“Was” must be changed to “Will be” !

Trump second term will be the greatest !! Trump President, House and senate just majority for Dems.

Entire 4 years government Shutdown ![]()

![]()

![]()

Well, can you stop eating for 4 years? ![]()

Corporate tax cut is a great move in the long term, I’m glad it could get done.

We should cut income tax as well, it’s too high.

On the other hand, sales tax should be increased to avoid consumption waste. There are too much waste due to absurdly low consumer prices.

I think the best environmental policy we could have is to increase sales tax to reduce waste. We can repeal property tax and replace it with sales tax. The impact of property tax and sales tax is the same to consumers since housing and consumption are both evenly burdened to everyone, it can help people to balance their personal needs with the earth and the air. I think it’s more important for people to pay more for wasteful consumption and pay less for housing. Property tax makes housing too expensive and pushes marginal population into homeless and increases government burden.

Property tax makes housing too expensive. Period.

.

Is your original thought or you have read some academic paper or articles?

Intuitively I feel property tax dampens property prices.

Start being an intellectual instead of uneducated layman. Being an economist, being a pro instead of an amateur.

Housing cost is the aggregate spending of all population on their housing. Market price of for sale houses is a tiny portion of the housing price. That’s the first argument.

For all the 300M Americans, the most important of the housing cost is property tax, mortgage interest payment and rent payment. I guess that these 3 are roughly 33% each. If we repeal property tax, housing cost should immediately go down 33%. Over time, zero property tax would stimulate new home building and new rental building. People would buy more houses or rentals instead of eating too much to be fat, or buying seeds to get high, or buying useless jewekry to be pretty, or buying gadgets to be indulgent. This would cause the market price and market rent to reduce even more.

What I said is common sense in economics. I’m frustrated at the widespread ignorance of housing economics even among the college educated. Houses are not strawberries. You don’t buy a house every night to live. You buy strawberries to eat since it does not last 100 years, not even a week.