There is a wealth of information and years of cumulative learning in this forum that is buried under several topics. Lets organize all that into single thread.

Hedging strategies from @marcus335

These aren’t ranked in order of preference:

Buy puts. I’m not a huge fan since your timing has to be really good. If you’re regularly buying then, you’ll offset most of your gains.

Sell OTM covered calls to finance buying puts. This gives you a range of max profit and max loss for the given time window.

Sell OTM covered calls to create yield and that gain can offset future drops. The risk is having to sell and the stick keeps going up. There are always pullbacks to rebuy though if you’re patient.

Set a technical indicator as a stop to limit your downside from the high. Let’s face it. None of us are going to exactly time the highs and lows. This removes the emotion.

Buy puts in the weaker competition. In theory, the company you own should be doing well at the expense of competitors. If it’s an economic or industry cause of stock decline, then weaker companies competitors should decline even more. That gives you more insurance for less.

I honestly think diversification is hard unless you have a ton of time to dedicate to it. My goal is to own a max of 5 stocks and work positions around them. That makes up about 80%. The other 20% I do technical based options trading. Right now, I size call positions 2x as big as puts and try to have 2x as many call trades as puts. That makes me net 80% long. I prefer options with 3x leverage so that’s more like 240% long and a 60% hedge.

Option Stragies from @hanera

KISS. Long calls for uptrend, long puts for downtrend. Fast open and close. Other types of option position tends to be a little hard to get in and out with the price you like.

Aggressive goes for weekly and near-month.

Conservative goes for far-month and LEAPS (is a cool replacement for underlying). I have a buy n hold mindset so I bought mostly LEAPS calls.

If implied volatility is too high like 40%+, better to go for underlying directly.

Do your trading platform has paper trading? Think and Swim of Ameritrade has paper trading where you can practice trading.

From @hanera

When a stock is near an impending correction using TA, you have pundits talk bearish about the business and its stock. The given reasons don’t matter  what matters is the timing

what matters is the timing  After the declining have started, if it didn’t meet their clients’ target, more bearish news would be thrown out. Pump n dump. Dump n pump. They would use FA or TA or both as reasons but those are just for putting a persuasive story.

After the declining have started, if it didn’t meet their clients’ target, more bearish news would be thrown out. Pump n dump. Dump n pump. They would use FA or TA or both as reasons but those are just for putting a persuasive story.

Time to Short Apple, Says Rupal Bhansali. Yes, Short Apple.

Short Apple stock because the company is “disadvantaged on many fronts and trying to play catch-up,” says Rupal Bhansali, chief investment officer, international & global equities at Ariel Investments.

I have question about dividing the investable capital into various class. What will be a right balance.

like buy and hold types (slow growers)

Growth types (fast movers)

options etc

Honestly, unless you’re within 5-10 years of retirement then focus on growth. Once you’re that close then I’d put 10 years worth of money in income producing investments. At current interest rates, I wouldn’t touch bonds. Dividend aristocrat stocks yield more and never reduced their dividend even in the Great Recession. Who cares if the principal value varies as long as you keep receiving the dividend income?

Asset allocation? Rental & stock equities. Like @marcus335, don’t like bonds.

Stock portfolio? Index fund, dividend paying, growth, trading (fast movers + options).

Frankly don’t use % to allocate nor think in terms of right balance so don’t do re-balancing as suggested by textbooks and pundits. I am not a textbook guy… you should know by now. I invest based on intent.

Index fund: Intent is to be inherited and serve as a replacement for life insurance. DCA purchasing, still doing.

Dividend-paying: Intent is to create a passive income for retirement in 20 years. Bought a bunch of stocks (mostly consumer staples/utitlities) for a few years, stopped building after AAPL started giving dividends, liquidated most of them.

Growth: Intent is to grow wealth  , about 10% of net worth then, bought a bunch of stocks (many no longer exist), after 2000 dotcom crash, move all to AAPLs. After 2012, AAPL is the growth, buy n hold and dividend-paying stock.

, about 10% of net worth then, bought a bunch of stocks (many no longer exist), after 2000 dotcom crash, move all to AAPLs. After 2012, AAPL is the growth, buy n hold and dividend-paying stock.

Trading: Intent is to entertain myself, flip-flop with playing video games. So on and off, no consistency and don’t gamble big. Open an account and pump in $ amount to about 2% of net worth then. Strictly won’t add if lost all the $$$.

which platform do you use for option trading ? When I traded a long ago, I used option house (sold to etrade since then) because it was the cheapest and I only had to enter trades, did not have to do my own analysis.

I see you miss a dozen of my posts.

ThinkorSwim, now belong to TD AmeriTrade which will be bought by Charles Schwab.

A little on Tom Sosnoff, founder of ToS. He talked a bit on options trading.

Cross posted

Did I say owning a stock is a speculation?

Anything (even the safest asset) can be speculation or an investment depending upon the understanding of two things:

- Safety of Principal

- Rewards/Risk Ratio

Speculating or investment is not the character of an asset but of the thinking that goes behind the money paid in to acquire that asset.

For example, if 9/10 startups fail, can investing in a startup be a speculation? But, it can also be rewarding. Can it be investing then?

What about the options? What about the penny stocks? What about the junk bonds?

Position sizing is important in situations like these. The amount and possibility of risk (loss) vs the amount and possibility of the gain.

crossposting

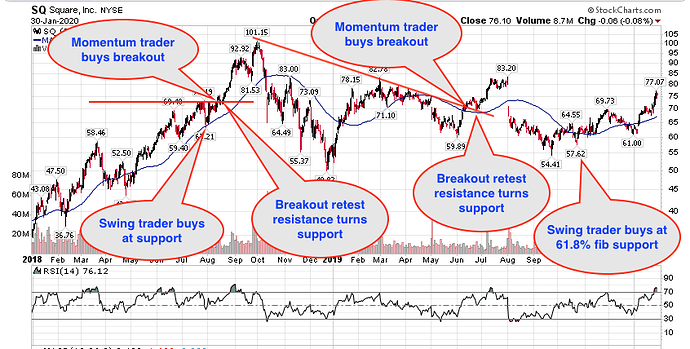

explanation of chart above

cp

How do you distinguish between a successful break out and a failed breakout?

How much time should one wait for a breakout to be successful? When to abandon a position if the price moves out of the triangle and then shows no action, or actually returns to the triangle?

Momentum trader buys the breakout.

Swing trader buys at support.

You should read the book recommended by @marcus335 since the active stock traders here are mostly swing to position traders. You are asking a momentum trader’s question.

Anyhoo, breakout tends to retest previous resistance. It is why there is a need to place a sell stop just below the previous resistance in case it fails, the resistance should act as a support for a true breakout. I doubt there is a foolproof way to determine whether it is a true breakout or not, only rules to defend your ass. May be the book got some tip on this.

Btw, currently delta* for my SQ position is about 300, reduce from 1000 as it approaches the resistance, err on the safe side ![]()

*Delta is kind of equivalent number of shares, one of the GREEK of options.

Thanks for the answer but I got more confused between swing , momentum, and position trading. I do not know what kind of trader I am. Which book are you referring to? Hope it is an easy read. Not too much of maths and stats.

Thanks a lot. This explains very well.

So to summarize

A momentum trader buys when the breakout is confirmed (price is above 3% resistance line) while the swing traders buys at the support (like in this case looks like 50 days SMA line). Correct?

That was about making an entry. How do you plan to exit? When to sell?

It’s a service not a book. I learned a ton about trading options. Books usually cover theory, pricing models, and are academic in nature. They don’t cover how to actually make trades.

See @marcus335’s comment below. You’re supposed to develop your own trading strategy ![]()

Anyhoo, common exit points are when stock declines below 9-11 days SMA (@marcus335 said he preferred 10-day SMA), use trailing sell stops/ conditional sells (refer to your trading platform), a fixed % gain or decline or a fixed dollar amount. Depends on your aggressive profile ![]()