I don’t see corporate lawyers during my daily life. However, lately out of several corporate counsels I saw in person, 60% are African Americans. Not sure whether it was coincidence or whether they tend to send African American lawyers to meetings, it seems a dominance in my personal perception. However, I don’t have statistical data. Do you?

By this time next year, Uber and Lyft passengers in San Francisco will be paying a new surcharge on every trip if voters approve a deal cut in a North Beach restaurant by Supervisor Aaron Peskin and representatives of the ride-hail giants.

The goal is to raise $30 million a year to deal with traffic congestion, brought on in large part by the ride services themselves.

Can ride sharing ever be profitable?

Hopefully the monetization scheme is not selling your privacy

How can you become billionaire if you never bought IPO’s?

Buying IPO does not necessarily make anyone millionaire or billionaire !

Basic principle is not to buy hype, but buy companies/stock after calculating its worth/value. Like we have appraisal to a home, we need to derive worth/value of a company and buy when you are comfortable. Broker’s will have some reports, prospectus, income/expense statement, read, understand and then buy it.

If we do not do it, sure we choose the path of bankruptcy, be it IPO or after IPO.

Profile of subscribers? 90% Millennials? 90% work in IT? 90% work in Uber, Didi?

Maybe oversubscribed by Uber employees…

Lyft is losing a lot of money. And it might not turn a sizable profit until 2023

The No. 2 US ridesharing service lost nearly $1 billion in 2018. Lyft has lost money each year since its founding in 2012.

This type of business model works so long there are gamblers investors who would fund the business till it is profitable eventually. It is a bet on a distant future that might not happen.

That he shared the same view as me, have as much free time as possible and starting business is the only way to be a billionaire. His other views are rehashed of what WB said. One more thing, he is pretty dumb, has he poured all in to MSFT or AAPL during IPO, he is richer than now.

What did you learn from that billionaire optometrist?

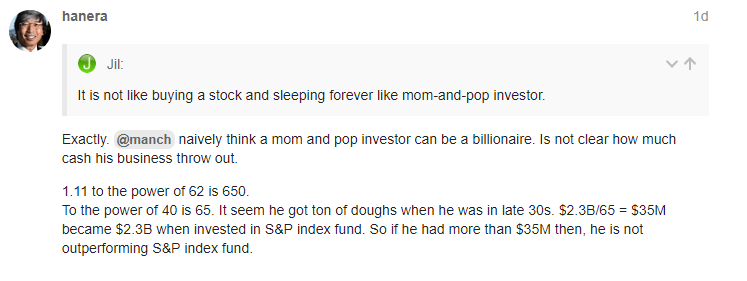

Do you agree with hanera’s assessment that optometrist track record was 11% growth year over year?

If you do not agree, what is the growth rate you calculate for optometrist ?

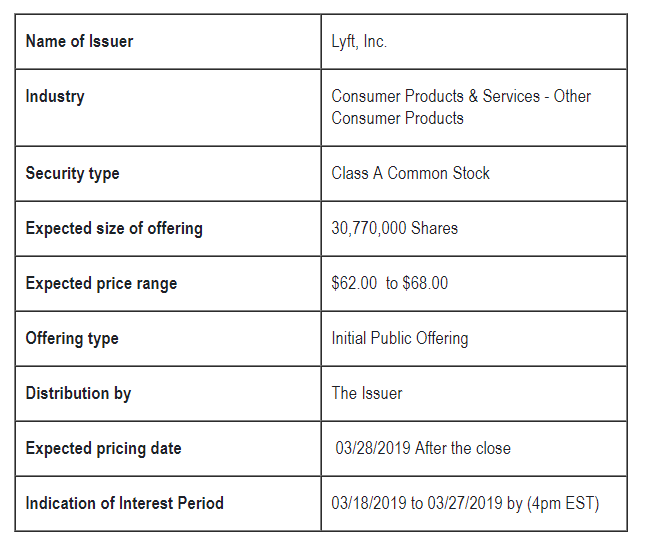

This is exactly I talked my friend about LYFT IPO today, sharing for information purpose.

-

In IPO, you need know the difference between real value and the hype.

-

Even SNAP was oversubscribed and Facebook was oversubscribed, both went down thereafter, but you see which one is successful now.

-

You need analyze whether you want to gift the company or the company has to give you everlasting gift as growth !

-

It is your money and you have decide which is better for you.

I asked him to read pages 19 to 34 of Margin of safety which explains conflict of interest of wallstreet, merchant banking and the ultimate investors who puts the money.

AAPL was overhyped into IPO too. Breakeven after 7 years!

Billionaire dude bought apple and Microsoft at IPO. If I remember right his holding is about 200M each. How is that 11% a year?