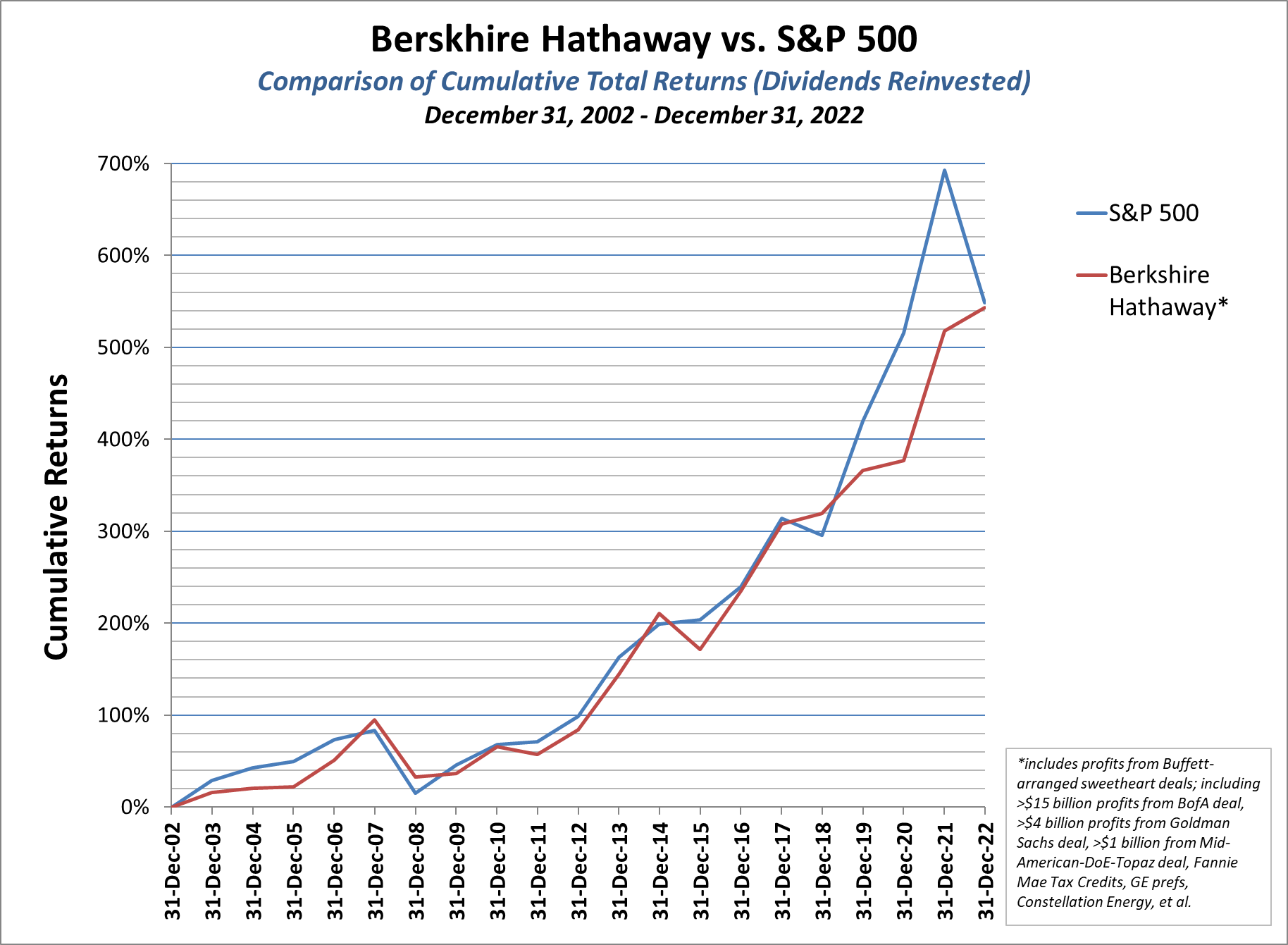

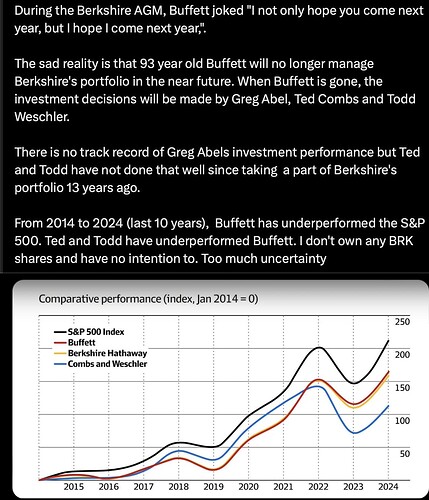

Buffett has NOT outperformed S&P in the last 20 years. His lifetime outperformance came from his earlier years, and he just kept pace with the market afterwards.

Now then you know? Told practically no strategy beat S&P return for 20+ years timeframe.

WB has been beating S&P up until he’s 65 years old or so. So he has been beating for over 30 years. Just not in the past 20 years.

The world has been increasingly dominated by tech. WB is too old to understand it. Like he famously didn’t invest in any of the high fliers like Google and Amazon.

.

So you believe what is spouted by the media.

Can you come up with other possible reasons?

For example, smaller size is easier to grow faster. I am not saying this is the reason, just thinking, can’t accept anything spout by media blindly.

I sense you think you understand tech well and hence could beat S&P for a 20+ years duration.

You should verify yourself. Choose a start date (can backdate) and verify that your portfolio’s return is higher than S&P over a 20+ years. ![]()

This is not correct reason.

My 2 cents;

This is the correct reason, big funds issue being a part of S&P.

SPY = a * AAPL+b * GOOGL+c * AMZN+d * BRK+e * TSLA…etc 500 stocks.

BRK = x1 * AAPL+x2 * AXP+x3 * KO…etc 365 companies.

a b c d e and x1, x2, x3 are some factors representing holding ratios.

If AAPL moves up, it moves BRK and as well as SPY. He has to invest in a company that is not a part of S&P and has to grow extremely fast rate. It is not easy for him to choose such a company as smaller companies are not stable.

Above all, BRK (AFAIK) P/E is appx 6 while S&P P/E is appx 21.

With this mathematical equation, he can beat S&P during recession or correction periods as S&P drastically corrects its P/E from 30 to 10 while BRK P/E is held.

This is the issue for many big funds, they can not beat market, - esp multi-billions level and they are forced to keep 25%-30% cash as they cannot trade, but only invest in good companies.

I just pointed out the fact that WB had been beating S&P for almost 40 years until 20 years ago, and then just kept pace but not overperformed the market for the last 20 years.

That much is basic fact. Anyone can just pull up Berkshire’s price chart and check.

Actually my main point is this. Many people cite Buffett and Munger to support their arguments. Like how @hanera said Munger bought crapload of BABA and so my criticism of Chinese stocks is invalid. But in fact they are not the genius investors anymore. Their performance has literally been fairly average for decades. The world has changed a lot and they are very old. So better do your own homework instead of relying on celebrities for tips.

Well in the case of BABA, to Munger’s credit, he did say recently it’s the worst mistake of his investing life. So they still can learn.

They are very conservative/defensive investors who do not like to loose their money by picking deep discounted stocks, hold for long term.

If there is a mistake, the revert back immediately like TSM.

They do not go over stock price, but they look for company income return and also do not pay for future growth using net present value formula (most of the growth stocks are like this).

Buffet started buying back BRK shares when he sees its P/E is too low and attractive than any other companies!

With their own conservative idea, still they lead in top 10 Mega Gaps.

.

So sensitive ![]() Geopolitics risk of investing in China is too high for ordinary American people… mainly delisting risk. Turnout the risk is about the same as investing in high growth SAAS/ cloud stocks in USA. Anyhoo, BABA business is doing ok.

Geopolitics risk of investing in China is too high for ordinary American people… mainly delisting risk. Turnout the risk is about the same as investing in high growth SAAS/ cloud stocks in USA. Anyhoo, BABA business is doing ok.

If you are staying in HK or SG with an HK account, ok to invest in China stocks.

Munger bought at too high prices. His mistake is he didn’t foresee the collapse of SAAS/ cloud stocks and go on 150% ie on margin ![]() He views BABA as a platform business not realizing it is in a retail space known for hyper competitive environment… low margin and low barrier to entry. Main mistake: on margin

He views BABA as a platform business not realizing it is in a retail space known for hyper competitive environment… low margin and low barrier to entry. Main mistake: on margin ![]()

Btw, you are again pivoting, got use to your tactics ![]()

See 130 Billions started working now.

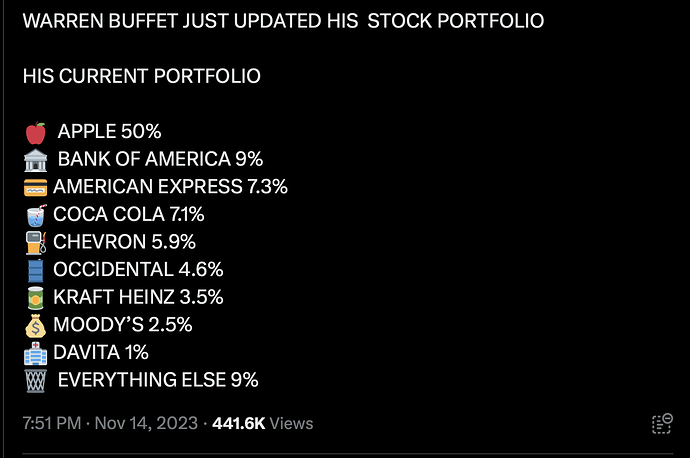

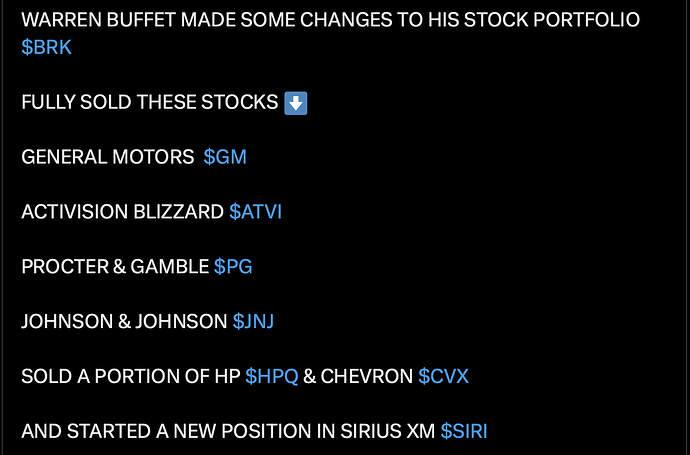

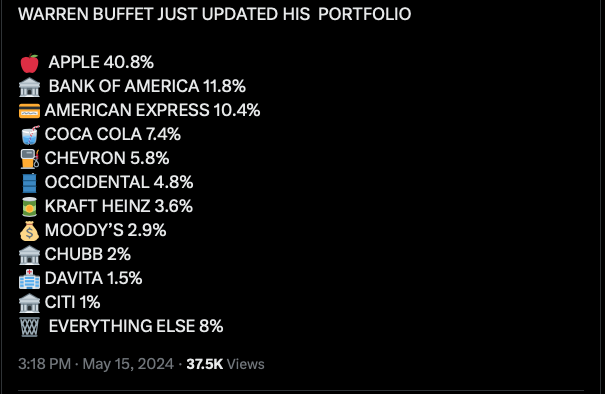

Obvious that WB willing be selling AAPL till end of the year. Just don’t know why. Geo politics concern? Impending recession? Preparation for successor?

WB can continue to unload 10% (in terms of portfolio size) AAPL per quarter, AAPL is still the largest holding.

Aug 3, 2024

To date has unloaded 50% of his holdings. Based on rumors so far, in addition to above reasons…

Good question.

AAPL and BAC have high liquidity. WB can unload a lot of stocks without crashing the prices of these two stocks. In fact, AAPL continues to rally by 20+% since he started selling. Even today, AAPL didn’t crash despite triple whammy (WB 50% sale, yen carry trade and potential retaliation by IRAN vs Israel).