Appreciation from 2011-2018 was heady stuff. Time for a pause. Market choppy in 2018. 2019-2029 who knows.

But the FED wants to kill the party. Don’t fight the FED.

Guess who just got hired to run Google’s cloud business?

Wow. That’s insane. Google is already struggling in the third spot. Why would they hire someone from the fifth or sixth spot?

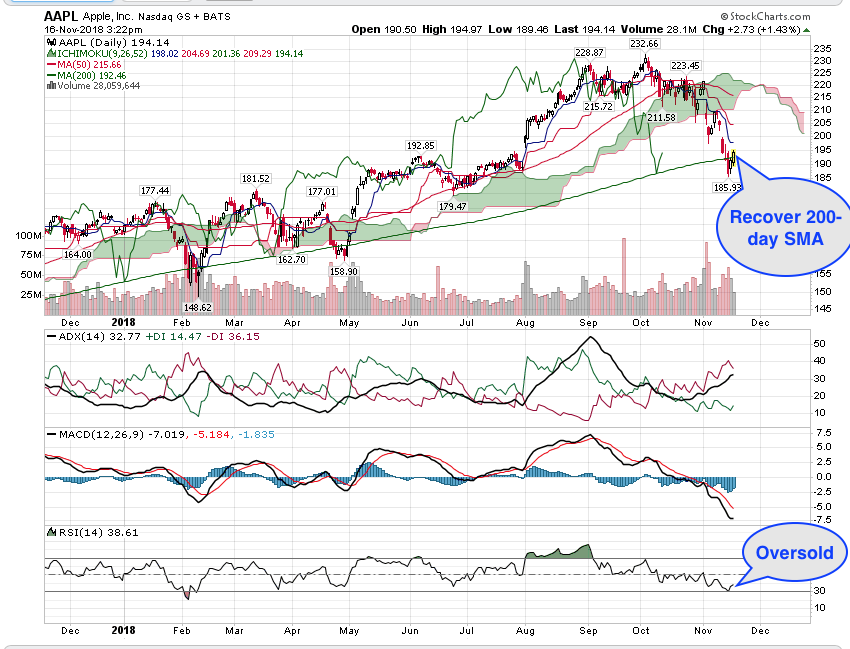

Watch AAPL. If AAPL recovers, S&P index would recover.

Is the recovery above 200-day SMA, a technical re-bounce or resumption of the bull trend?

Why JP Morgan’s top internet analyst expects breakout growth for Facebook and Amazon shares in 2019

Finally, some positive analysis for you…

manch,

Did you load up AMZN? I had sold down to 1  super duper share. Ditto for GOOG.

super duper share. Ditto for GOOG.

Time for me to build up again?

Wait until the trend is confirmed. No hurry.

The super wealthy are already out of the stock market.

However, they are positioning to weather the storm by putting money in real estate and private equity

Really. I don’t see how they could’ve become wealthy in the first place…

Any one read this?

After midterm and Democrats won the house, he is not able to push any new tariffs anyway. Saying it now make him sound reasonable. Anyhoo, just in time to ignite the Santa Claus rally. Congrats to those who has fully loaded.

Cliff notes. Other than RE, put your money in AMZN, AAPL, FB and BRK. I invested in all 4 ![]() . Time for manch to nibble some AAPL and BRK. Think I need to accelerate my investment in AMZN.

. Time for manch to nibble some AAPL and BRK. Think I need to accelerate my investment in AMZN.

First thing first, can employees of AMZN and FB tell their CEOs to stop talking noble acting evil. Walk the talk.

I am not super wealthy like you.

Dr. Evil is just living up to his name.

How you know?

FB, NFLX and GOOGL already crossed/crossing death cross, recovery doubtful with rate hikes, while AAPL, AMZN, BRK is fine (as of date)

Condition if GE is the biggest hit for US economy which has massive debt. If they are going towards bankruptcy, we will see ripple effect. GE debt load is appx equal to half of China Tariff amount.

Trump declared no further tariff. FED should not hike the rate. First time, Jerome Powell admitted the issue.

Hope he is not hiking any rate in Dec 2018. If they hike, IMO, we will be doomed towards bear market.

Do you know that most of the time when it is obvious to everybody it is a bear market, it is almost over? Looking at S&P chart from EW perspective, the index has started the flat corrective pattern since late Jan and should have completed its pattern around late Oct. So the new bullish impulse could have started.

True, with this bold highlighted expectation, I am fully into market positioning for growth. This is kind of buy low timing, esp when most of the stocks are below sma200. Everything likely change if FED adds rate hike. Even if they pass the rate hike this time, it may take around 9-12 months to get the peak.