I really don’t getting long energy. We’ve already proven the US can quickly add more capacity if prices increase. Then that drives the price back down. That’d would seem to indicate there’s a cap on prices, so profitability only improves if costs are lower.

Performance of Gundlach’s funds is pretty lackluster. Why do we need to hear his ideas? I’d rather listen to @wuqijun’s.

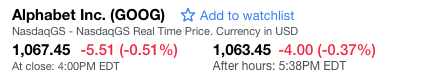

Google will rock our world today, either way.

Big beat from google.

ATH is close to $1200… big beat is still $1085. Anyhoo, I own 2 shares ![]() and plenty more in S&P index fund.

and plenty more in S&P index fund.

Google is increasing investment. In other words @tomato is making too much and sinking GOOG stock.

Their CPC is down too. People are paying less for Google ads which is the opposite of Facebook who’s getting more money per ad. This could be the destruction of Google’s business model as companies are starting to value Facebook ads more than Google ads.

You are underestimating a bunch of things. There are factors not activated that keeps cpc lower than what it is. It is intentional, but over time they might be get relaxed. Also fb fills only higher quality demand - it does not fill a bunch of impressions intentionally.

Last purchase of GOOG is $1000. Need at least 3% drop, so wake me up when it is trading at less than $970.

“Google properties, like search and YouTube, saw paid clicks (how many times people clicked its ads) increase 8 percent quarter-over-quarter while cost-per-click, or how much it can charge for its ads, decreased 7 percent quarter-over-quarter (with a 59 percent increase and a 19 percent decrease year-over-year, respectively). Properties revenues were nearly $22 billion.”

8% growth in clicks but 7% decline in CPC. That’s not great qtr-qtr.

Cost per click might not be as important anymore if Google is increasing revenue based on ad placement (like traditional media).

First Quarter 2018 Operational and Other Financial Highlights

Daily active users (DAUs) – DAUs were 1.45 billion on average for March 2018, an increase of 13% year-over-year.

Monthly active users (MAUs) – MAUs were 2.20 billion as of March 31, 2018, an increase of 13% year-over-year.

Mobile advertising revenue – Mobile advertising revenue represented approximately 91% of advertising revenue for the first quarter of 2018, up from approximately 85% of advertising revenue in the first quarter of 2017.

Capital expenditures – Capital expenditures for the first quarter of 2018 were $2.81 billion.

Cash and cash equivalents and marketable securities – Cash and cash equivalents and marketable securities were $43.96 billion at the end of the first quarter of 2018.

Headcount – Headcount was 27,742 as of March 31, 2018, an increase of 48% year-over-year.

In April 2018, we increased the amount authorized under our share repurchase program by an additional $9.0 billion. Our board of directors originally authorized repurchases of up to $6.0 billion of our Class A common stock under the repurchase program, and this increase is incremental to the original authorization.

Ridiculous earnings. Unreal. Ad revenues grew by half to $11.795B from a year-ago $7.857B

IG is the new Facebook and they are barely scratching the monetization surface. WhatsApp and FB messenger dont produce any meaningful rev yet.

I don’t get how people so underestimate the obvious potential of Facebook. It’s as plain as daylight.

yeahhhh babby!!!

People who bought during the weakness… congratulations!

Now, the stock I’m hoping heads to $200 in 6 months(i.e. 10/190=5%) above their highs

Huh? Are all of them in SV?

Within 2 - 10 miles of my Primary ![]()

…

No, they’re hiring in Seattle, Chicago, NY too but majority SV.

Not in Austin?