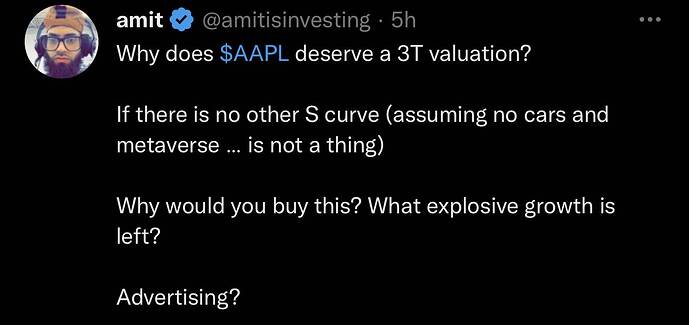

Security analysis 101. Amit is drowned by those high growth talks and EM hyped S curves. AAPL has plenty of S curves hidden in plain sight. Apple doesn’t hype them, just patiently executes, make huge FCF.

According to Nikkei Asia, the tech behemoth has reduced orders from suppliers for almost all of its products.

Any difference from the usual post-holiday Q2 production cut?

Either AAPL has bottomed or would bottom around Feb 5 (earning).

From here, anytime above $133 means in a new bull market.

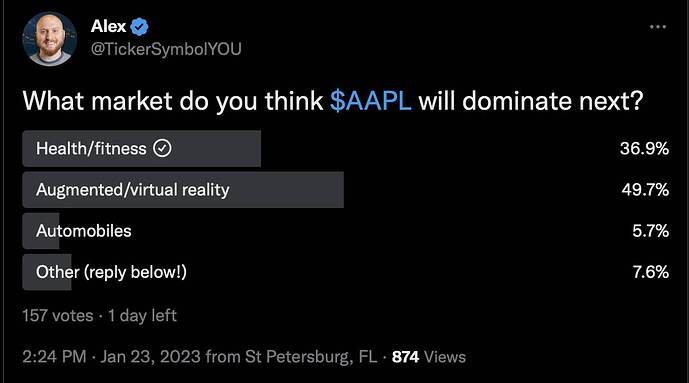

Apple entry into a market usually mark the start of the early majority phase.

Article may have misquoted Kuo. Thought the first product is a VR headset. Then follow by an AR glasses a few years later.

Closed $133.49, now have to see what he will tweet.

Tim Cook ![]()

EM ![]()

…Apple recently hit $1 billion in AirTag sales.

So much, no wonder Google wants in.

Another Elliottician also think AAPL has completed a Cycle degree wave IV (double zigzag).

Using Korinek’s naming convention…

Wave (i) might have completed, now in wave (ii)… likely 61.8% ie $130.

The full label is Wave ((5)).(1).1.(ii)… my convention is V.1.i.(2) ![]()