AirPods ![]()

Knox is assessing where would wave ii be.

Ofc, AAPL has not achieved the higher high higher low criteria… essentially in wave iii ![]() EWspeak… complete wave ii, then go higher than wave i, to confirm is in wave iii.

EWspeak… complete wave ii, then go higher than wave i, to confirm is in wave iii.

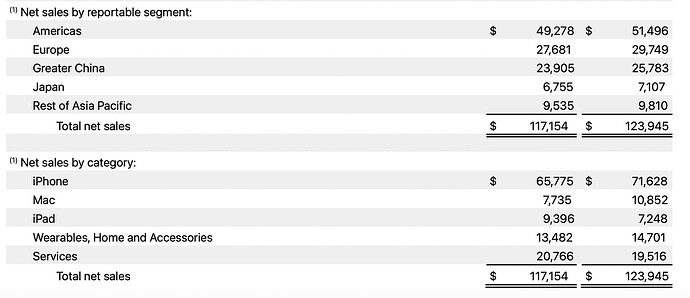

Earnings is widely expected to be down because of Covid lockdowns. Favorable comparison for next year yoy Q1 comparison.

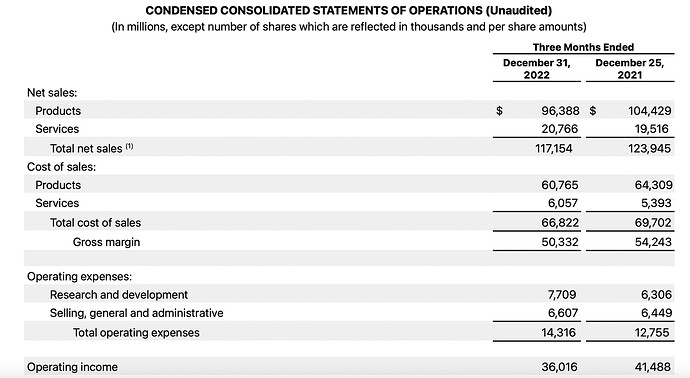

Apple’s overall sales for the holiday quarter were about 5% lower than last year’s, the first year-over-year sales decline since 2019.

Apple CEO Tim Cook said three factors impacted the results: A strong dollar, production issues in China affecting the iPhone 14 Pro and iPhone 14 Pro Max, and the overall macroeconomic environment.

USD has been weakening

Cook said that production is now back to levels Apple is comfortable with ![]()

“We’re also recognizing the environment that we’re in is tough. And so we’re cutting costs. We’re cutting hiring, we’re being very prudent and deliberate on people that we hire,” Cook said. ![]()

Cost control in cost centers. Continued investing in R&D.

Good for services

Going forward ![]()

Is it in wave ii (or in wave iii)? Target?

23.6% retracement = $144.80 (min retracement for a wave two)

38.2% retracement = $140.86

50.0% retracement = $137.68

61.8% retracement = $134.49

Blue label count = Bullish count

Red label count = Bearish count

As a buy n hold (hopefully forever) investor, regardless of which one is the correct count, just do nothing, no hedging, no margin, no selling of covered calls, nada… sit.

Please read Cook’s comment.

That is, unit sale has increased. It is the dollar sale that has decreased because of strong USD. Moreover, couldn’t fulfill demand of iPhone 14 Pro and Pro Max because China factory was shutdown during Covid lockdowns. That is, without shutdown, unit sale should be more.

For more details,

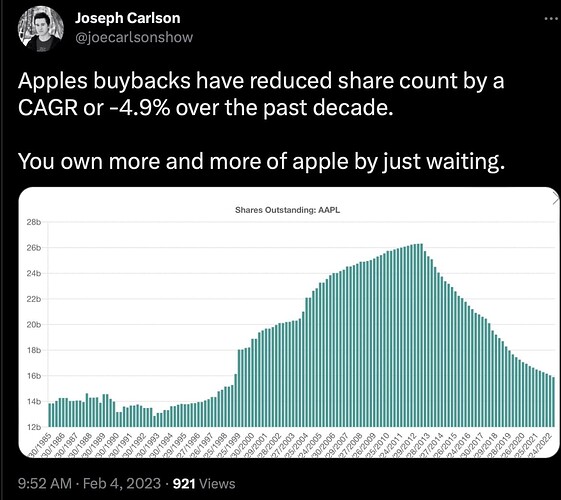

Would Apple keep buying back to reduce share count?

Is there a share count that Apple want to reduce to? 14b?

Power of financial engineering. Key reason why Apple stock keeps going up while its products stagnate.

Apple doesn’t have a place to put its cash to work. Its cars are nowhere near ready. Apple glasses seem to be a year or two out, and probably doesn’t take that much cash to ramp. I think Tim Apple will keep buying back stock.

.

I understand what you’re saying. I am wondering whether there are not so obvious reason for doing that.

When late SJ return to Apple, in order to keep employees working hard and not leave, Apple issues tons of EOs that dilute shareholders ownership a lot… from 14+b in 1997 to 26+b in 2012. Since the share buyback started, outstanding shares has reduced to ~16b… will Apple stop buyback at 14b or continue to buy back to reach ‘zero cash’?

Apple generates an insane amount of cash. Every year, they are generating over $100B of cash flow from operations. There’s <100 companies in the entire world who generate that much revenue. There are just over 100 companies who have a market cap higher than Apple’s annual cash flow. In other words, every year Apple generates enough cash flow to buy any other company in the world except ~100 of them.

.

I presume you are saying Apple would not stop at 14b and would keep buying back share.

I don’t see any reason why 14B share count is some sacred number. Tim Apple probably will keep going lower. The only project that takes a lot of cash to ramp is probably the Apple car. But it’s still really far off if it ever materializes.

Oh, forgot there is a new 1% buyback tax starting this year. Not sure what the impact will be.

I think they’ll keep doing buybacks. It makes sense with how much cash flow they have. There’s literally nothing to spend it on. 1 car factory is ~$5-10B. They could literally use 1 year of cash flow and build more factories than Tesla has built in their entire history.

Now that I know a little bit more about EV’s, I think it’ll be a mistake for Apple to make a full blown EV. Cars don’t have the “winner takes all” dynamic because it’s more like fashion than computers. It’s hard to imagine everybody driving the same car brand, just like it’s hard to imagine everyone wears the same shoe brand.

Warren Buffett quote: When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.

Car business has a stellar reputation for having terrible economics. The Tesla cult will probably find out a few years later this brutal fact. Apple would be wise to avoid it altogether. But if it can somehow become the OS supplier of EV’s that could be very lucrative. It is not in Apple’s DNA to make software for other hardware vendors though. Not sure how it will play out.

In Sep, AAPL bears immediately pounce on the low demand story of iPhone 14, ignoring the high demand of iPhone 14 Pro and Pro Max. I view this as a marketing miscalculation that they can price iPhone 14 with almost similar spec as iPhone 13 Pro that high. If this type of marketing miscalculation repeats, some marketing czars would be out of a job.

Today, AAPL bears pounces on the same low demand story of iPhone 14 line…

A successful re-test of the 200-day SMA would confirm AAPL is in stage 2 i.e. making the easy money, buying now is hard money (to make).

Two possible EW counts.

…

They view Tesla as a tech/software company with many S-curves. They knew very well the economics of a car business.

Except for Tesla’s energy business, which I don’t know much about and want to keep an open mind, all the other S-curves are bogus pipe dreams.

The following is a comment I read somewhere and it echoes my comment earlier pasted above.

I just bought a new iPhone - it is marginal improvement over my 6 1/2 year old one. The prices are mad - my conclusion is that Apple are in for a big awakening and Tim has made a big misjudgement