.

One day late.

Not golden cross yet.

.

One day late.

Not golden cross yet.

Multi-month bull trend

Golden Cross

Price above cloud

Price above both 50-day SMA and 200-day SMA

Daily Chart

2 hourly Chart

![]()

AAPL continues to ![]() ?

?

![]()

$205 ![]()

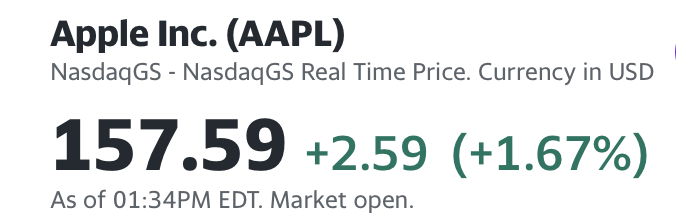

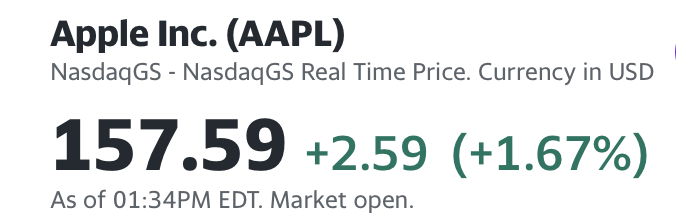

AAPL outperforms S&P and QQQ ytd over 1 yr, 2 yr and 5 yr. Yet most actively managed underperformed the indices. Might as well just hold AAPL. Current trading price of AAPL is less than 10% from ATH.

FinTwitter below is happy that his hours of effort pay off but… not much different from a lazy investor who is 100% into AAPL. Actually return of the twitter’s portfolio is lower than indicated because he didn’t include the cash still lying around, the return indicated is return of what were bought… many investors like to fool themselves, SMH. Return of the lazy AAPL investor with no un-invested cash trumps this fintwitter hands down.

Slightly less bullish alternative count by Wes Pike. Main difference from most bullish count is the internal wave structure. Higher degree count is identical i.e. in wave iii. Btw, wave 1.v is expected to be a new ATH.

Apple watch knockoff selling for 13 dollars.

![]()

AirPods knockoffs for 10 bucks.

![]()

Remember that I was telling last week how market can drop without AAPL coming to double top!

The max for AAPL is previous ATH that results double top.

First 20 mins is about AAPL products. I agree with his view on AR/VR glasses. I need an AR glass ![]() and will buy the VR headset for evaluation purpose.

and will buy the VR headset for evaluation purpose.

![]()

In the future, TBTF banks are likely to be around. However, days for regional banks are numbered.

4 days ago…

Today, broke above $166.84 shortly after open.

Updated 1 year daily chart… not sure how to count internal waves of wave iii…

Cook’s visit to India underscores Apple’s growing ambitions for the country, where despite having just a 3% market share the company has been expanding iPhone assembly via contract manufacturers, and also boosting its exports.

This should bring down the selling price of iPhone in India, thus enable Apple to capture a larger market share (currently 3% :)).

Earnings on May 4 is not as significant as the India news + WWDC Jun 5-9 (Mixed Reality Headset). For May 4 earnings, I am interested only in their buyback + dividends announcement… wishing for higher raise (10+%) for dividends and reduced buyback. And the growth rate of the services category.

WWDC Jun 5-9. All eyes on whether the rumored Mixed Reality Headset is able to launch metaverse from innovators’ phase to early adopters’ phase. Early Majority phase can only happen with Apple glass… next year… I guess.