![]()

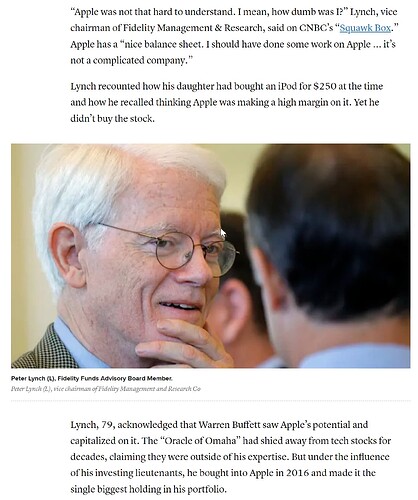

In 2016, Apple is easy to understand. Not so easy earlier in 1997. Even so, many folks still think is already too large, too matured, no more S-curves… so they prefer TSLA CRYPTO PLTR ENPH SNOW NET ![]() Young investors believe in ROI (radio on internet)

Young investors believe in ROI (radio on internet) ![]()

Sundar pays top dollar for three Apple engineers. They are that good?

If they are that good of engineers, then wouldn’t Siri be better?

.

Apple ties their own hands to respect privacy and use limited data. I am not well verse in AI technology. Is it true that AI need lots and lots of data to train? Anyhoo, too few data, insufficient training. Looking from another perspective, there is no breakthrough in using limited data.

It does take a lot of data. I’m learning a ton about AI lately. I’m involved in building cost models for all the AI products under development. What I’ve learned is converting speech into text is VERY compute intensive. Once text is created, then it’s inexpensive to apply AI models. Converting speech to text is a trade off between latency and accuracy. Allowing latency gives the model have more context which increases accuracy.

The backlog for nVidia’s new H100 processor is 4-5 months. I wonder about the long-term growth for it. It appears it only needs to be used to train the models. Once they are trained, then they run on CPUs. There’s a training boom right now.

ChatGPT must have a very high training cost. However, once they train it the costs to run it would be very low. The margins are probably amazing. Training costs should hit R&D expense. I want to see a P&L for OpenAI. It should be all about hitting scale with revenue to cover the training costs. There would be an inflection point where the start printing profits.

Thank you for the detailed explanation.

Look like NVDA still have some rooms to run… after that, might have to re-assess.

.

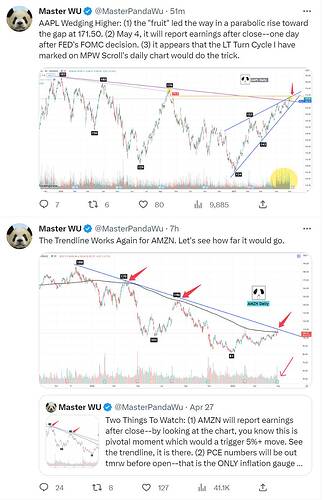

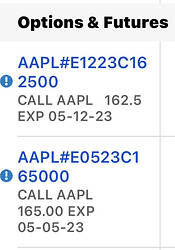

Yet another new high. Earning is on May 4 ![]()

The “LT” downtrend line didn’t work, Panda is praying that the LT Cycle will work. ![]()

Technically, AAPL MSFT META have similar charts. Would be surprised AAPL behaves differently from MSFT META post-earning.

If dips? BTFD ![]()

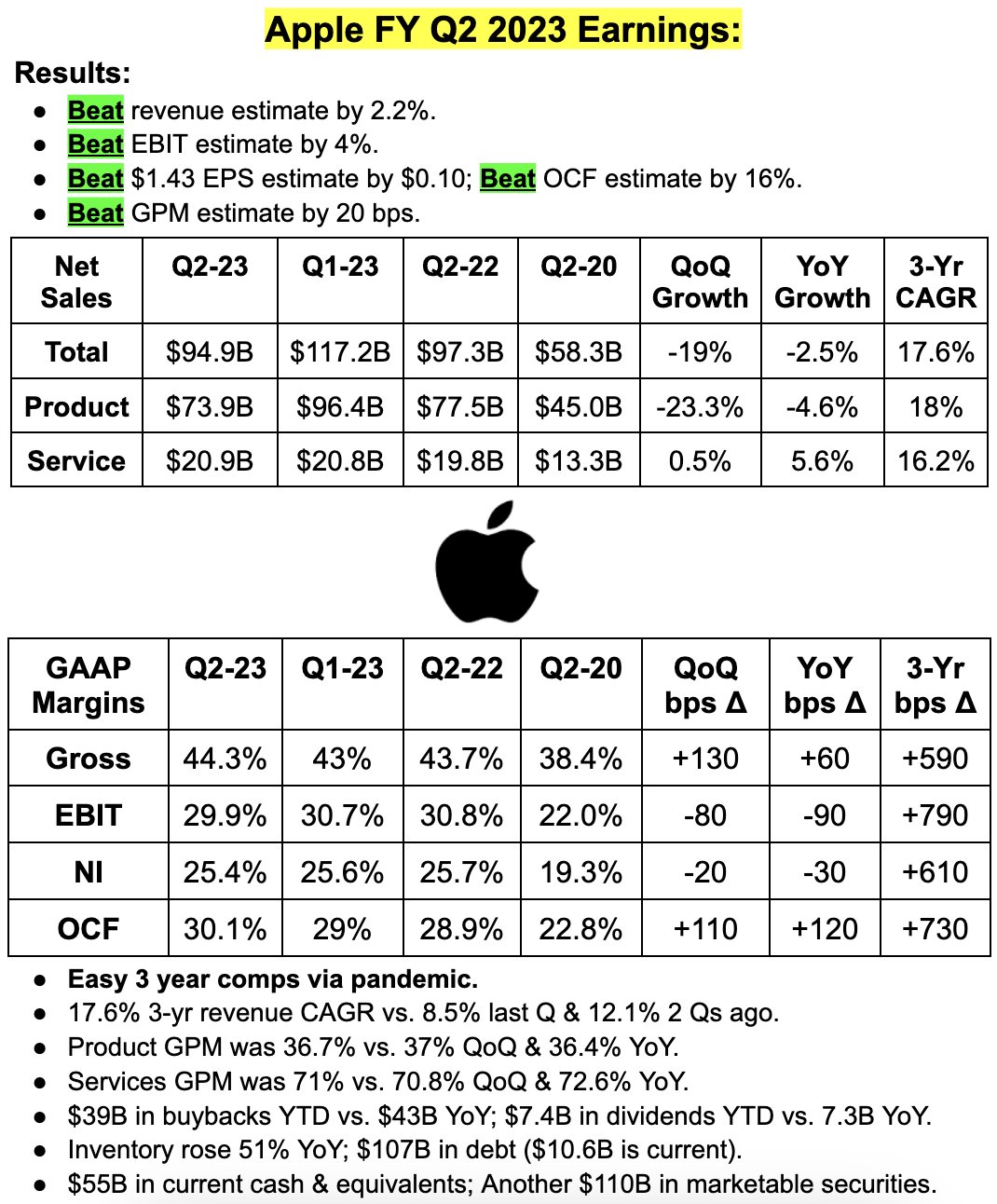

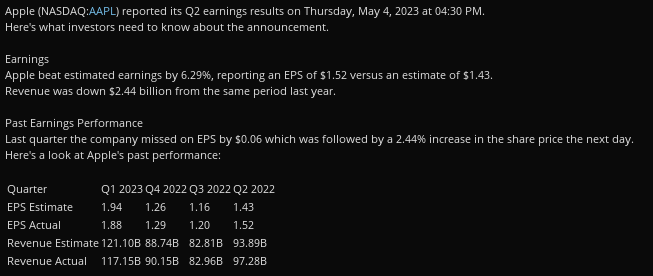

Beat top and bottom lines. Share price hardly moved. Not good enough for Mr Market.

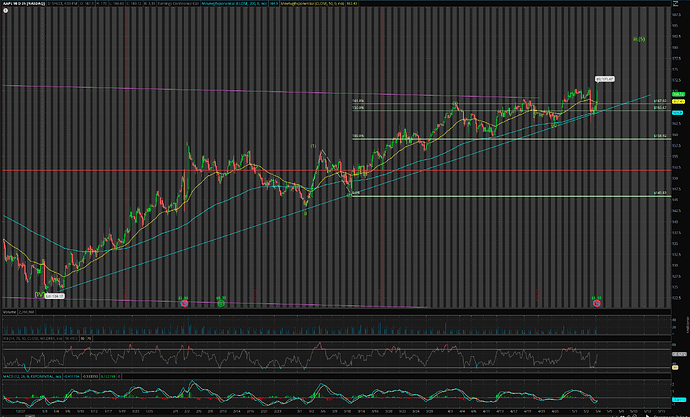

No idea how to count the internal structure of the intermediate (multi-week) waves. Below is just one possible count ![]()

.

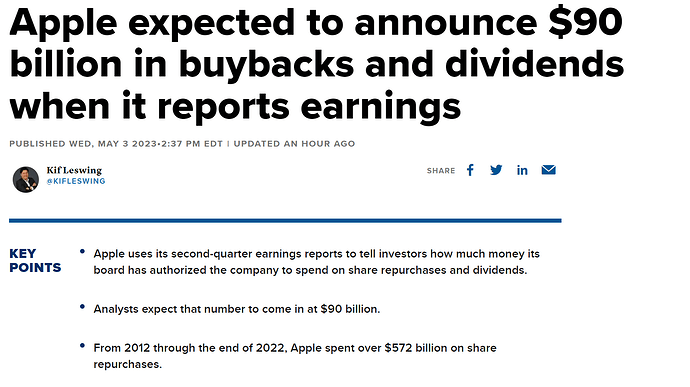

You are quick to throw mud ![]() Anyhoo, some maths for you…

Anyhoo, some maths for you…

Revenue = Product sales * GPM (product) + Services sale * GPM (service)

Don’t you like that Services which have the higher GPM is growing ![]()

Btw, as an investor, share price ![]() weighs more than revenue (small fluctuations are ok, increasing would be splendid).

weighs more than revenue (small fluctuations are ok, increasing would be splendid).

I was just pointing out the fact that Apple is not a growth company. Sure it can have high margins. But if revenue is not growing (it’s in fact falling) it can be a great cash cow but not going to be in the leading wave companies for the next era.

Contrasts that with Microsoft. Similar age. But Microsoft has been very aggressive in getting into new markets. Apple is just coasting on old glories.

Huh! Chasing latest hype is good? What ChatGPT is what many tech companies trying to do decades ago. Then is called intelligent agent or secretary or daemon or something like that… can’t remember the exact words used… many decades ago. MSFT has been trying to figure out… their engineers are crappy… need to adopt ChatGPT… shame on MSFT.

You have been sleeping on your wheel. Anyhoo, Apple won’t announce any vapor wares. Products will be announced when they are ready for mass adoption. Not the same as MSFT and TSLA.

Please look through the revenue for a few years. Don’t just repeat what media claimed.