An observer noted…

Views of typical no profit asset-light high growth investors who didn’t believe in asset-heavy matured companies…

Essentially saying market is wrong and they are right.

An observer noted…

Views of typical no profit asset-light high growth investors who didn’t believe in asset-heavy matured companies…

Essentially saying market is wrong and they are right.

Because Huawei and Xiaomei pushing into premium segment? Why are they doing so? Perhaps, expecting good demand in the future… an expanding pie. Every handset manufacturers could gain in revenue ![]()

“If you’re looking for vision, innovation and growth, you don’t hire Tim Cook,” he said, arguing that Apple’s shrinking sales are proof that Cook wasn’t the right successor to Jobs.

Parroting what is the current view of the non-investors is why you have sold in 1997. Investing is about the future, not about the past (4 quarters). Market knows this and is not letting go of AAPL… installed base is growing, iPhone is selling well, services are growing, Apple presence in healthcare and FinTech is growing, Vision Pro is coming, Car is lurking somewhere.

“If I hadn’t sold, those 300 shares (with all the stock splits) would have turned into 33,600 shares today,” Gioia said in a X post on Sunday. “At today’s share price, my investment would be worth $6.4 million — which is about 700 times what I sold them for. Sigh!”

Since TC became CEO…

In August 2011, when Cook was named Apple CEO the company’s share price was under $13 dollars—now it stands at more than 14 times that at $191.45, up 53% this year alone.

Source: https://stocks.apple.com/AsImASSCoRreFVkdZNGJlbw

“Our recent Asia supply chain checks remain very firm for Apple’s iPhone 15 into an important holiday season with particular strength in the China region despite all the negative bear noise a few months ago,” he wrote in a note released Friday.

![]()

Ignore those non-investors. Their bear thesis has been wrong yet they keep repeating them as if that will make it happen.

It also references this article which is important for Apple doomers:

If we are through the smart phone bear market, then Apple revenue is going to start growing again.

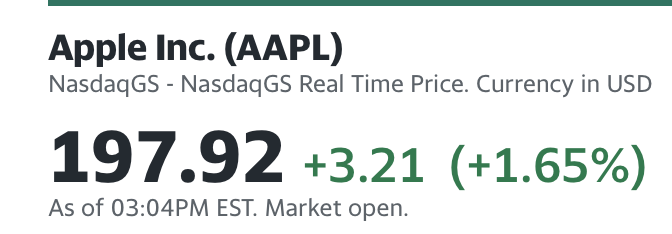

Didn’t retrace below $186.50 so was in wave iv. Now in wave 1.v :). Making a new ATH would be good. Previous ATH is $197.70.

Possibly due to good news…

Update:

Retrace below $187.45 confirm is in wave 2. Meanwhile, can presume is in wave (2).

Previous.

AAPL is $2 from ATH established in Jul. If the preferred count is correct, there should be a retracement, wave 2, once a new ATH is established, follow by a powerful uptrend, wave 3. What is the catalyst for wave 3?

a. A successful launch of Vision Pro or

b. recovery of hardware sales or

c. increased valuation due to lower discount rate?

Anyone has more suggestions for catalyst?

However, if there was a financial impact to Apple (AAPL) due to the implications of the case, it could impact the roughly $25B in revenue the App Store generates for the tech giant. Of that $25B, 7% comes from the European Union, 32% from the U.S., 27% from China and 34% from the rest of the world.

“Assuming 85% [gross margin on App Store revenue], we estimate about $1.00 of annual earnings contribution,” Mohan wrote. “Every 10% reduction in annual App Store [revenue] thus impacts earnings by about $0.10.”

AAPL rocketing and makes a new ATH… How high would it go? Will it makes a new closing ATH?

YTD 52.2%, outperforms both Nasdaq and S&P.

.

Closing ATH $197.96 ![]()

“We believe the bears on the stock are missing the structural gross margin expansion story driven by iPhone premiumization, acceleration in services sales, and the silicon insourcing benefit. … We expect the above trends to continue next year, and view AI Phones and Vision Pro adoption as potential upside catalysts,” Citi analyst Atif Malik wrote in a research note.

Malik has a Buy rating and $230 target price on Apple stock.

Thank you, Malik ![]()

Everyone says WW phone sales hit a bottom and will recover. That’s bullish for AAPL.