Triple ETF is more risky than its underlying index in that fast decline won’t be recovered. Purely short-term trading instrument. Must not hold long term. Anyhoo have been dabbling UPRO, so far, small amount like $10k-$20k per trade. Have not lost any trade yet, touch wood ![]() index is easier to predict than stock ticker.

index is easier to predict than stock ticker.

I’d rather do SPY options than buy/sell a leveraged ETF.

I think it was IBM who did a study saying total cost of Macs were lower for corporations. Most apps are cloud and web based now so OS doesn’t matter. I can use slack and zoom on a Mac. The only thing I don’t have is Power BI desktop which is only needed if you want the higher end features for creating dashboards. You don’t need it to view.

If I get a choice, then I’ll take a Mac.

What I meant is with WFH, home = office. Office = home. The line has blurred.

BTFD

Yeah, but SF is so amazing that if people don’t have to live near work, then even more people will choose to live in SF.

For people like me, no need for earbuds (which I don’t use) and chargers (has plenty from previous iOS devices). Why need earbuds when has AirPods?

Not surprising. With ARM-based MAC, iPad and ![]()

![]() are similar products of different form factor/configurations.

are similar products of different form factor/configurations.

![]() built-in display/ keyboard/ trackpad/ stand

built-in display/ keyboard/ trackpad/ stand

![]() built-in display/ stand

built-in display/ stand

iPad - built-in display

Mac Pro - no built-in peripherals

Do we still need a ![]() ? Or a trackpad?

? Or a trackpad?

Consider the purchasing decision facing a laptop buyer next year: an iPad Pro with a trackpad and a touchscreen that runs iPad apps, or a MacBook with a trackpad and no touchscreen that runs iPad apps and Mac apps. Increasingly, the distinction between them could be more about form factor than about capability.

Maybe no trackpad MBP with touchscreen ![]()

Good essay by an ex-Microsoft exec on Apple’s ARM mac migration.

Developers don’t need touch screen Macs. Consumers do. As usual the article focuses on separate pieces of technology and didn’t have the depth of Sinofsky’s own essay that talks at length about org structure, business strategy and execution.

Reading Sinofsky’s essay, it occurs to me why Apple didn’t follow the WFH fad and opt for employees to return to office. That level of synchronization is impossible with phoning it in from Kansas. It’s more than just being secretive.

Interesting. Mr. Steve Sinofsky who was Chief of Windows 8, the most hated windows release, thinks ARM-based mac will be the ultimate developer PC.

Finally read the article. How come I don’t sense that?

First, the people at Apple are amazing. Yes everyone says that and believes that but boy everyone at Apple is the world’s best at their thing.

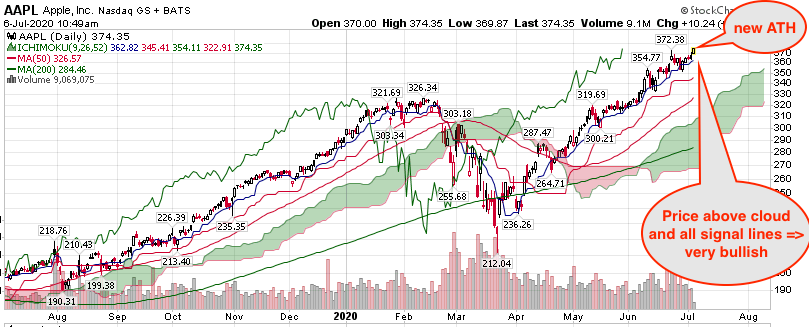

Good for me ![]() make me $

make me $ ![]()

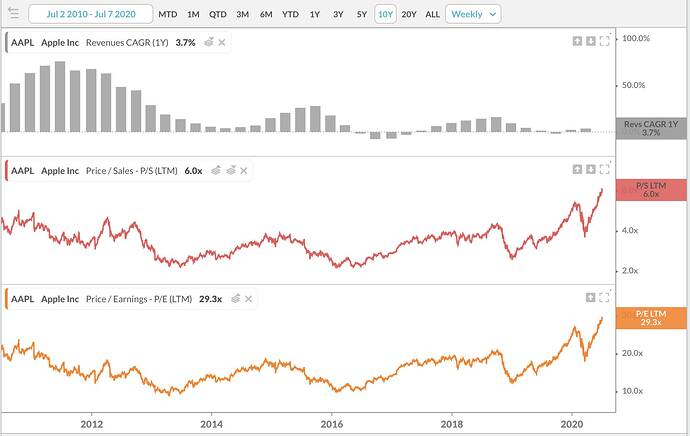

Another way to interpret the increased P/E is investors are changing their view of future performance of AAPL from a slow growth matured company to a growth ![]() company. You have insisted that service

company. You have insisted that service ![]() and wearables

and wearables ![]() businesses are non-starters despite evidences that they are growing like leaps and bounds. Given your horrid assessment of SHOP and TSLA, you need to re-read your business books or just go to college

businesses are non-starters despite evidences that they are growing like leaps and bounds. Given your horrid assessment of SHOP and TSLA, you need to re-read your business books or just go to college ![]() to get a proper biz lecture.

to get a proper biz lecture.

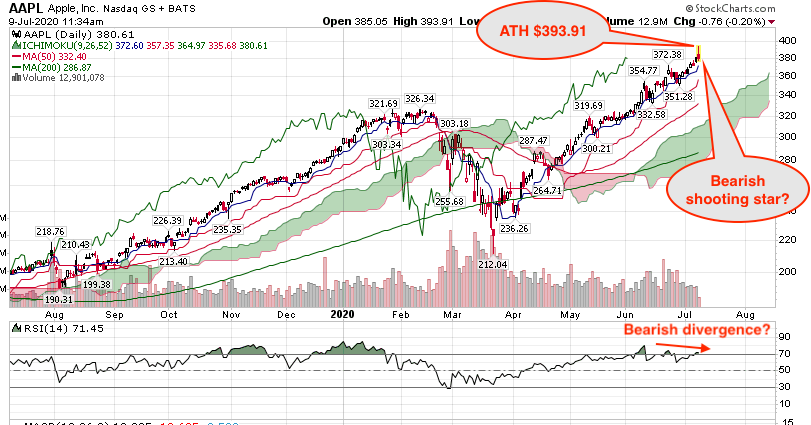

Another happy day for AAPL investors.